Introduction: Bitcoin vs Ethereum

The year 2025 began with Bitcoin vs Ethereum headlines dominating the crypto space, as Bitcoin reached a historic milestone of $100,000.

Bitcoin was created in 2008 by an anonymous group under the pseudonym Satoshi Nakamoto. It gained mainstream attention during the 2017 bull run and its momentum accelerated after 2020 as companies like MicroStrategy and Tesla, Inc. added it to their balance sheets.

Ethereum was conceptualized in 2013 by programmer Vitalik Buterin, who envisioned a blockchain platform capable of more than just financial transactions.

By introducing smart contracts and decentralized applications, Ethereum has become the foundation of the Web3 ecosystem.

Together, Bitcoin and Ethereum account for a dominant share of the total crypto market capitalization. Their liquidity, stability, and institutional recognition set them apart from the rest of the market.

They consistently lead every major bull run and act as sentiment indicators for the entire crypto ecosystem.

In this post, we explore Bitcoin vs Ethereum comparison and key insights to understand their investment potential.

We will cover:

- Fundamentals – supply, consensus, utility, and adoption

- Price history – bull and bear cycles, key patterns

- Recent technical outlook – major levels and trends

- Investor positioning – who should buy BTC vs ETH

This guide will help both new and experienced investors make clear, data-driven decisions.

10 Oct 2025 – Liquidation Day

On October 10, 2025, Donald Trump’s 100% tariff announcement on Chinese imports triggered a wave of panic selling across global markets, leading to over $19 billion in leveraged crypto liquidations, the largest in crypto history.

For context, during the March 2020 COVID crash, liquidations were around $1.2 billion, a fraction of what the market saw this time.

Countless traders lost millions, with many seeing their entire life savings wiped out in minutes as some coins lost 100% of value in the blink of an eye.

But how did it happen?

Two key factors:

- Excessive leverage: Many traders were using high leverage.

- Rapid crash: The fall was so steep and fast that stop-loss orders were skipped, leaving no time to exit positions.

How to protect yourself against such flash crash in future:

- Diversify: Don’t put all your capital into a single asset or market.

- Book profits: Move your crypto gains into other assets like stocks or real estate.

- Invest wisely: Avoid meme coins for long term investments; focus on assets with real-world utility.

- Use leverage carefully: If you don’t fully understand it, don’t use it.

Fundamentals: Bitcoin vs Ethereum

Fundamentals refer to the core economic factors that give a digital asset its value, utility, and long-term potential.

Strong fundamentals often act as the foundation for long-term growth.

Supply

Understanding supply is key for long-term investing. Scarcity matters, the lower or slower the supply growth, the higher the potential for price appreciation.

- Bitcoin: Scarce and predictable – only 21M BTC will ever exist. Most are already mined, making it a deflationary asset and a strong store of value.

- Ethereum: Supply is flexible but can shrink when network activity is high (ETH burn + staking).

In the context of Bitcoin vs Ethereum, Bitcoin is better for wealth preservation.

Consensus Mechanism

- Bitcoin uses Proof of Work, where miners secure the network and earn rewards. It is highly secure and scarce, but consumes massive energy – a growing concern that could affect adoption or regulation in the future.

- Ethereum uses Proof of Stake, where validators secure the network by staking ETH, earn rewards, and reduce circulating supply. It is energy-efficient, making it more sustainable for long-term growth.

Utility & Use Cases

This is one of the most critical factors when comparing Bitcoin vs Ethereum.

Bitcoin

- Bitcoin is primarily a store of value, often called digital gold.

- It can also be used for peer-to-peer payments, though adoption is slower than Ethereum.

- Its scarcity and decentralization make it a safe-haven asset in volatile markets.

- Growing institutional adoption as an alternative to fiat strengthens its long-term appeal.

Ethereum

- Ethereum powers DeFi, NFTs, and smart contracts, enabling decentralized apps and financial services.

- Its network usage directly affects demand and value through ETH burn and staking.

- Ethereum’s ecosystem is expanding rapidly, with real-world applications attracting developers and users.

Adoption

Bitcoin

- ETFs & Funds: Bitcoin ETFs and investment products make it easier for institutions and retail investors to invest.

- Government Recognition: Some countries are adopting or regulating Bitcoin, increasing legitimacy.

- Institutional Investment: Large corporations and hedge funds holding BTC signal confidence in its long-term store-of-value.

