Share Price of Tata Motors: Introduction

The share price of Tata Motors has been on a wild ride, from crashing to ₹67 during COVID-19 to rising nearly 1,700% in just four years, before facing a sharp correction.

This blog takes a dive into Tata Motors’ past trends, present performance, and what the future might hold. Alongside, we will analyze technicals and fundamental valuations to see where the stock stands today.

But before we start, here are important points one must keep in mind:

- This post should not be considered a buy/sell recommendation but rather a resource to support your own research and analysis.

- Always invest with a long-term perspective and only use capital you can afford to lose.

- Manage your risk and know where to exit the stock, nobody can predict the future.

Share Price of Tata Motors: What’s Going On?

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025] 1 recent fall in tata motors](https://thsinvestor.com/wp-content/uploads/2025/08/Tata-Motors-Fall-1024x516.webp)

The Share Price of Tata Motors was trading at around ₹67 during the COVID crash in March 2020. From there, it rose nearly 1,700% in just four years, hitting an all-time high on 30 July 2024.

Since then, however, the stock has corrected by about 55% over the next year, a sharp fall.

The decline is not surprising. The above chart shows Tata Motors’ historical price action on a monthly timeframe. It’s clear that after the post-COVID rally, the price hit a multi-year resistance at the upper trendline of a rising channel.

A 55% correction looks steep for investors who bought near the all-time high without proper analysis or context. But for an informed investor, the fall was foreseeable.

Adding to this, since September 2024, quarterly results have been weakening year-on-year. In Q1 FY2025-2026, net profit dropped more than 60% YoY.

Performance has been below estimates as domestic competition intensifies, margins contract, and market share declines. On the global front, Jaguar Land Rover (JLR) has been facing higher costs and tariffs, further denting profitability.

So, Tata Motors’ share price has been under pressure from both technical and fundamental factors.

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025] 2 tata motors uptrend](https://thsinvestor.com/wp-content/uploads/2025/08/Tata-Motors-demand-1024x508.webp)

Currently, the price has rebounded from the middle trendline, highlighting the historical importance of this level, and is now consolidating.

Tata Motors History

Tata Motors, a part of the Tata Group, is one of India’s largest automobile manufacturers, producing cars, trucks, vans, and buses.

The company’s journey dates back to 1945, when it was founded as Tata Engineering and Locomotive Co. Ltd. (TELCO). Over the decades, it has grown into a global player with significant milestones along the way:

- 2008 – Acquired Jaguar Land Rover (JLR) from Ford, transforming itself into a serious contender in the global luxury car market.

- 2009 – Launched the Tata Nano, positioned as the world’s most affordable car, which became an iconic part of India’s automotive story.

Today, Tata Motors has a strong international presence, operating in India, the UK, South Korea, South Africa, China, Brazil, Austria, and Slovakia.

Efforts in E vehicles

Tata Motors was among the first Indian automakers to take electric vehicles (EVs) seriously. It started with the Tigor EV, followed up with the Nexon EV in 2020, that went on to become India’s best selling electric car.

Over the next few years, it plans to double its EV portfolio, with Harrier EV, Sierra EV, and more affordable mass-market models. Alongside, the company is investing heavily in R&D, new platforms, and charging infrastructure.

Its subsidiary Jaguar Land Rover (JLR) is also moving aggressively into electrification. It is preparing to launch the Range Rover Electric, while Jaguar is set to transition into an all-electric brand by 2030.

Share Price of Tata Motors: Technical Analysis

Nifty Auto Index

The Nifty Auto Index (CNXAUTO) measures how the automobile sector performs in the stock market, comprising 15 large auto companies.

Tata Motors holds the 3rd largest weight in the index, with a share of around 12.5%. The movement of the index and its constituent stocks is largely similar, especially among the major stocks.

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025] 3 share of tata motors in auto index](https://thsinvestor.com/wp-content/uploads/2025/08/Tata-Motors-share-1024x515.webp)

It is important to study the index chart as it reflects the overall sentiment of the entire sector. If the Auto Index is bullish, Share Price of Tata Motors is likely to follow the same trend.

