What is Support and Resistance?

Support and resistance are fundamental concepts in technical analysis which are used to identify important price levels where price is likely to experience buying or selling pressure.

Support is a zone where fall of price is expected to pause due to presence of concentrated demand while resistance is a zone where rise of price is expected to halt due to presence of concentrated supply.

So, Support works as a floor which supports the price from falling further and Resistance acts as a ceiling preventing further rise.

Drawing Support and Resistance

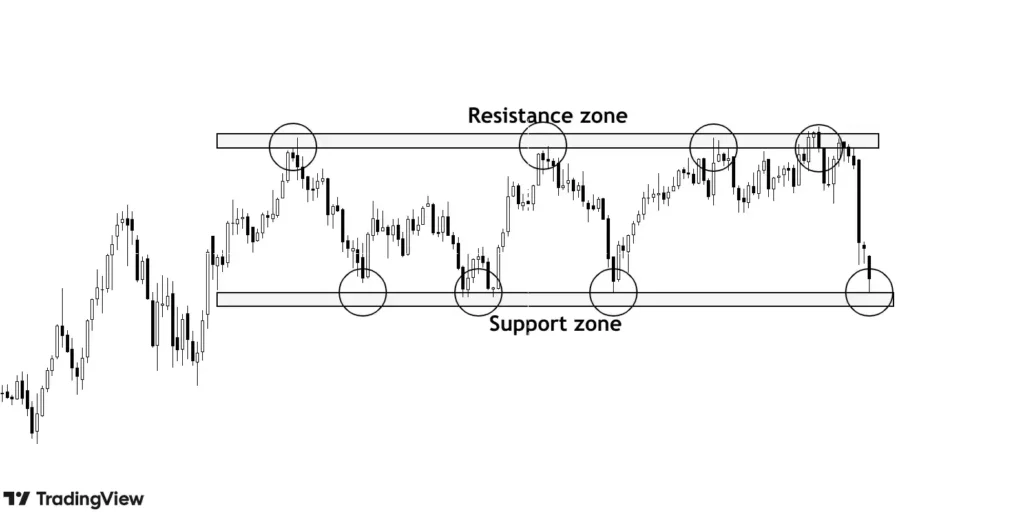

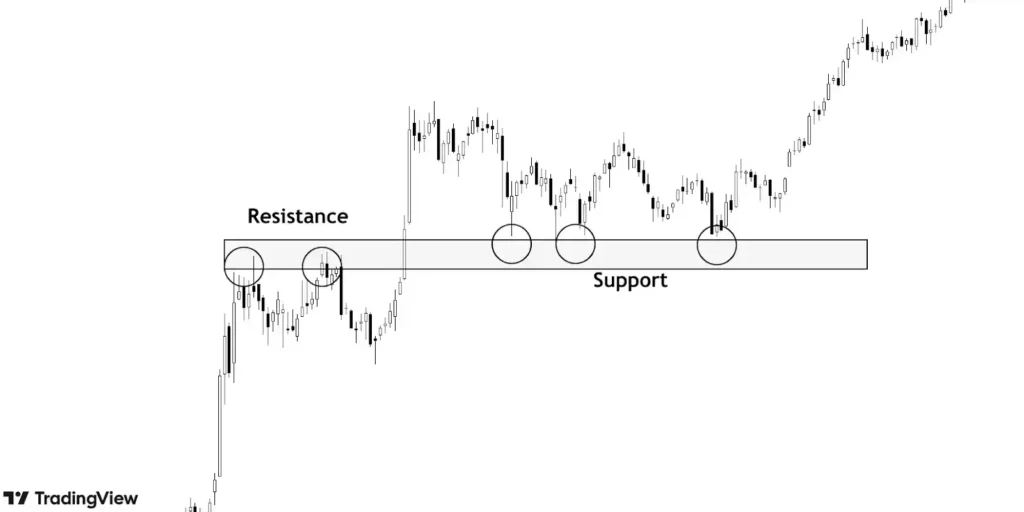

Identifying Support and Resistance is very easy. To draw a Support/ Resistance, connect as many points as possible.

It’s always better to draw S/R on one time frame higher as higher time frames are more reliable. Support and resistance are zones or price ranges, not just precise lines.

Here is another example of the same-

Recently formed support and resistance zones are more reliable than zones made in the past. So, while spotting the S/R zones, you should give more preference to newly formed S/R.

