Profit Booking Techniques

Perfect time to book profits is not easy as it sounds. Booking profits early will make you regret your decision and so will booking late. Though it is impossible to capture the exact top or bottom, we can still maximize and protect our profits using certain profit booking techniques.

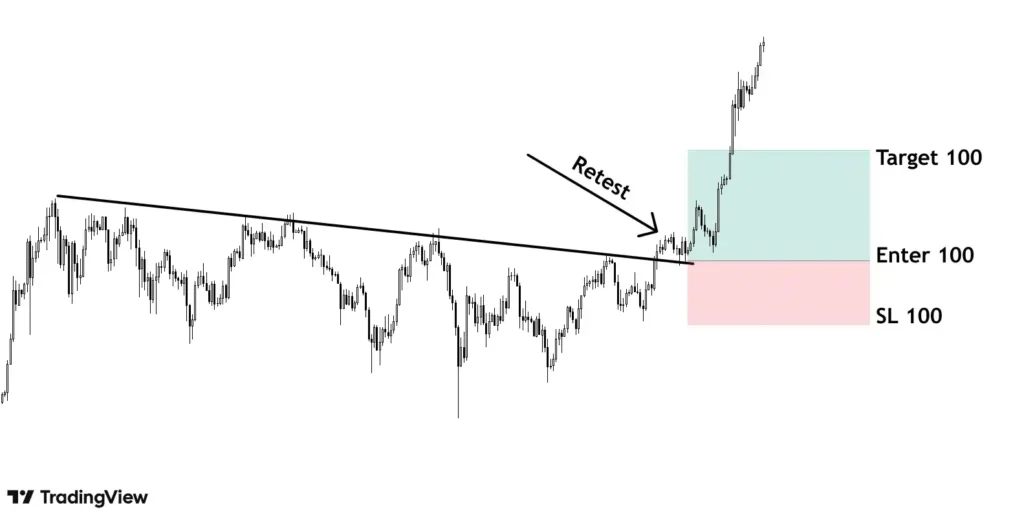

Fixed Profit

This is one of the simplest forms of profit booking techniques. After you have established SL and position sizing, keeping a good Risk Reward ratio i.e, at least 1:2, your profit taking point will be 2x your SL.

We have already discussed why SL, position sizing and Risk Reward is important and how to set them in detail.

As per the above example, if you are entering at 100 with SL at 90 (approx 10%), with R:R 2x, your profit booking point should be 20% i.e, around 120.

But as it is evident, it may not always be an efficient method. Prices can go further in our favor and we need to get more out of it duly controlling our risk and not giving back profits we have already made.

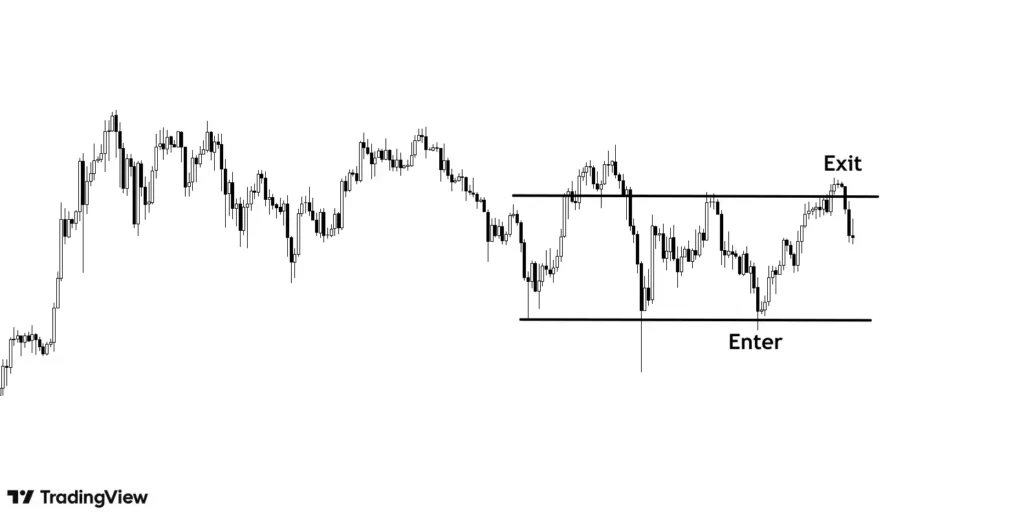

Near Support/ Resistance zone

Again, entering near support and exiting near resistance is a basic idea. Needless to say, minimum R:R has to be maintained here too. Price can reverse after reaching resistance or can break resistance and continue going further. There is also a probability of missing out on a bigger rally.

