Multibagger Penny Stocks – Introduction

Multibagger Penny Stocks are the dream of every retail investor — low-cost shares that can multiply your money manifold if chosen wisely.

Penny stocks are small companies that trade at a relatively low price (below Rs.50). They have a low market capitalization, limited trading volume and are less known.

Penny stocks attract traders and investors, specially retailers due to their potential to deliver multibagger returns from small investments.

Unlike large-cap stocks that offer steady but limited returns, penny stocks can easily deliver 10x returns.

However, these penny stocks go through extreme volatility, have low liquidity, and carry extremely high risk. In worst cases, they can lose their entire value overnight.

That’s why blindly investing in penny stocks is not recommended. They require extra caution and deep analysis.

This post focuses on identifying the Top Multibagger Penny Stocks in India for 2025 — selected based on both technical indicators and strong financials.

These were the key criteria used to shortlist the top 5 multibagger penny stocks:

- A custom screener filter with following conditions:

- Price under ₹50

- Market Capitalization below ₹1000 crore

- 1-week average volume over 50,000

- Zero pledged promoter holdings

- Return on equity (ROE) above 10%

- Positive net profit in the last financial year

- From the above filtered list, further stocks were shortlisted with strong price action.

- Finally, further in-depth fundamental research gave us top 5 multibagger penny stocks

Before we start analyzing each stock, here are some important points one must keep in mind:

- This post should not be considered a buy/sell recommendation but rather a resource to support your own research and analysis.

- Penny stocks are extremely risky, they can easily go to 0.

- These small companies have limited liquidity and highly sensitivity to news.

- Fundamentals matter even more in penny stocks — never compromise on financial health.

- Always invest with a long-term perspective and only use capital you can afford to lose.

That being said, let’s dive into the Top Multibagger Penny Stocks in India for 2025. We’ll explore their business models, study the fundamentals, and analyze their charts with proper risk management in mind.

5. Multibagger Penny Stocks – Sarveshwar Foods Ltd

Sarveshwar Foods Ltd (SFL), incorporated in 2004, is a Jammu & Kashmir-based company engaged in processing and marketing of both branded and unbranded basmati and non-basmati rice.

It caters to both domestic and international markets, with a presence in more than 45 countries.

The company has built a strong distribution network with over 500 distributors and 800+ retail outlets across multiple Indian cities.

Fundamental Analysis

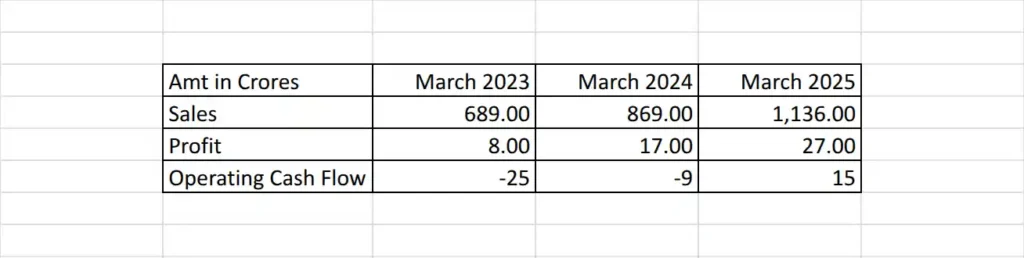

Sales, Profit and Operating Cash flow

- Sales: Strong, steady growth—up by 65% over three years.

- Profit: Net profits more than tripled over the same period.

- Operating Cash Flow: Negative OCF is a red flag. The same has turned positive in FY 2025.

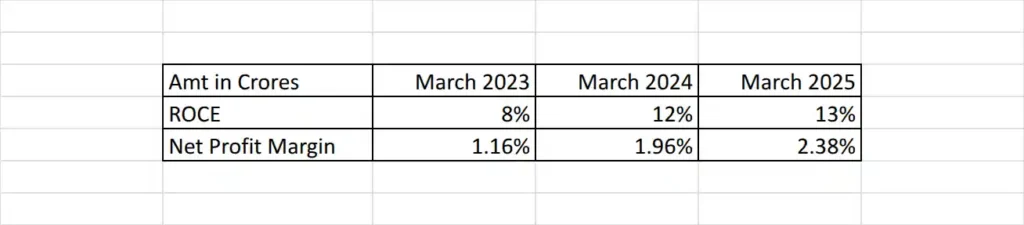

Profitability Overview

- Return on Capital Employed (ROCE): Steady climb from 8% to 13%.