S/R zones near round numbers like 100, 500, 1000 etc also provide psychological advantage. So, given a choice, prefer zones around important round numbers.

The example below shows how support of 60,000 worked at point C than support at 57,532.

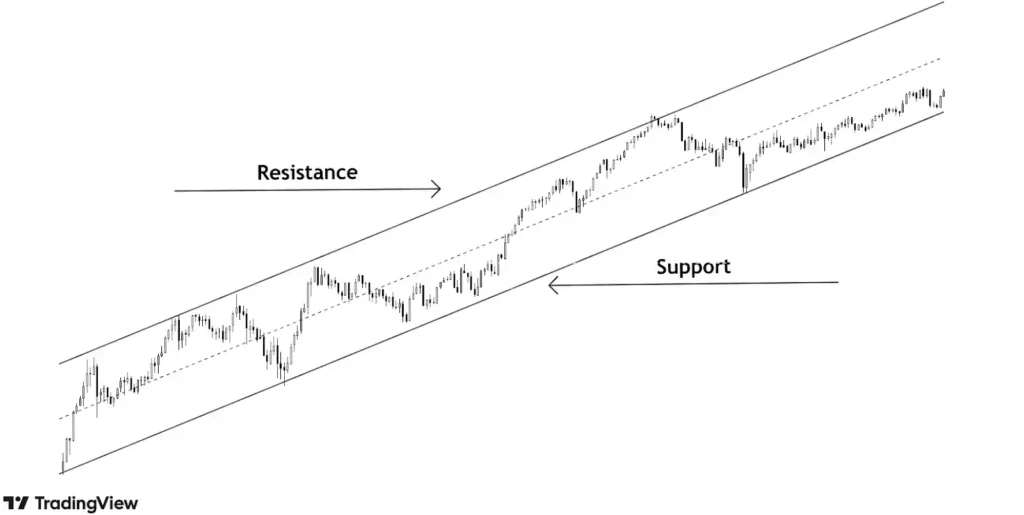

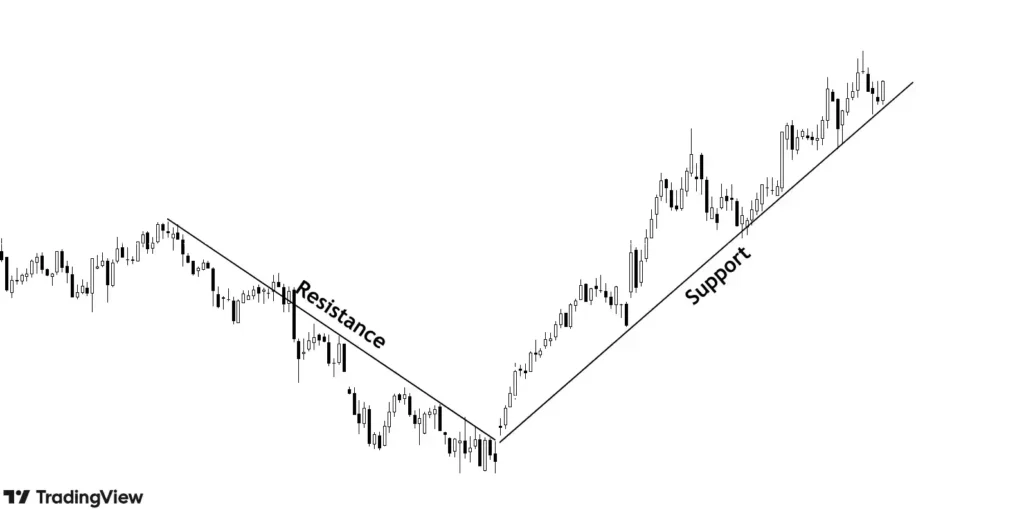

S/R doesn’t always have to be horizontal lines, it can also be observed in inclined lines, generally known as trendlines. These trendlines are also representative of the current direction of price, known as trend of price.

