Future of Yes Bank in 2025: Introduction

Yes Bank was founded in 2003 by Mr Rana Kapoor and Mr Ashok Kapur, headquartered in Mumbai. Once a rising star, Yes Bank faced one of the worst modern banking crises in India.

Yes Bank’s share price history has been dramatic, rising from Rs. 10 in 2005 to Rs. 400 in 2018, only to crash back to Rs. 10 in 2021. The stock is currently trading around Rs. 20.

In this post, we’ll dive deep into the history of Yes Bank, how it rose to become one of India’s leading private banks, only to come close to collapse. We’ll also analyze the future of Yes Bank through both fundamental and technical angles, and discuss the potential Yes Bank target for investors going forward

History of Yes Bank: Rise to Collapse to Recovery

Rise (2004–2017)

In 2004, Yes Bank received its banking license and was listed on the stock exchange after its IPO in 2005 at an issue price of ₹35. The IPO was subscribed 19.79 times.

Within its first six years of operations, YES Bank achieved a compound annual growth rate (CAGR) of 74%, and by 2010–2011, it had emerged as the fourth-largest private sector bank in India.

It launched India’s First Green Infrastructure Bond Issue of INR 500 Crores plus Greenshoe and became the first Indian bank to be selected in Dow Tones Sustainability Indices – laying the foundation for what many thought would be a strong and stable future of Yes Bank.

Further, the Bank received multiple national and international awards, along with consistent upgrades in external ratings, everything seemed to be going in its favor.

Collapse (2018–2020)

Yes Bank’s share price peaked at ₹404 in August 2018 and its steep decline started almost immediately.

The most prominent reason was aggressive lending to financially stressed companies that were unable to repay their loans, leading to a sharp rise in non-performing assets (NPAs)

Additionally, the RBI discovered that Yes Bank had been underreporting its actual NPA levels, which dealt a major blow to investor confidence.

Soon after, the RBI declined to extend the tenure of CEO Rana Kapoor, triggering a free fall in stock’s price.

With every passing quarter, the bank was forced to concede more and more NPAs. As bad loans mounted, the bank faced the added burden of higher provisioning requirements, creating an urgent need for additional capital.

In mid 2019, the Tirupati temple trust withdrew its deposits from Yes Bank worth Rs 1,300 crore.

By this time, panic had set in among customers, leading to long queues as people rushed to withdraw their money.

Recovery & Rebuilding (2020–2025)

In March 2020, the RBI imposed a 30-day moratorium on Yes Bank and capped withdrawals at ₹50,000 per account. Imagine the shock of not being able to access your own hard-earned money.

The crisis was so severe that the stock plummeted to just ₹5.55.

The RBI stepped in decisively—superseding the board, appointing Mr. Prashant Kumar as the new MD & CEO, and forming a rescue consortium comprising SBI, HDFC, ICICI, and others. The rescue consortium injected the much-needed capital to keep the bank afloat.

Because more shares were issued to new investors (rescue consortium), the ownership percentage of existing shareholders became smaller. This reduced the intrinsic value of Yes Bank share, leading to a significant dilution in their stake.

With the new board, asset quality of the bank is improving, NPAs are being settled and annual revenue is increasing, and the value of Yes Bank is stabilizing.

Over the past few years, the stock price has stabilized after a period of high volatility, remaining range-bound between ₹10 and ₹30.

Recently, in June 2025, reports emerged that Japan’s second-largest bank, Sumitomo Mitsui Banking Corporation (SMBC), has agreed to acquire a 20% stake in Yes Bank.

The fact that a crisis-stricken Bank is now attracting high-quality investors to replace SBI and other initial backers highlights the bank’s ongoing recovery and renewed investor confidence in future of Yes Bank.

Future of Yes Bank: Fundamental Analysis

Sector Overview

- Banks are tapping rural and low-income segments with loans and insurance, expanding their customer base.

- Focus is shifting from physical branches to digital infrastructure, reducing long-term costs.

- A rising middle class and young population are driving demand for personal loans and credit cards.

- Low insurance penetration in India and growing SIP inflows present cross-selling opportunities for banks.

So, the future of banking in India looks strong —powered by rural inclusion, rising retail credit demand, digital adoption, and cross-selling of financial products.

The future of Yes Bank will depend on how effectively it leverages these trends.