- Net Profit Margin: NPM is growing but still below comfortable levels.

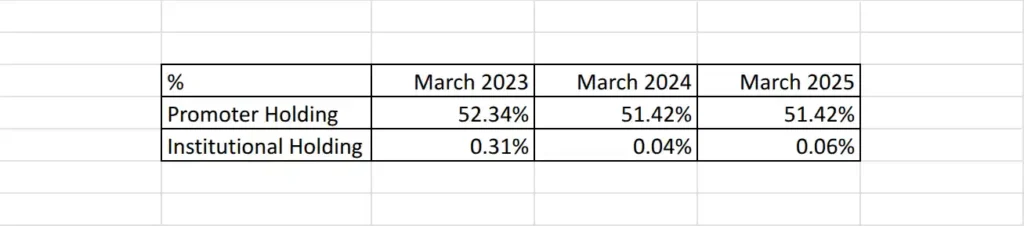

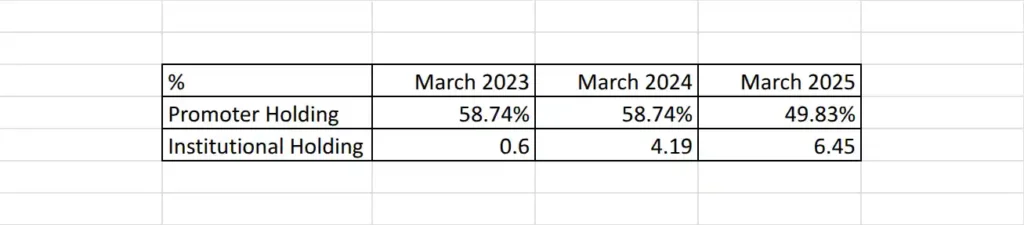

Shareholding Pattern

- Promoter Holding: Slight decline, but remains at a majority.

- Institutional Holding: Negligible, suggesting the stock is still off institutional radars.

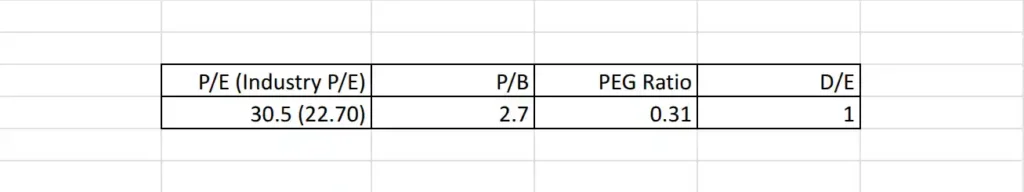

Valuation and Leverage (As of March 2025)

- P/E of 30.5 is above the industry average, trading at a premium compared to the sector.

- P/B at 2.7: Reflects market optimism but not excessive.

- PEG Ratio of 0.31: below 1, considered attractive for growth investors.

- Leverage: D/E of 1 is at satisfactory level.

Sarveshwar Foods is growing with rising sales and improving profit margins, showing signs of better business efficiency.

It finally turned cash flow positive in FY25 after two years. That said, the stock’s high valuation means it really needs to keep performing well to justify the valuations.

Promoters still hold the majority, but with little institutional interest, the stock might stay volatile. Overall, there’s potential here.

Technical Analysis

The above screenshot shows the historical monthly chart of Sarveshwar Foods Ltd. One of the first observations is its strong uptrend since 2020, delivering an impressive 30x return.

However, this rally was followed by a sharp correction, with the stock falling nearly 60% from its peak.

The broader uptrend has been respecting an upward parallel channel, and the price is currently hovering near the lower trendline—suggesting a potential support zone.

The red line on the chart represents the 20 EMA, which has consistently acted as dynamic support. Notably, the 20 EMA is now aligning with the lower trendline, reinforcing this area as a strong confluence support.

The latest monthly candle has witnessed a notable surge in volume, reflecting renewed interest from market participants.

A crucial reminder: never enter any stock without a predefined stop-loss. For this setup, a reference SL has been marked on the chart for guidance.