Additional studies can be done like the type of candles being formed or how different indicators are behaving for further confirmations.

Personal experience: keeping things basic and not complicating things work; people often lose trying to do sophisticated things.

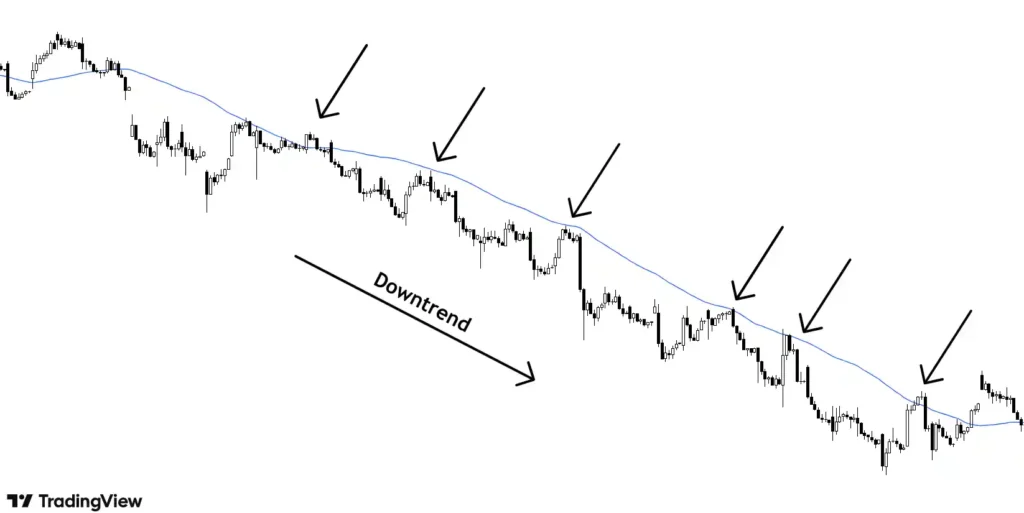

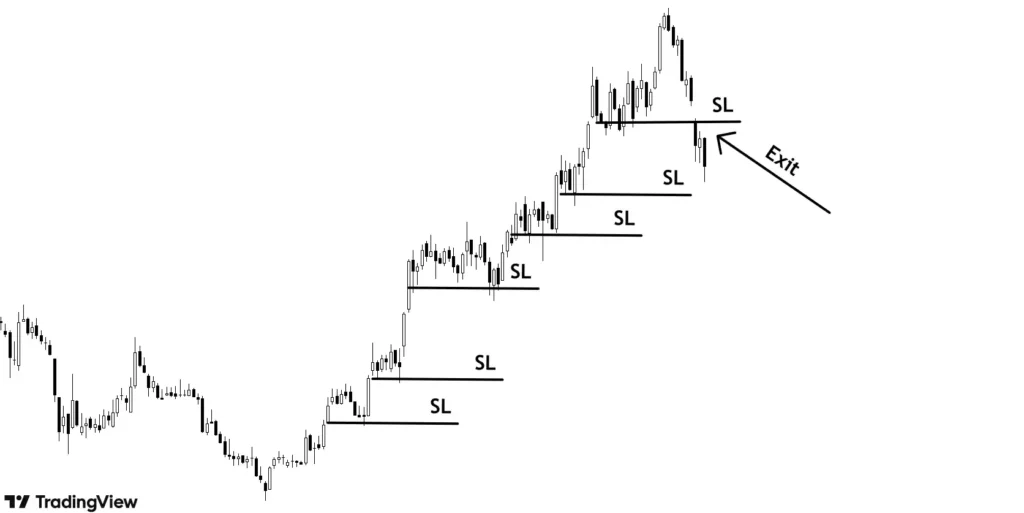

Trailing profit

Trailing your profits means shifting your SL as your trade moves in your direction, potentially locking your profits.