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025] 4 long term channel of nifty auto](https://thsinvestor.com/wp-content/uploads/2025/08/Auto-Index-channel-1024x513.webp)

The above chart shows the historical price action of the CNX Auto Index on a monthly timeframe. The index has largely moved within a rising channel supported by multiple trendlines numbered 1 to 4.

The price has touched trendline 4 only twice in its entire history, once during the financial crisis of 2008 and again in the COVID crash of 2020. Both times, it rebounded sharply and moved straight back toward trendline 1.

Excluding these rare events, the index has consistently traded between trendlines 1 and 3.

Historically, after testing trendline 1, prices have comfortably traded between trendlines 1 and 2 for extended periods, and even moved beyond trendline 1.

Currently, the price is taking support at trendline 2 and moving upwards, which is a positive sign. The recovery pattern in Tata Motors mirrors the index closely, as seen in its chart below:

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025] 2 tata motors uptrend](https://thsinvestor.com/wp-content/uploads/2025/08/Tata-Motors-demand-1024x508.webp)

Now, let’s look at how the price has behaved around a moving average. The red line in the chart represents the 21-period Exponential Moving Average (EMA).

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025] 6 EMA study on nifty auto](https://thsinvestor.com/wp-content/uploads/2025/08/Auto-Index-EMA-1024x516.webp)

Throughout history, the price has respected this moving average almost without exception, apart from the two global market crashes highlighted earlier. Apart from those rare cases, the 21 EMA has consistently acted as a dynamic support.

At present, the 21 EMA coincides with trendline 2, from which price has already taken support and shown demand.

Another inference is that if the price were to break below the 21 EMA, a deeper correction can follow, possibly down to trendline 4.

Another confirmation comes from studying historical RSI behavior. The chart below shows how price has reacted around RSI levels.

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025] 7 RSI study on nifty auto](https://thsinvestor.com/wp-content/uploads/2025/08/Auto-Index-RSI-1024x519.webp)

Once again, only during the two major market crashes did RSI dip below the 52 level. Notably, recently, RSI touched 52 when the index tested trendline 2, and both have since turned upward.

With multiple confirmations pointing to recovery-trendline support, 21 EMA alignment, and RSI rebound, a fresh uptrend may be on the cards on Nifty Auto Index.

Tata Motors: Technical Analysis

The chart of Tata Motors is not much different from its index. A similar study of its price action returns similar results.

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025] 8 long term tata motors channel](https://thsinvestor.com/wp-content/uploads/2025/08/Tata-Motors-channel-1024x516.webp)

The price has broken trendline 2 only during global market crashes—the Dot-com bubble, the Financial Crisis of 2008, and the COVID crash.

Likewise, RSI broke below the 41 level only during these three instances. At present, it has once again taken support at 41 and is rising along with the price.

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025] 9 long term support tata motors](https://thsinvestor.com/wp-content/uploads/2025/08/Tata-Motors-hammer-1024x515.webp)

Further, trendline 2 coincides with a multi-year resistance zone, which is now acting as a strong support.

A hammer candle has formed right at this support level, an important bullish signal. The candle resembles a hammer, with a long lower wick and a small body, which shows buyers are in control and are a dominant force.

Zooming into the weekly timeframe, we can observe a recent downtrend with the price forming Lower Lows and Lower Highs, as depicted below:

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025] 10 new uptrend on tata motor chart](https://thsinvestor.com/wp-content/uploads/2025/08/Tata-Motors-trend-change-1024x513.webp)

However, around the same support level, the price is now forming a base, a triple bottom pattern and the sequence of Lower Lows has stopped, meaning selling pressure is reducing.

For confirmation of a trend reversal, the price needs to close above the immediate resistance and form a Higher High, which would signal the end of the downtrend.

At the current level, Tata Motors offers a very attractive risk-reward setup. One can consider entering near trendline 2 with a stop-loss placed just below it, and a target around trendline 1.

Share Price of Tata Motors: Fundamental Analysis

Sector Overview

- India’s car penetration remains very low, just 26 per 1,000 people compared to 183 in China and 594 in the U.S., which means immense growth potential.

- The government has set an ambitious target of 30% EV sales by 2030.

- Improved rural income and infrastructure-led growth are driving demand for two-wheelers, commercial vehicles, and tractors.