Additionally, the lower trendline of the upward parallel channel serves as a reference for trailing the stop-loss.

4. Multibagger Penny Stocks – Ajanta Soya Ltd

Ajanta Soya Ltd (ASL), incorporated in 1992, is a manufacturer of Vanaspati, refined edible oils, and specialty fats used in products like biscuits, puffs, and pastries.

It operates under well-known brand names such as Anchal, Dhruv, Nutri-1992, ASL Pure, Parv, and Fine Fingers, offering a range of oils like soybean, palm, mustard, sunflower, and groundnut.

The company serves reputed clients including Britannia, Godrej, Haldirams, Bikano, Anmol etc, supplying them with food ingredients.

Fundamental Analysis

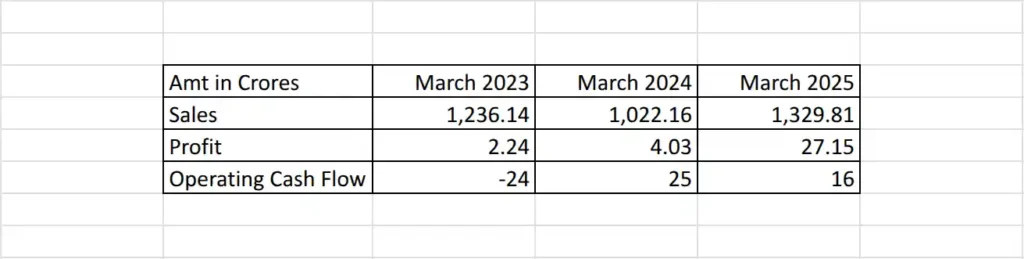

Sales, Profit and Operating Cash flow

- Sales: Dipped in 2024 but rebounded in 2025, signaling volatility but resilience.

- Profit Growth: Remarkable jump in 2025, outpacing sales growth.

- Operating Cash Flow: Turned positive in 2024 but still volatile. Strong companies have consistent Operating Cash Flows in tune with Net profits.

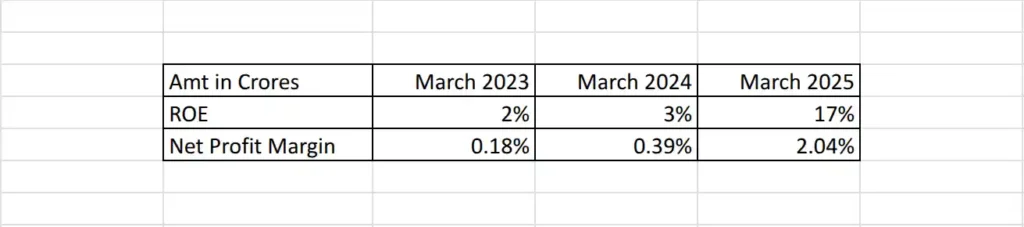

Profitability Overview

- Return on Equity (ROE): Strong improvement, rising from 2% to 17% over three years, indicating efficient use of shareholder funds.

- Net Profit Margin: Sharply increased in 2025 but still not there. A net profit margin of 5–10% is generally considered good for microcaps.

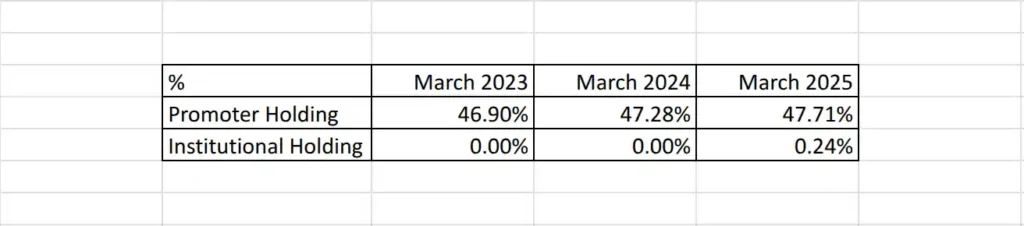

Shareholding Pattern

- Promoter Holding: Constant and slightly increasing, suggesting promoter confidence in the company’s prospects.

- Institutional Holding: Still very low, but nominal institutional interest appears in 2025.