This is done to increase your profits by riding most of the momentum. You can also start to trail profits after desired profit is achieved according to set RR.

- Fixed Percentage

The SL will always be at a pre decided fixed percentage away from the current price. If you decide to trail SL by 5% after entering at 100, your initial SL will be at 95%. If the stock moves to 110, your SL will shift to 104.5 i.e, 5% below 110.

This fixed percentage can be decided using the Average True Range (ATR) indicator.

SL in this case should be above moving average. The above example uses 20 SMA; the type of moving average to be used should be selected by hit and trial method, whatever has worked in the past should be good enough for future.

Moving averages work well in trending markets and should be avoided in sideways markets.

Price is in uptrend and making HH and HL. SL can be trailed with every new HL.

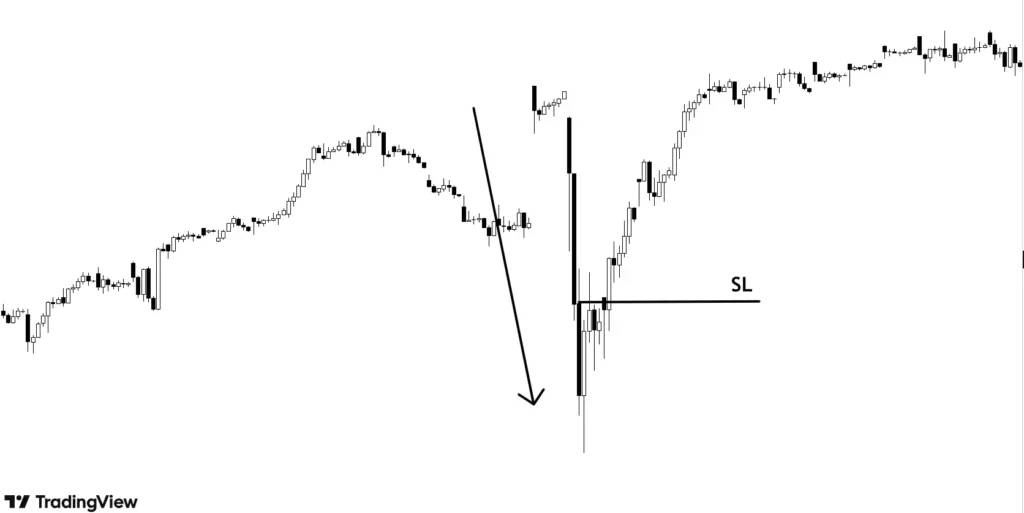

- Low/high of last candle

There will be cases when price moves in one direction without much pullbacks/consolidation. In such cases, SL should be placed below/above the immediate previous candle to protect quick gains.