Financial Health

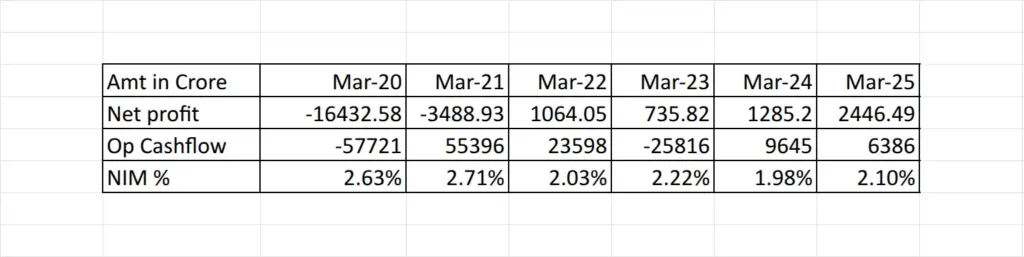

Net Profit, Operating Cashflow and Net Interest Margin

Net Profit: Final profit after all expenses, interest, taxes. Shows actual earnings available to shareholders.

From massive losses in FY19-20 and FY20–21 (due to high provisioning), Yes Bank has made a steady turnaround, with net profit improving in recent years although the profit is not rising consistently.

Operating Cash Flow (OCF): Real cash generated by core operations like lending, deposits.

The OCF of Yes Bank is very volatile.

Ideally, OCF > Net Profit consistently which represents good quality earnings.

In Yes Bank’s case, the inconsistency shows recovery phase + restructuring.

Net Interest Margin (NIM): Indicates how efficiently a bank earns interest income from its lending activities relative to the interest it pays to depositors.

NIM of Yes Bank has been below industry average for private sector banks (which is ~3–4%).

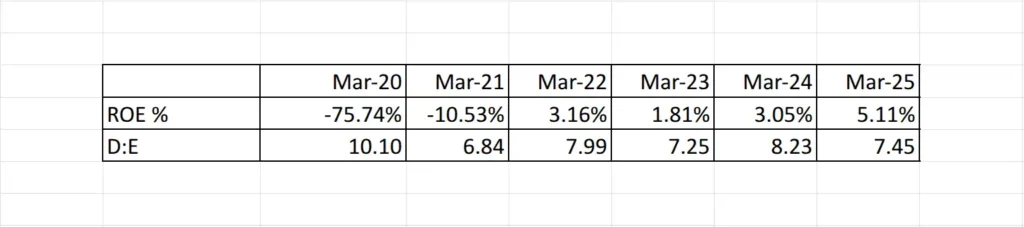

Return of Equity and Debt Equity Ratio

ROE (Return on Equity): Measures how efficiently a company generates profit from shareholders’ equity (Higher = better return for investors).

Debt-to-Equity (D:E) Ratio: Total Debt / Total Equity. Higher = more reliance on debt funding. Lower is generally safer.

ROE is improving, but still too low to be attractive to long-term investors(>15% is considered as healthy), especially given the very high leverage (<4 is considered safer).

High ROE with high debt-to-equity means the company might be using borrowed money to amplify returns which also raises risk.

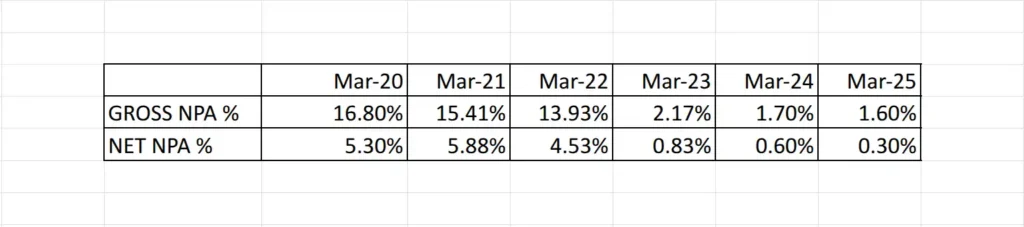

Gross and Net NPA levels

Gross NPA (GNPA): % of total loans that have gone bad (defaulted).

Net NPA (NNPA): (GNPA – provisions). It shows how much bad debt remains uncovered by provisioning.

NPAs of the bank are coming under control now. Much of the improvement came from write-offs and selling bad loans to ARC.

The focus now should be on growing quality lending, not just cleaning the past.

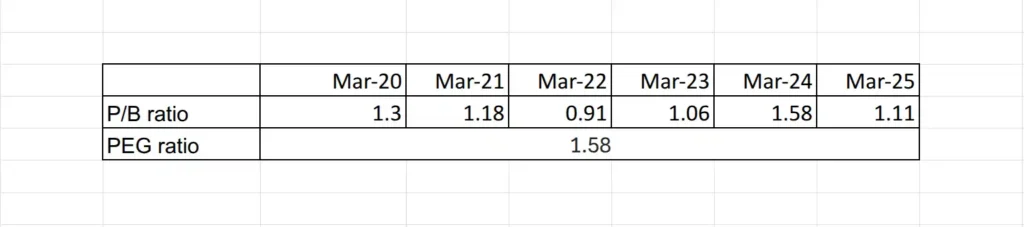

Valuations

P/B Ratio: Price per share ÷ Book value per share.