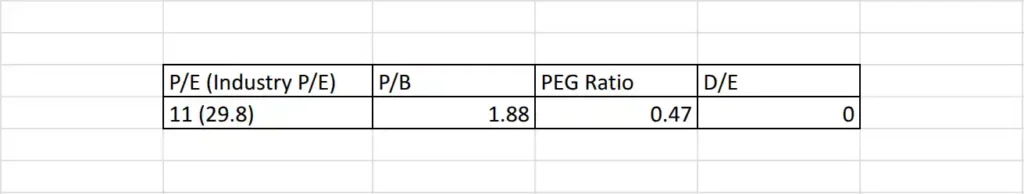

Valuation and Leverage (As of March 2025)

- P/E (11): Well below industry average, signaling potential undervaluation, especially after profit uptick.

- P/B (1.88): Reasonable – below 2 is acceptable

- PEG (0.47): Far below 1, indicates strong earnings growth relative to valuation; attractive for growth investors.

- Leverage: Debt-free (D/E = 0) – a safer bet with lower default risk.

So, Ajanta Soya is showing strong signs of a turnaround, with growth in profits and return on equity in the latest year.

With low valuations, improving financials, and almost no debt, the stock is a solid opportunity.

Technical Analysis

The monthly chart of Ajanta Soya Ltd shows a broad channel that has been guiding the price action. Since hitting its all-time high in January 2022, the stock has been moving sideways.

Currently, the price is around the upper trendline of the channel, which is not a good entry point as the risk reward is not in favor.

However, the ideal entry would be closer to the middle trendline (around green circle), which also coincides with a key support zone.

The stoploss can be placed below the middle trendline.

3. Multibagger Penny Stocks – Shree Rama Multi-Tech Ltd

Shree Rama Multi-Tech Ltd. (SRMTL), founded in 1987, is engaged in manufacturing high-quality packaging materials. Based in Gujarat, the company specializes in packaging solutions like laminated tubes.

Its main products are used for packing paste or gel-based items. SRMTL serves sectors such as oral care, cosmetics, pharmaceuticals, food, and personal care.

SRMTL maintains business relationships with major clients like Dabur, Vicco, HUL, Patanjali, and Sun Pharma.

Fundamental Analysis

Sales, Profit and Operating Cash flow

- Sales: Slight dip in FY24, then a strong recovery in FY25.

- Profit: A notable leap to ₹51 crore in FY25.

- Operating Cash Flow: Positive and stable cash flows is another positive sign.

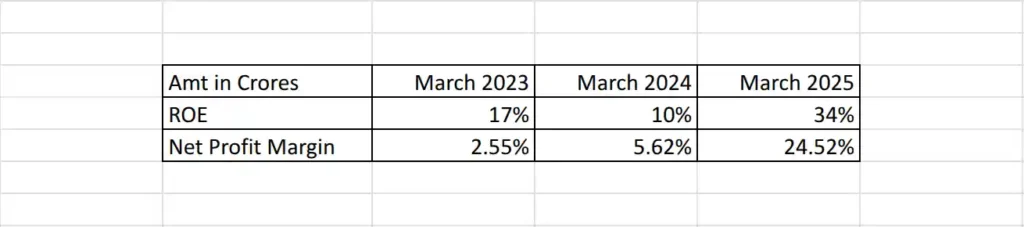

Profitability Overview

- Return on Equity (ROE): Rebounded to 34% in FY25, signals value creation for shareholders.

- Net Profit Margin: Significant improvement to 24.52% by FY25.

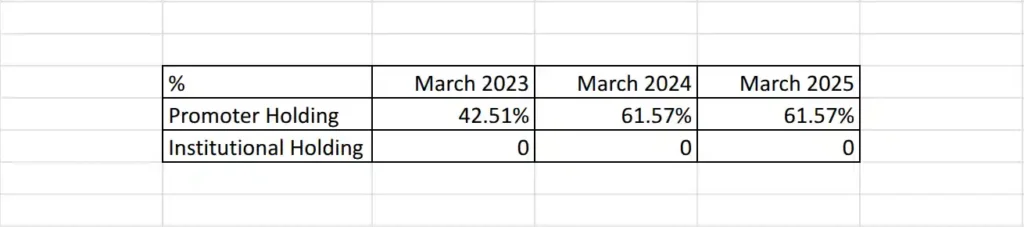

Shareholding Pattern

- Promoter Holding: Increased sharply and maintained. Promoters’ skin in the game is a confidence booster for investors.

