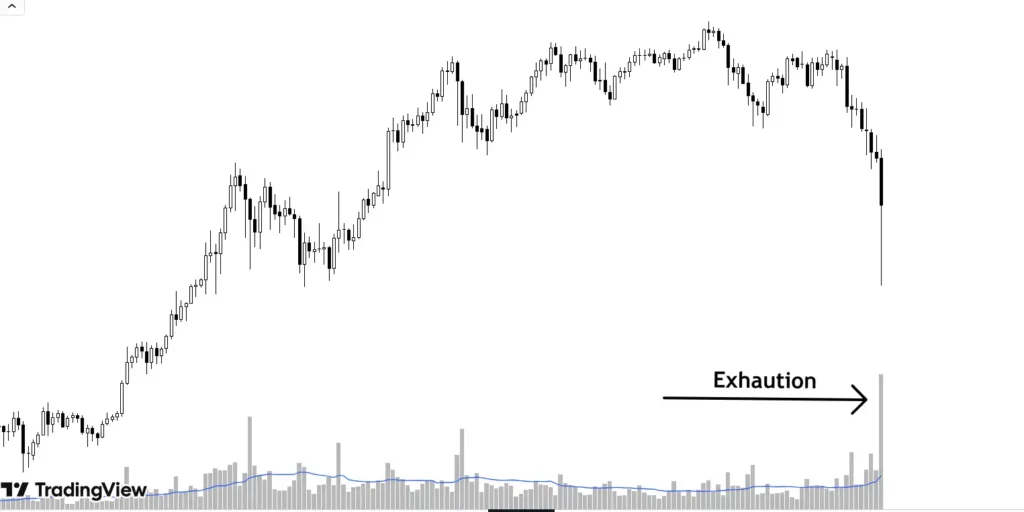

What is Exhaustion volume?

Exhaustion volume is an abnormally high spike in volume comparatively to recent candles or average volume which generally takes place after a sustained up or down trend.

This shows incredible increased activity of selling and buying

Importance

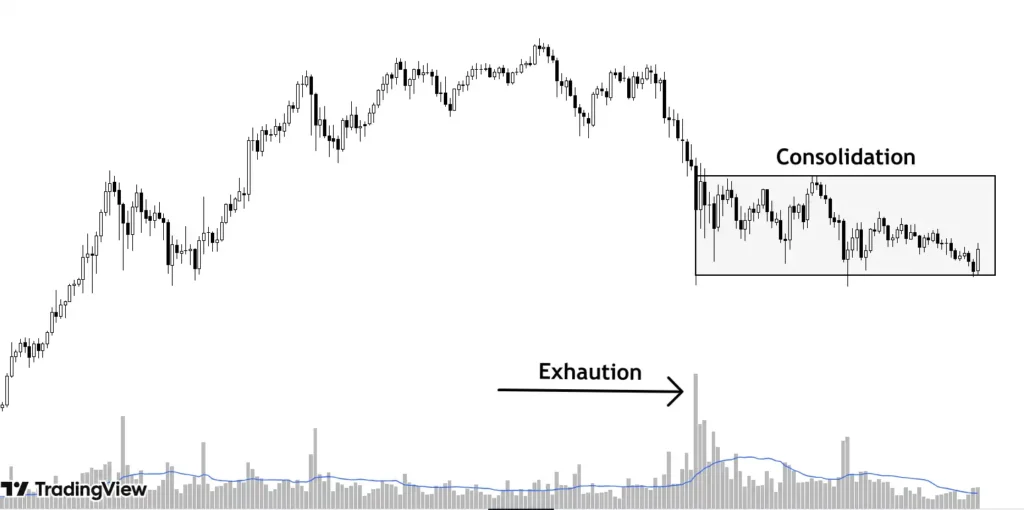

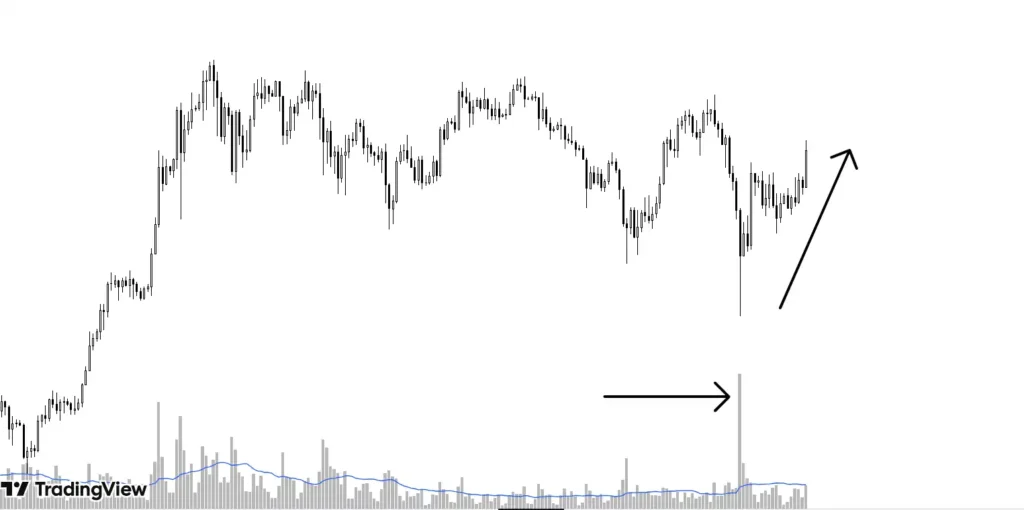

Whenever this happens, price either reverses or goes into consolidation. So this serves as caution to participants to either book profits or avoid taking fresh positions in the existing trend.

The above chart is an example of price going into consolidation after exhaustion in volume.

Another example depicting how price instantly reverses after high volume. Chances of price going with the trend after such volume activity is very low and hence this event is extremely reliable. This can be observed on any timeframe.

Reasoning

Some of the reasons behind the Exhaustion Volume:

- High volume means overwhelming sellers (in downtrend) driving price down and post this, fewer sellers are left meaning selling pressure reduces to take the price further down. Same is true when in uptrend with a big green candle of volume.

- Retailers are rushing in to enter the trade, who are always latecomers, to make quick profits in fear of missing out. They are trapped in the trade by the big players.

- Exhaustion volume occurs after price has moved considerably in one direction in a short period. Big players realize this and are booking profits by closing their positions.

Characteristics

Exhaustion volume is characterized by the following facts:

- Extremely high volume comparatively to the recent past.

- Occurs after a significant price move in a direction, usually taking price in overbought/oversold conditions.

- Long wicks are formed in the price candle.

Key Takeaways

- It is very unlikely that price moves with the existing trend after exhaustion volume.

- One should look for profit booking opportunities after such spikes in volume.

- For additional confirmations, align exhaustion volume with support resistance and overbought/oversold zones in RSI.

- This setup has high accuracy.