Trendlines forming parallel channels, that is Support and Resistance lines parallel to each other and price enclosed between them, as shown in above image, is more reliable than price taking support/resistance from single trendline which is depicted below:

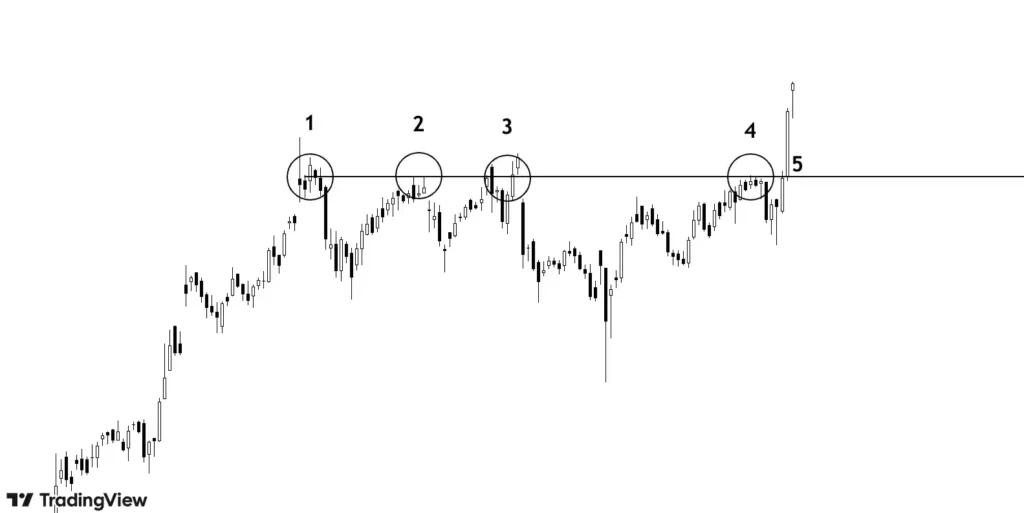

If a S/R is being tested multiple times, it becomes weaker. In the image below, the resistance is being tested multiple times and finally gets broken at the 5th attempt.

The psychology behind the same is that buyers are undoing the attempts of sellers to take the price down, repeatedly.