- Institutional Holding: Still undiscovered by larger funds.

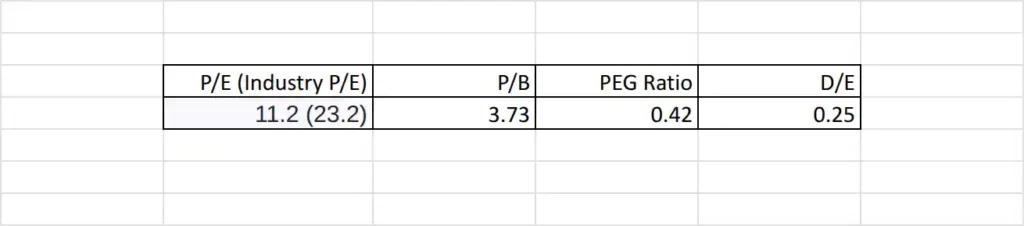

Valuation and Leverage (As of March 2025)

- P/E Ratio: 11.2, well below the industry average of 23.2.

- P/B Ratio: 3.73, The stock is trading at 3.73 times its book value, meaning investors are paying ₹3.73 for every ₹1 of net assets – moderate for a company with high recent ROE and profit growth.

- PEG Ratio: 0.42, PEG < 1 indicates that a stock is undervalued relative to its earnings growth rate.

- Debt/Equity (D/E): 0.25 – a healthy ratio.

Shree Rama Multi-Tech looks good, with profits and returns jumping sharply in FY25. Sales have bounced back, and cash flows are consistent and solid.

The promoters have increased their stake, which is a good sign of confidence. Even with the growth, the stock still seems reasonably priced.

Technical Analysis

The price has broken out of the red zone for the first time since 2002. A breakout from a consolidation that lasted over two decades is a strong positive signal.

The stock is forming higher lows and has taken support near the red zone, further confirming its strength. The 20 EMA is also providing short-term dynamic support.

Long-term investors may consider placing their stop-loss below the red zone, which now acts as a key long-term support.

A short-term target has also been marked on the chart for reference.

2. Multibagger Penny Stocks – KM Sugar Mills Ltd

KM Sugar Mills Ltd is engaged in manufacturing sugar, distillery products, and electricity generation. Its unit is located in Faizabad, Uttar Pradesh.

The company produces three grades of sugar, packaged in jute and PP bags, and is involved in both domestic and export trading. In its distillery segment, it manufactures Rectified Spirit, Ethanol, and Extra Neutral Alcohol (ENA).

KM Sugar also runs a 25 MW bagasse-based co-generation power plant at Motinagar. The generated power is supplied to the Uttar Pradesh Power Corporation Limited (UPPCL).

This setup lets the company earn from multiple areas while using its resources effectively.

Fundamental Analysis

Sales, Profit and Operating Cash flow

- Sales Growth: Decent growth, rising from ₹576 crore to ₹659 crore—most of it happening in FY24. FY25 was more or less flat.

- Profit Growth: Net profit is increasing steadily.

- Operating Cash Flow: OCF is positive for all the years, though it has reduced from FY 2023 and is now stabilizing.