It tells you how much investors are paying relative to the bank’s net worth (assets – liabilities). Higher P/B = market believes the bank is efficient, profitable, and growing.

For a private sector bank, a P/B between 1.5–3.5 is common depending on return metrics. Yes Bank at 1.11 = fairly valued but still not there.

PEG Ratio: Price-to-Earnings ÷ Estimated Earnings Growth Rate. Helps assess whether a stock is over/under-valued relative to its growth.

PEG = 1 is Fairly valued

PEG of 1.58 means the stock is trading at a valuation slightly higher than its earnings growth justifies and Investors may be paying a premium due to future optimism.

Analyzing the above data, we may conclude that Yes Bank is on the path to recovery after a rough few years.

Profits and loan quality have improved a lot, but it’s still not performing as strongly as industry standards. The numbers show it’s getting better, but there’s more work to do.

Future of Yes Bank: Technical Analysis

Looking at the Yes Bank chart, there’s been a one-sided decline since 2018. Post 2020, however, prices have been consolidating, supported by the above fundamental analysis, suggesting that while the worst may be behind, the bank is still far from its best.

The immediate hurdle is the Rs. 27–32 range, which will act as a strong resistance zone.

The red line marks the anchored VWAP drawn from the peak where the downtrend began. It’s also converging with this resistance zone, adding further weight to it.

To be very honest, Yes Bank’s chart still looks lifeless. The only good thing is that price action is forming higher lows, hinting that buyers are stepping in earlier than before. But the strength of this upward move remains unconvincing.

For anyone eyeing the Yes Bank target price, a breakout above ₹32 could indicate the start of a new trend.

In conclusion, fundamentals haven’t fully recovered and the technicals remain weak — caution for investors considering new positions.

Future of Yes Bank: Conclusion

Lessons from Yes Bank

- Keep Stoploss: Do not fall in love with any stock, always have a point where you will exit and book loss, no matter what.

- Never buy a falling stock: Many investors rushed in after Yes Bank fell over 90%, thinking it couldn’t drop much further — but it kept falling and losing 98% of its value.

- Do not just look at price: Don’t assume a stock is cheap just because it fell from ₹400 to ₹15; price alone means nothing without context.

- Never ignore the management: Before the fall, there were serious concerns around management practices, loan disclosures, and aggressive lending. Yet, many investors ignored these.

What should Investors do?

Disclaimer: The information shared here is purely for informational purposes and not a recommendation to buy, sell, or hold any security. Investment decisions should always be made based on individual risk tolerance, financial goals, and own due diligence.

For those still holding Yes Bank shares with the hope that it will return to its previous highs anytime soon, that will not happen.

For new investors, the stock has been consolidating for years, and there’s no clear timeline for when this phase might end. A clear trend may emerge once price breaks the resistance zone.

Frequently Asked Questions

Yes Bank failed due to reckless lending to risky borrowers, under reporting bad loans, and poor corporate governance that led to a collapse in investor confidence.

Post the 2020 rescue, major shareholders include SBI, LIC, ICICI, and HDFC; recently, SMBC is reportedly set to acquire a 20% stake.

Unlikely, as massive equity dilution and weaker financials make a return to ₹400 unrealistic in the foreseeable future.

When Yes Bank was trading at its peak price of ₹400 with around 235 crore shares, its market cap was approximately ₹94,000 crore. Today, even though the share price is only ₹20, the number of shares has risen sharply to about 3,000 crore, bringing the current market cap to roughly ₹60,000–₹70,000 crore.

This means even after a massive drop in share price, the bank’s overall valuation is not far from its earlier peak.

It may suit high-risk investors betting on a long-term turnaround, but it’s not ideal for conservative or short-term investors yet.

Yes, the bank has returned to profitability, but profit growth and return ratios remain below industry standards.

![Share Price of Tata Motors: A Complete Analysis of Past, Present & Future [2025]](https://thsinvestor.com/wp-content/uploads/2025/08/Tata-Motors-logo-768x384.webp)

![Top Nifty 50 Companies [2025]](https://thsinvestor.com/wp-content/uploads/2025/04/top-5-nifty-50-companies-768x384.webp)