Best Cryptocurrencies to Invest [2026] – Introduction

Finding the best cryptocurrencies to invest in 2026 is not easy, especially small-caps. Investing in them can be extremely rewarding as the right projects can deliver huge returns.

But at the same time, they are highly volatile and risky. Many coins disappear as quickly as they rise. This is why fundamental analysis is essential before investing.

It helps you find projects that actually solve problems, have real-world use, and can survive long term instead of being short-lived hype.

A good investment strategy to find the best cryptocurrencies to invest should focus on these four areas:

- Utility (Knowing the Project) – It’s important to understand what the project does and what problem it solves.

- Management – A capable and transparent team gives investors confidence.

- Tokenomics – It defines the supply, distribution, and economics behind a token; how it enters and exits circulation to manage inflation.

- Competition – If the project offers something unique than others, it stands a better chance of long-term growth.

Even with strong fundamentals, risk management and discipline is absolutely necessary when choosing the best cryptocurrencies to invest in.

These coins move fast, and proper control over entries, exits, and emotions is key.

Risk Management:

- Always use a stop-loss.

- Avoid leverage and stick to the spot market only.

- Avoid trading and be an investor instead.

- Keep some cash ready for re-balancing when markets correct.

Discipline:

- Expect heavy volatility, 50–70% drawdowns are normal in small-caps.

- Think long-term and focus on projects that can survive multiple market cycles.

- Avoid FOMO; missing one setup doesn’t mean missing the opportunity.

For this research, a custom screener was used to find small-cap projects with genuine potential.

- Market cap between $50 million and $1 billion.

- Minimum 24-hour trading volume of $1 million.

- Project age of more than one year.

From this filtered list, only coins showing strong price action and strong fundamentals were shortlisted.

Please note, this post is not a buy or sell recommendation but for educational purposes only.

That being said, let’s explore the Best Cryptocurrencies to Invest in 2026.

Best Cryptocurrencies to Invest – Coinbase Wrapped Staked ETH (cbETH)

Fundamental Analysis

About the project

Coinbase Wrapped Staked ETH (cbETH) is a token that stands for ETH staked through Coinbase.

When you stake your ETH on Coinbase, you can “wrap” it to get cbETH which you can further trade, transfer, or use across DeFi apps, wallets and exchanges.

Normally, staked ETH is locked and can’t be moved until it’s unstaked. But cbETH solves this problem by giving you liquidity. You can use or sell cbETH anytime, while your original staked ETH keeps earning staking rewards in the background.

Management

cbETH is developed and managed by Coinbase Global, Inc., one of the largest and most regulated cryptocurrency exchanges in the world.

Coinbase is a publicly listed company (NASDAQ: COIN) that brings confidence and strict regulatory compliance.

Tokenomics

- Minting: When you wrap your staked ETH on Coinbase, new cbETH tokens are created and sent to you.

- Burning: When you unwrap cbETH to get your staked ETH (with rewards), those cbETH tokens are destroyed.

The total supply of cbETH changes based on how much ETH users wrap or unwrap.

Technology

cbETH is an ERC-20 token on the Ethereum blockchain. ERC-20 is a common standard that sets rules for creating and using tokens, so cbETH works easily with most DeFi apps, wallets, and exchanges.

Competition

Main competitors: Other liquid staking tokens like Lido’s stETH, Rocket Pool’s rETH, and Stakewise.

How cbETH is different: It’s issued by Coinbase, a regulated exchange. cbETH doesn’t change balance (non-rebasing), which makes it easier to use in DeFi and suits users who trust Coinbase’s custody.