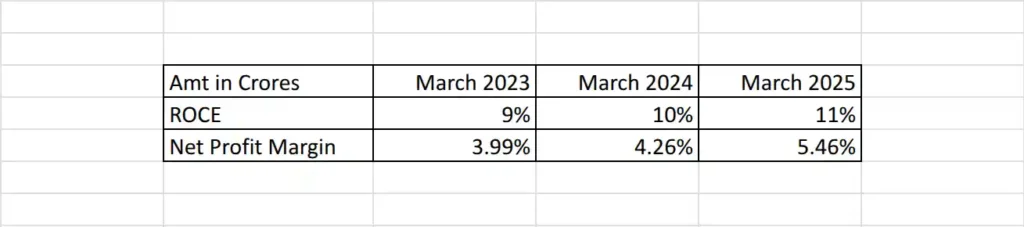

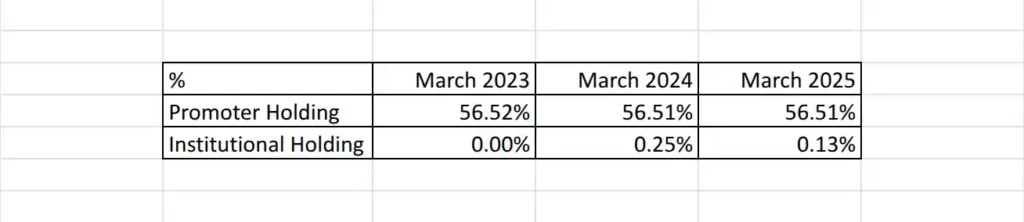

Profitability Overview

- Return on Capital Employed (ROCE): Steady improvement from 9% to 11% over three years.

- Net Profit Margin: Margins have improved from 3.99% to 5.46%, and are at acceptable levels.

Shareholding Pattern

- Promoter Holding: Remained consistently high.

- Institutional Holding: Minimal, with a small entry by institutions in FY24.

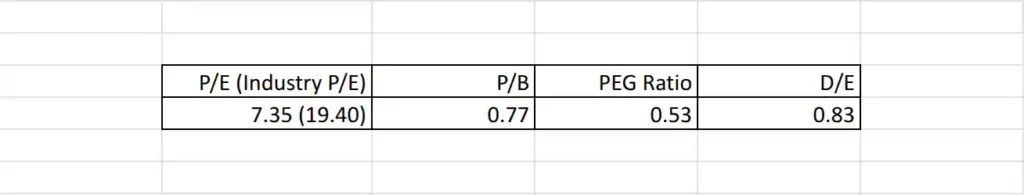

Valuation and Leverage (As of March 2025)

- P/E Ratio: At 7.35, well below the industry average (19.40).

- P/B Ratio: 0.77, indicates that the stock is trading at a discount to its book value.

- PEG Ratio: 0.53,considered very attractive for fundamental investors.

- Debt/Equity (D/E): 0.83, a D/E below 1 is considered healthy.

KM Sugar Mills has been steadily improving its profits with better margins and rising ROCE. Promoters holding is strong.

The stock is undervalued, backed by healthy cash flows and manageable debt.

It’s a solid pick for value-focused investors in the sugar space.

Technical Analysis

The chart of KM Sugar Mills Ltd appears to be forming a Cup and Handle pattern.

This pattern is considered a bullish continuation setup and consists of two key parts: the cup, which is a rounded bottom resembling a “U” shape, and the handle, which is a pullback—typically forming a small channel.

The pattern suggests a phase of consolidation and pullback before the stock potentially resumes its upward trend.

A stop-loss can be placed just below the handle for risk management.

1. Multibagger Penny Stocks – Kamdhenu Ltd

Kamdhenu Ltd is a well-known name in the steel space, making and selling TMT bars, structural steel, and related products under its brand “Kamdhenu.”

The company offers a wide range of products like Kamdhenu Nxt, PAS 100, Colour Max, and various structural steel items like beams, channels, and pipes.

Starting out in 1995 with just one unit in Bhiwadi, Rajasthan, it has now grown to over 50 manufacturing units across the country.

Kamdhenu also stepped into the decorative paints business in 2008. Over the years, it’s gone from being one among many to one of the top players in the industry.

Fundamental Analysis

Sales, Profit and Operating Cash flow

- Sales: Largely stable, around ₹730–750 crore.

- Profit: Decent growth, up nearly 50% across the three years.

- Operating Cash Flow: Robust, positive and more than Net profit which is a strong indicator of quality earnings.

Profitability Overview

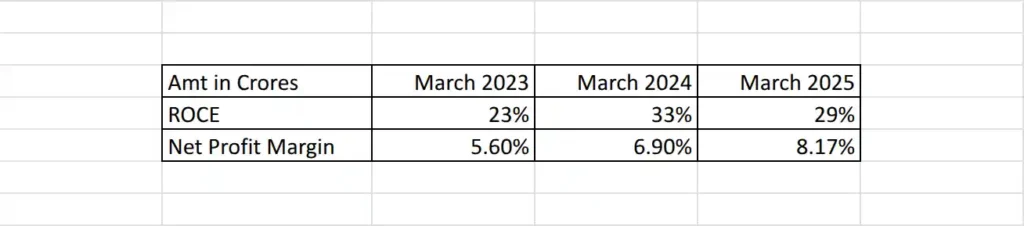

- ROCE: Strong and consistently high, peaking at 33% in FY24.