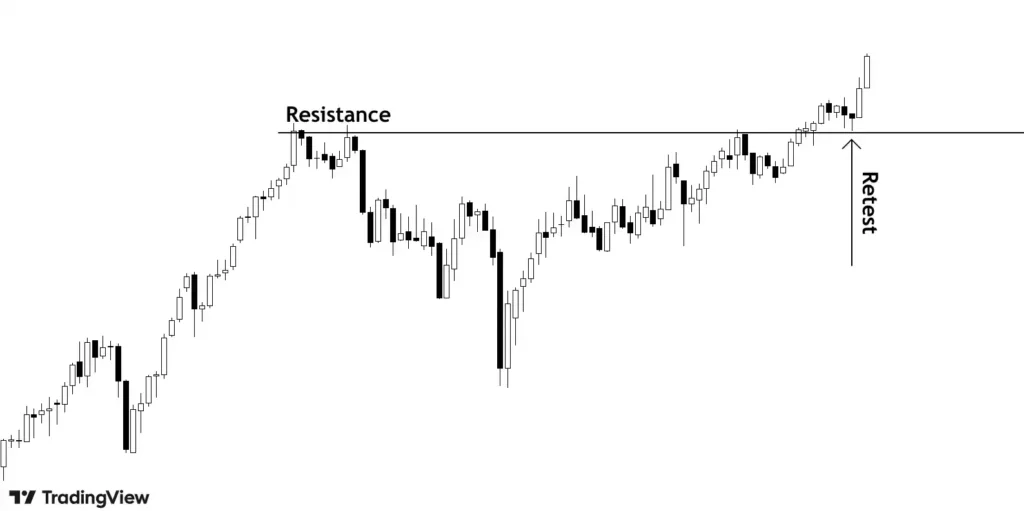

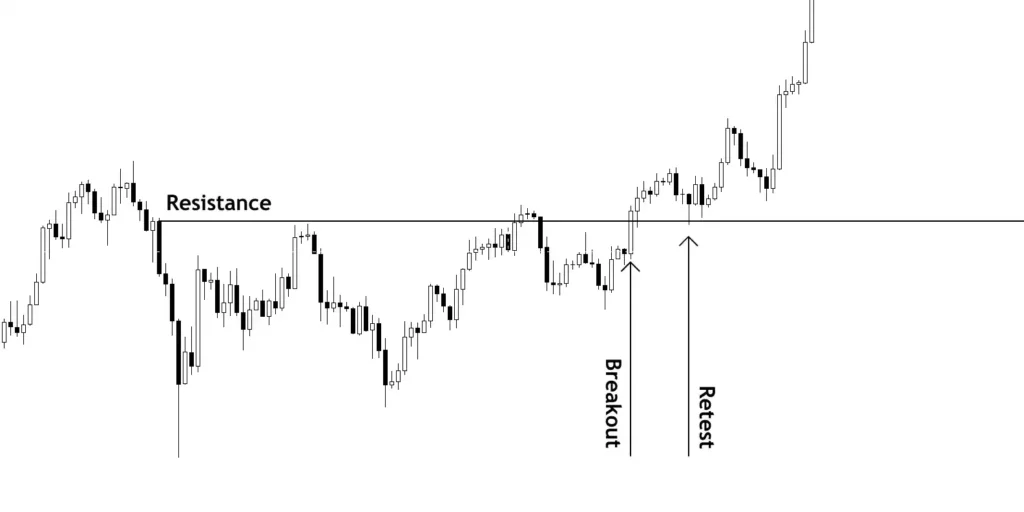

One more important point here is that after breaking of S/R, price often retests the broken zone. Movement of price after the retest candle is reliable and provides a better opportunity to enter a trade.

S/R function interchangeably—when the price approaches from below, the zone acts as resistance, and when approached from above, it acts as support.

In other words, when a resistance zone is broken, it tends to behave as support in future and vice versa.

In the above example, as the resistance zone is bypassed by a greater buying force, it gets transformed into a support zone as buyers who overcame selling pressure at resistance zone now would act as buying force whenever the price approaches the zone from above.

How to trade using Support Resistance

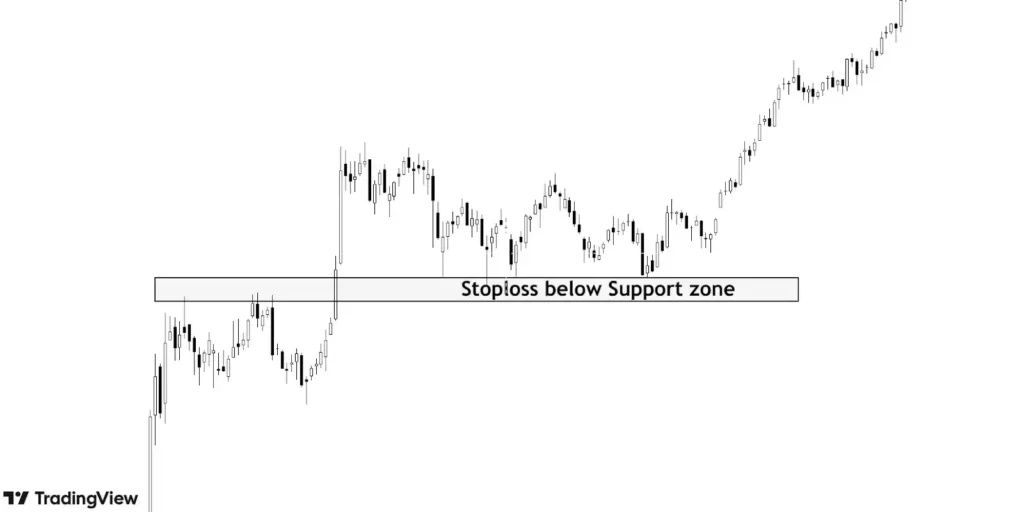

If you expect the price to rise, wait for it to reach the support zone before entering a trade, placing your stop-loss below support. This approach is commonly used in an uptrend when the price temporarily pulls back, forming a support zone.

(How to form a view will be dealt in detail in upcoming lectures)

A stoploss is a point where you exit the trade as price is not moving in the desired direction.

As shown in the chart, if your view is upwards, you enter near support. In the event of price moving down breaking support, you exit your trade as sellers have overcome the buying pressure at support.

Again, the exact point where to place stoploss will be covered in upcoming lectures.