Technical Analysis

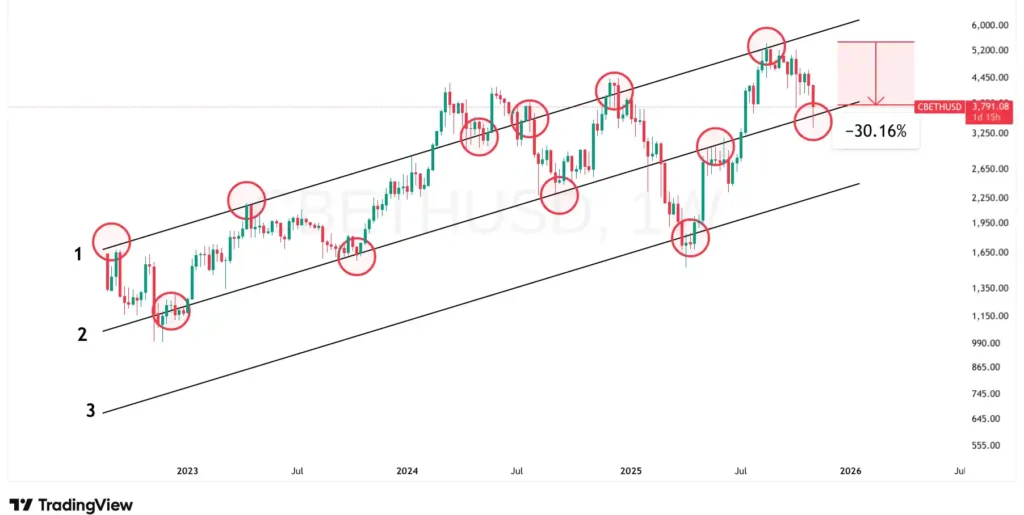

The chart above shows the weekly price of cbETH moving inside an upward-sloping channel with three trendlines. These trendlines act as dynamic support and resistance levels.

Trendline 2 has been broken only once in history, with the price mostly staying between trendline 1 and 2, making it one of the best cryptocurrencies to invest in 2026.

Currently, cbETH is down about 30% from its all-time high after hitting resistance near trendline 1 and is now close to the support near trendline 2.

The uptrend that started in April 2025, marked by higher lows, is still holding. Price is near the latest swing low, if this level breaks, it could signal a trend reversal. This level also aligns with the middle trendline, which strengthens its importance as support.

Looking at the RSI, every time price has bounced from trendline 2, RSI was near 45. At present, RSI is around 47 and price is again near the same support, suggesting a possible bounce with good probability.

A stop loss can be placed below the last swing low, under $3,500, which is also below trendline 2.

If this level breaks, re-entry can be planned near trendline 3 or once the price moves back above trendline 2.

Best Cryptocurrencies to Invest – Subsquid (SQD)

Fundamental Analysis

About the project

SQD is the native token of the Subsquid Network, a decentralized platform that gives fast and scalable access to blockchain data across multiple chains.

The goal is to make blockchain data easy to access and use at scale.

Subsquid powers APIs, data indexing, historical queries, analytics, and real-time data feeds for apps, dApps, and AI tools.

Management

Subsquid has an active engineering team focused on developer tools and indexing technology.

Rezolve AI, an AI-driven commerce company listed on Nasdaq, has officially acquired Subsquid (SQD) in Oct 2025.

Tokenomics

SQD is the main token of the network. It’s used to reward nodes (computers) that index and deliver data.

Users who need faster data access can lock SQD tokens instead of paying a centralized service.New SQD enters the market through node rewards and token vesting.

Nodes earn SQD for their work, similar to mining. Some of the SQD paid as fees can be burned or moved to a treasury to manage supply.

Technology

Subsquid is its own blockchain built with Substrate (a framework for building blockchains).

It connects to other blockchains like Ethereum, Solana, or any EVM chain using indexers. These indexers don’t make Subsquid part of those chains; they just read and process data from them.

Competition

The Graph (GRT) is the main rival. Both help apps fetch blockchain data, but Subsquid claims to be faster and cheaper for complex data queries.

Subsquid focuses on speed, flexibility, and support for many blockchains.

Technical analysis

The chart above shows Subsquid’s (SQD) weekly price action. The coin is down about 70% from its recent high, showing the volatility of small-cap cryptos.

After failing three times to break above the $0.22 resistance, SQD has now dropped near a multi-year support zone around $0.07.

At current levels, SQD appears to be forming a cup and handle pattern, a bullish setup that signals trend reversal.

For this to confirm, the price must move up from the current range and close above $0.22. A breakout above this zone will open room for strong upside.

On the downside, $0.04 remains the ultimate support, making it a good accumulation zone for long-term holders. A stop-loss can be placed below it.

Additionally, investors can also wait for Bitcoin to confirm an uptrend before entering, as further drop in Bitcoin can pull the market lower.

Best Cryptocurrencies to Invest – Pendle (PENDLE)

Fundamental Analysis

About the project

Pendle is a DeFi protocol that lets you trade the future interest your tokens will earn.