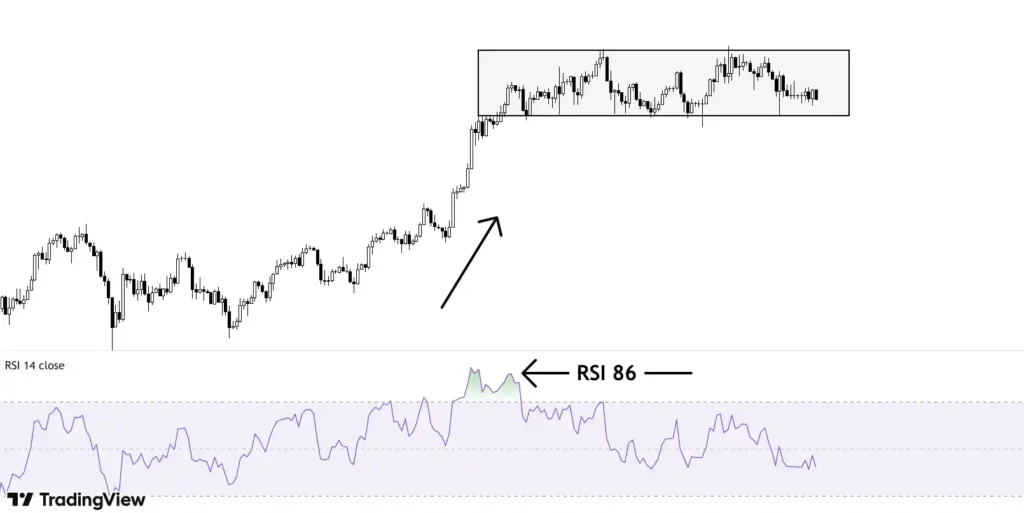

Heated RSI

RSI above 85 does not sustain long, so the stock will either go down or go into long consolidation. Although the price can still go beyond 90, it is advisable to book partial profits at high RSI values.

The opposite holds true if RSI is in oversold zones.

The above instance shows why booking partial profit and not full is a better option. The price keeps going up with slight dips even after RSI is above 85.

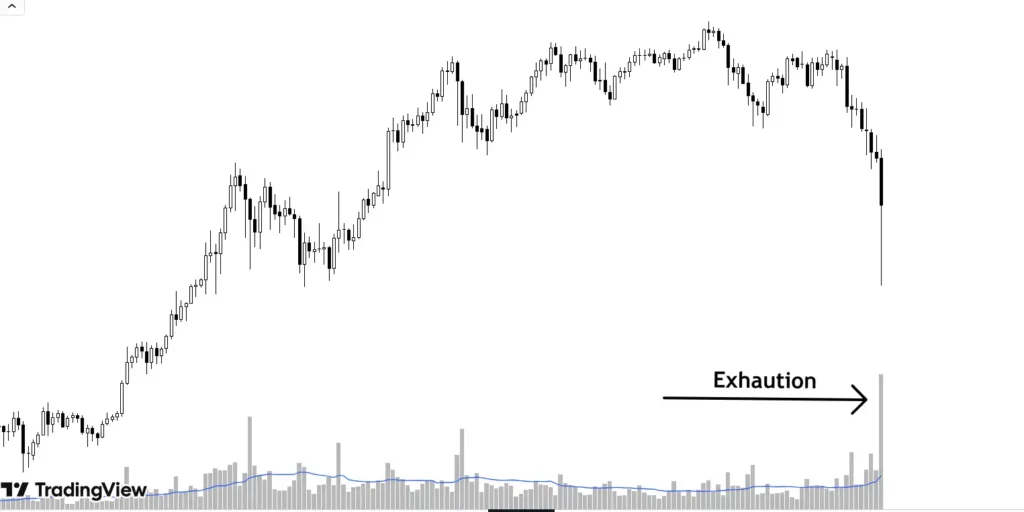

Exhaustion Volume

Exhaustion volume are the high volume candles which generally means end of current rally. In the above example, during selling exhaustion volume candles, nearly all selling pressure has been done with and further selling is unlikely.

Pro tips

These profit booking techniques should be used differently for trading and investing. In case of trading, SL must be based on trigger basis i.e, in a bullish trade, if SL is at 100, you should exit at 100.

In the case of investing, you can follow a mix of trigger and closing basis. If SL is at 100, one should wait for the next candle to close below 100 as closing of candle is an important part of the shift in sentiments.

For additional safety, trigger basis SL should be incorporated along with closing basis in case the SL candle is big. For instance, if SL is 100 on closing basis, one can keep trigger SL at 95 as the candle can go even low before final closing.

Key Takeaways

- There are multiple profit booking techniques, from basic to advanced.

- Under Fixed profit, you exit at pre decided levels.

- Immediate Support/Resistance levels can be set as logical booking levels.

- Profits can be trailed using moving averages and market structure.

- One should be careful when RSI is in oversold/overbought zones.

- Use trigger basis SL for trading and combination of trigger and closing basis for investing.