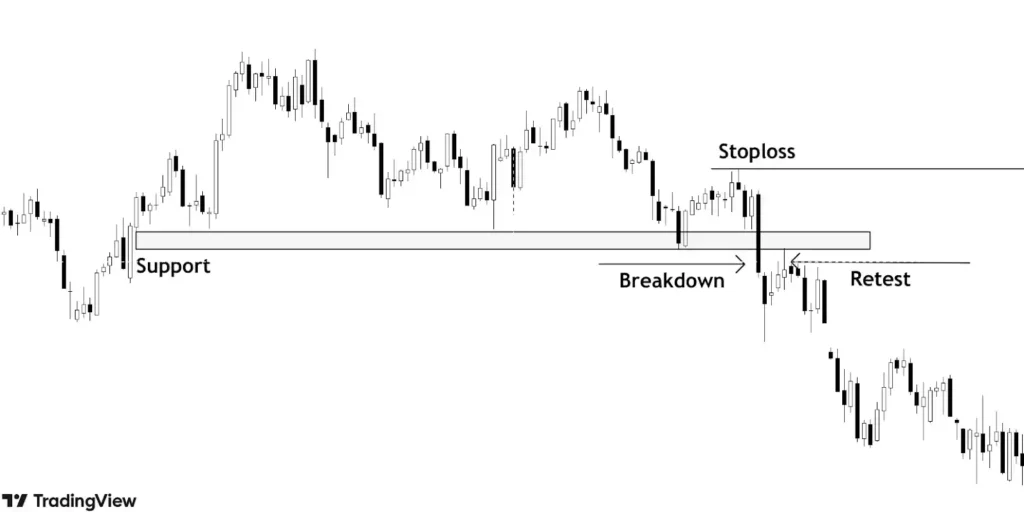

Alternatively, if your view is downwards, you can wait for support levels to break before entering a trade and keep your stoploss above support levels.

Retesting of broken S/R increases the chances of sustaining that breakdown/breakout.

Support/Resistance are crucial as these important levels help you minimize loss by exiting the wrong trade quickly.

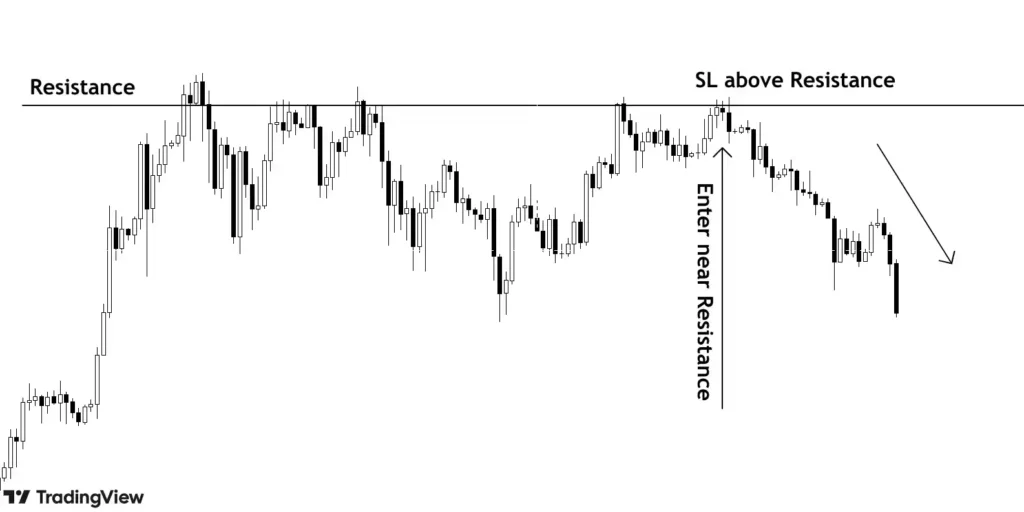

Below charts depicts application of resistance:

When your view is downwards: This approach is commonly used in a downtrend when the price temporarily pulls back, forming a resistance zone.

Also, when your view is up, one can wait for the resistance zone to break.

All the 4 combinations will be covered in detail as we dive further down.

Breakout/Breakdown vs Fake Breakout/Breakdown

When price breaks resistance, it is a breakout of price and when price breaks a support, it’s called breakdown.

If price, after a breakout/breakdown, doesn’t continue and comes back to previous level and starts moving opposite direction, it is known as fake breakout/breakdown. More about the same will be death with in upcoming lectures.

Key takeaways

- Buying pressure exceeds at supports and Selling pressure exceeds at resistances.

- Support prevents prices from falling and Resistance stops prices from going up.

- Once S/R are broken, we can see one way rally

- Support and Resistance are not different, these are important zones around which price behavior is predictable.

- Support and Resistance helps in placing your stoplosses indicating when to exit your trade.

![5-Minute Guide to Becoming 50% Pro Trader [Beginner]](https://thsinvestor.com/wp-content/uploads/2025/02/pro-trader-768x384.webp)