Normally, when you stake or lend crypto, your money and future rewards are locked. Pendle fixes this by splitting your token into two parts:

- PT (Principal Token): your main deposit.

- YT (Yield Token): the future interest your deposit will earn.

This way, you can trade or invest based on what you think will happen to yields:

- If you think yields will rise, buy YT to earn more.

- If you think yields will fall, hold PT for stability.

Example:

You stake 1 ETH and earn 5% yearly. That 5% is your future yield, and Pendle lets you trade it separately instead of waiting a full year.

Management

TN Lee (Co-Founder), a seasoned DeFi builder who started in the Ethereum community and later joined Kyber Network’s founding team.

Tokenomics

New PENDLE tokens aren’t created through mining. The protocol releases them as rewards.

The supply goes down indirectly when people lock their PENDLE to get vePENDLE, which gives them voting rights and higher yields.

Technology

Pendle runs on Ethereum and other EVM chains (Ethereum-compatible blockchains).

How tokenization works:

- Suppose you have a yield token like stETH.

- Pendle first wraps it into an SY token (Standardized Yield token).

- Then it splits that SY token into:

- PT (Principal Token): your main deposit.

- YT (Yield Token): the future interest until maturity.

Competition

Most competitors’ DeFi projects like Element, Tempus, or Notional offer fixed yield, meaning you get a set return no matter how rates move.

For example, if you deposit 1 ETH and are promised 5% in 6 months, you’ll get exactly that, stable but limited.

Pendle works differently. It doesn’t fix the rate. Instead, it creates a market for yields, where users can trade or speculate on future yield changes, similar to how people trade prices in regular markets.

Technical Analysis

Pendle’s last bull run delivered about 21,815% returns in under three years, starting from November 2022, generational gains.

The above monthly chart shows that since 2024, the price has been in a consolidation phase, forming a bull flag pattern, which signals continuation after a strong rally.

Pendle is one of the few small-cap coins with a strong and well-defined price structure, making it another high conviction pick among the best cryptocurrencies to invest in 2026.

The above chart shows weekly price action of Pendle. After huge gains, a period of consolidation is expected.

A likely scenario is the price moving between $6.00 and $1.80, possibly dipping below $1.80 to grab liquidity before the next major uptrend.

Investors can consider keeping a stop-loss below $1.80 and look for re-entry above $1.80 once support holds again.

In the previous bull run, the price consistently respected the 21 EMA, so it’s important to watch how it behaves around that level in the next cycle.

Best Cryptocurrencies to Invest – OriginTrail (TRAC)

Fundamental Analysis

About the project

OriginTrail is a network that helps make information trustworthy and easy to check.

It connects and verifies data about real world things, like where a product came from, if a certificate is real, or if some data used by AI is correct.

Management

OriginTrail is built by an open and public team with active developers and engineers.

OriginTrail also runs the Trace Alliance, a network that brings together companies, tech partners, and organizations working on supply-chain and data verification projects.

Tokenomics

There’s no traditional mining like Bitcoin. Instead, nodes earn TRAC as a reward for providing storage, verification, and indexing services.

When users pay TRAC to publish or update data, some tokens are locked or redistributed, which reduces active circulation.

Technology

OriginTrail runs on a system called the Decentralized Knowledge Graph (DKG). DKG is like a web of verified information, built on blockchain, that anyone can use to check facts and trust data.

The DKG connects to many blockchains and can also use off-chain storage, making it interoperable

Competition

Other projects focus on things like supply chain tracking, decentralized data storage, or blockchain tools for businesses but most solve only one part of the problem.

What makes OriginTrail different:

- It builds a full Decentralized Knowledge Graph (DKG) that connects and verifies data, not just stores it.

- It works on AI reliability, making sure AI uses real and verified information.

- It also runs the Trace Alliance.

Technical Analysis

The chart above shows the weekly price of OriginTrail (TRAC). Since 2021, the price has moved within a range of $0.85 to $0.30, where $0.85 acts as resistance and $0.30 as support.

The price has tried to break above $0.85 three times in the past but failed each time. Currently, it’s facing resistance again around the same level and has started to retrace.

It is important to note that while most cryptocurrencies, including Bitcoin, are under selling pressure, TRAC has shown relative strength, making it one of the stronger performers in the market.

There are two possible trade/invest setups:

- Breakout trade: Wait for a breakout above $0.85 with strong volume and place a stop-loss just below it.