- Net Profit Margin: Steadily climbing from 5.6% to 8.17%, indicating improving efficiency.

Shareholding Pattern

- Promoter Holding: High and stable, but falls in FY25. Still remains significant.

- Institutional Holding: Rises from 0.6% to 6.45% over two years, highlighting growing market interest.

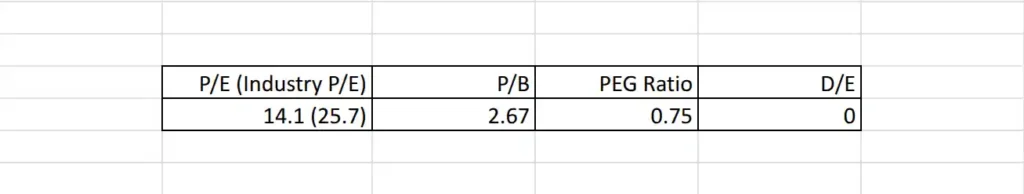

Valuation and Leverage (As of March 2025)

- P/E of 14.1 is well below the industry average of 25.7.

- P/B of 2.67, reasonable pricing for a high-ROE business.

- PEG Ratio of 0.75—below 1—indicates undervalued.

- Leverage: Debt-free (D/E = 0).

Kamdhenu Ltd is showing strong fundamentals—high returns on equity, growing margins, and solid cash flows.

The company is debt-free and looks undervalued based on its P/E and PEG ratios. Institutional interest is rising, which adds confidence.

Overall, it’s one of the best stocks in terms of fundamentals.

Technical Analysis

Post-COVID, the stock delivered a massive 30x rally in just four years, topping out in May 2024. Since then, it has corrected nearly 55% and is now trading around ₹28, near Support 1.

The red line is the anchored VWAP, which aligns closely with Support 1. This zone could offer a good entry opportunity, with a stoploss placed just below the support.

If Support 1 fails to hold, the price may head down toward Support 2.

Conclusion: Final Thoughts on Multibagger Penny Stocks for 2025

Multibagger Penny Stocks have the potential to turn small investments into massive returns—but they come with equally high risk.

The five stocks covered in this post — Sarveshwar Foods, Ajanta Soya, Shree Rama Multi-Tech, KM Sugar Mills, and Kamdhenu Ltd — were selected based on a combination of strong fundamentals and promising chart setups.

These are the companies showing profit growth, healthy cash flows, better margins, and cleaner balance sheets.

By combining technical breakouts with solid financials, these picks stand out among other Multibagger Penny Stocks currently under ₹50.

Still, it’s important to remember that penny stocks are highly volatile and sensitive to even the smallest news or events.

Prices can swing wildly, and liquidity can dry up quickly. That’s why proper risk management is important — always use a stop-loss and never invest more than you can afford to lose.

Use the filters and framework shared in this blog to build your own watchlist and refine it regularly. Diversify your picks, track the company’s quarterly/yearly performance, and don’t hesitate to exit if the fundamentals weaken.

With the right strategy, 2025 can unlock high returns from well-researched Multibagger Penny Stocks.

Frequently Asked Questions

Penny stocks are low-priced shares (typically under ₹50) of small-cap companies with low market capitalization and limited liquidity.

They can be—but only with the right stock, timing, and risk management. Some have delivered huge returns; others have crashed completely.

Yes. They are extremely volatile, illiquid, and prone to sharp price swings. Never invest without proper analysis and a stop-loss.

Yes. Many successful companies started as penny stocks. With strong fundamentals and growth, they can deliver 10x+ returns.

Our top picks for 2025 (based on fundamentals and charts):

1. Kamdhenu Ltd

2. KM Sugar Mills

3. Shree Rama Multi-Tech

4. Ajanta Soya

5. Sarveshwar Foods

Not a financial advice. Do your own research.

![Top Nifty 50 Companies [2025]](https://thsinvestor.com/wp-content/uploads/2025/04/top-5-nifty-50-companies-768x384.webp)

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025]](https://thsinvestor.com/wp-content/uploads/2025/08/Tata-Motors-logo-768x384.webp)