- The government plans to simplify GST with two main slabs—5% and 18%. Taxes on small cars will be cut from 28% to 18%, making vehicles more affordable.

Tata Motors – Fundamentals

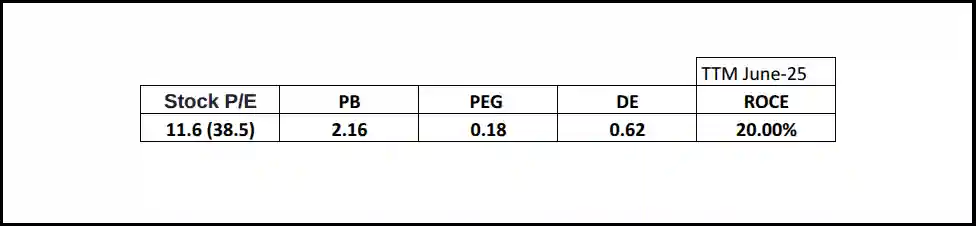

P/E Ratio (11.6 vs Industry 38.5): Tata Motors is trading at a much lower P/E than the industry average, which suggests the stock is undervalued compared to peers.

P/B Ratio (2.16): In the auto sector, a healthy P/B usually ranges between 2–4, and Tata’s 2.16 falls within this range which is fair, neither expensive nor too cheap

PEG Ratio (0.18): A PEG ratio below 1 signals undervalued growth, and Tata’s 0.18 indicates the share Price of Tata Motors is cheap relative to its expected earnings growth.

Debt-to-Equity (0.62): The acceptable D/E less than 1.00, and Tata’s 0.62 reflects healthy leverage.

ROCE (20%): With a benchmark of 12–15%, Tata’s 20% ROCE reflects very strong capital efficiency.

Overall, Tata Motors appears attractively valued with a low P/E, PEG ratio, healthy debt levels and strong ROCE of 20%.

Share Price of Tata Motors: Conclusion

Share Price of Tata Motors has seen a correction of more than 50% from July 2024 highs. However, the Stock and Auto Index now finds strong support at key trendlines, the 21 EMA, while RSI hints at a potential uptrend reversal.

Fundamentally, with an attractive valuation, indicated by a low P/E, PEG and strong ROCE of 20%, share price of Tata Motors appears undervalued relative to peers.

Further, GST reforms slashing taxes can be a game changing step for the auto industry.

It goes without saying that nobody can predict the future, and even the best analysis can go wrong. But currently, Tata Motors offers a favorable risk-reward setup for long-term investors.

The downside looks limited with a small stop-loss, while the upside potential is quite attractive.

Still, it’s important to manage risk at all times and be clear about where to exit if things start to go south.

Frequently Asked Questions

After a 1,700% post-COVID rally, Tata Motors hit multi-year resistance with an overheated RSI and has since corrected ~55%. Weak earnings, margin pressure, and rising competition have further put pressure on share price of Tata Motors.

Tata Motors is showing demand at current levels. Investors can hold as long as the stock sustains above the multi-year support or trendline 2 as discussed in the blog.

Technically, Tata Motors has corrected to a strong support zone, with the Auto Index also holding firm and the stock taking support from key moving averages. RSI is turning upward, hinting at a possible bounce. Fundamentally, valuations look attractive, with the stock appearing undervalued relative to peers. So, Tata Motors seems a good buy now.

P/E (11.6 vs industry 38.5) and PEG (0.18) suggest strong value relative to peers and growth potential. With a fair P/B (2.16), healthy debt-to-equity (0.62), and strong ROCE (20%), fundamentals indicate the stock is undervalued.

Risk Reward, currently, seems attractive for long term investors. One can conservatively expect the stock becoming 2x in coming years.

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025]](https://thsinvestor.com/wp-content/uploads/2025/08/Tata-Motors-logo-scaled.webp)

![[2025] Why is Nifty falling? Explained. When will the fall stop?](https://thsinvestor.com/wp-content/uploads/2025/02/why-is-nifty-falling-768x384.webp)

![Top Nifty 50 Companies [2025]](https://thsinvestor.com/wp-content/uploads/2025/04/top-5-nifty-50-companies-768x384.webp)