- Range trade: Wait for the price to drop near $0.30 support and buy there, keeping a stop-loss slightly below it.

This will ensure your risk management keeping your loss in control.

Best Cryptocurrencies to Invest – AIOZ (AIOZ Network)

Fundamental Analysis

About the project

AIOZ Network is a Layer-1 blockchain (independent), built for media, storage, video streaming, and AI computing, all without central servers.

It wants to decentralize the internet’s backbone, so instead of big companies running data centers, users run nodes to share storage, bandwidth, and computing power.

Everyone who helps earns rewards.

AIOZ works like an upgraded, blockchain-powered version of torrents, it shares data through users’ devices but adds rewards, trust, and more use cases.

Management

The founder/CEO is Erman Tjiputra. He has a background in peer-to-peer sharing and early decentralised systems.

Having a public, identifiable team helps build trust (you know who is leading the project).

Tokenomics

AIOZ doesn’t use traditional mining (like Bitcoin). Instead, users run nodes that Store data, Deliver content, Provide compute power for AI or streaming.

These nodes earn AIOZ tokens as rewards.

AIOZ plans to burn part of its tokens from real usage. Burning permanently removes tokens from circulation, which reduces supply and helps balance inflation.

Technology

AIOZ Network is a Layer-1 blockchain. It also supports EVM (Ethereum Virtual Machine), so apps made for Ethereum can run easily on AIOZ.

AIOZ connects to other blockchains through Cosmos IBC (Inter-Blockchain Communication).

AIOZ has also built tools like AIOZ Stream, which allows peer-to-peer live and on-demand video streaming.

Competition

AIOZ focuses on media streaming, content delivery, data storage, and AI computing, industries dominated by giants like YouTube, Netflix, and AWS.

It aims to decentralize these sectors and create fairer, user-driven alternatives.

AIOZ offers the complete stack (blockchain + storage + streaming + AI)

Technical Analysis

AIOZ has dropped about 87% from its all-time high, but it’s worth noting that it had earlier gained around 13,011% from its lows, signifying long-term potential.

The key support level is at $0.12, which the price is currently testing. This zone can offer a good entry opportunity, with a stop-loss below $0.12.

Alternatively, since the price has historically respected the 21 EMA (blue line) during both uptrends and downtrends, a safer entry could be either above the 21 EMA and above $0.40, with a stop-loss just below it.

Best Cryptocurrencies to Invest [2026] – Conclusion

Small-cap altcoins can deliver massive gains, but they also carry equally high risk. The key is to focus on strong fundamentals.

Every project covered here, cbETH, SQD, PENDLE, TRAC, and AIOZ, stands out for a specific reason: sound fundamentals and strong technical setups and can be one of the best cryptocurrencies to invest in 2026.

Still, prices fluctuate sharply, so it’s important to invest gradually, use stop-losses religiously, and avoid leverage.

Keeping some liquidity ready for corrections is better than going all in at once.

Small-cap cryptocurrencies can create generational wealth and change lives but only when investments are made with proper risk management.

Frequently Asked Questions

Our top 5 smallcap picks include cbETH, Subsquid (SQD), Pendle (PENDLE), OriginTrail (TRAC), and AIOZ Network (AIOZ), all offering strong fundamentals and technicals.

A small-cap crypto is a cryptocurrency with a relatively low market capitalization, usually between $50 million and $1 billion.

Altcoins are any cryptocurrencies that are not Bitcoin. The name is a combination of “alternative” and “coin”.

Look for tokens with strong utility, team, tokenomics, and real-world use. Analyze charts and stay away from meme coins.

It can be if you use risk management, keep funds diversified, and invest only what you can afford to lose.

![Best Cryptocurrencies to Invest [2026]: Top Small-Cap Altcoins](https://thsinvestor.com/wp-content/uploads/2025/11/Best-Cryptocurrencies-smallcap.webp)

![What is the Real Value of Bitcoin and Other Cryptocurrencies? A Fundamental Perspective [2025]](https://thsinvestor.com/wp-content/uploads/2025/04/cryptocurrency-utility-768x384.webp)

![Bitcoin Analysis [March 2025]: Charts, Trends & Predictions](https://thsinvestor.com/wp-content/uploads/2025/02/Bitcoin-march-768x403.webp)