Ethereum

- Web3 Infrastructure: Ethereum powers decentralized apps, DeFi platforms, NFTs forming the backbone of Web3.

- Corporate Adoption: Companies are building on Ethereum for enterprise solutions.

As of now, Bitcoin remains the safest long-term store of value, while Ethereum has higher growth potential tied to real-world adoption and network activity.

Historical Price Action: Bitcoin vs Ethereum

To understand where Bitcoin vs Ethereum might be headed, it’s important to look at their historical price patterns.

In this section, we will analyze yearly and monthly charts, key trends, corrections, and market cycles to gain an understanding of future price movements.

Bitcoin

Analyzing the yearly chart (Jan – Dec), you can see a maximum of 3 consecutive green candles in a row before a red one shows up, and we’ve never had two red candles back-to-back.

It is important to note that the third green candle is currently in progress.

The biggest red candle saw a 70% drop (3rd red candle in 2018), while the largest green one gained a massive 5,500% (2nd green candle in 2013). Over time, the green candles are getting smaller, showing that growth is becoming more gradual.

Another thing to notice is that the gap between each all-time high (ATH) is shrinking. This means each bull run is a bit smaller than the last, which is a sign that Bitcoin is maturing as an asset.

Drawing a Fibonacci channel on Bitcoin’s Monthly chart:

A Fibonacci channel is a technical analysis tool that uses Fibonacci ratios to draw parallel trendlines. These channels help traders identify potential support, resistance, and price targets during trending markets.

We can see that previous bull runs were very strong, often hitting the upper channel with massive gains.

In contrast, the current rally from 2022 to 2025 is the slowest and most gradual climb in BTC history. The percentage gains are smaller, but the growth is steadier and healthier.

This trend is another sign that cryptocurrencies are maturing. It now takes significantly more capital to achieve the same explosive growth seen in past cycles.

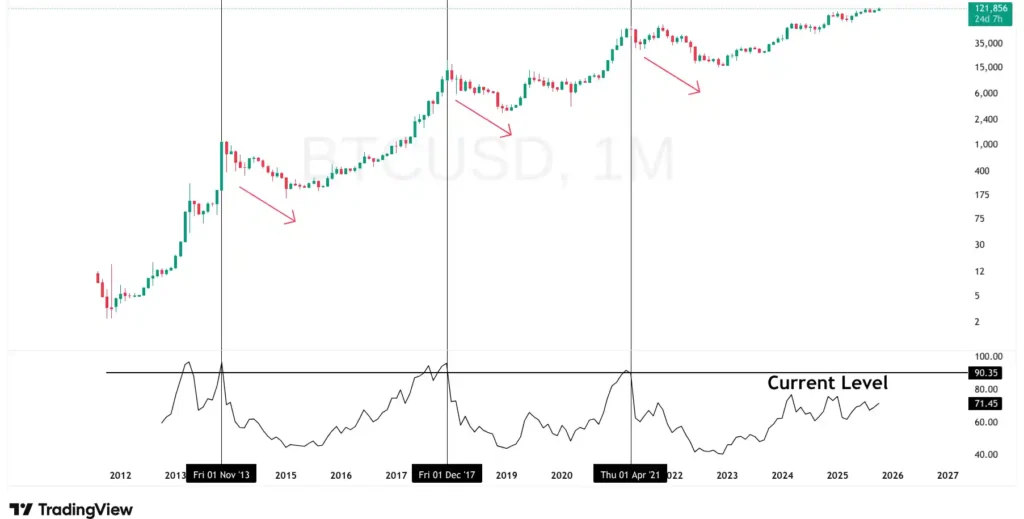

Looking at Bitcoin’s monthly RSI (Relative Strength Index), a clear pattern emerges:

Relative Strength Index (RSI) is a momentum indicator which measures the strength or rate of increase/decrease in prices. The value of RSI increases/decreases when there is a large increase/decrease in prices in relatively less time. It has a value between 0 to 100.

Every major bear cycle started when RSI reached around 90, indicating extreme overbought conditions.

Historically, RSI hitting this level has been a strong signal that the market was overheated, followed by sharp corrections. In fact, these overbought peaks ended with massive declines:

- 2014–15: -86%

- 2018: -81%

- 2021–22: -78%

The current RSI on the monthly chart is around 70, indicating that the risk of a major pullback is relatively low.

Ethereum

Ethereum’s yearly chart shows a pattern similar to Bitcoin’s: typically, after no more than three consecutive green yearly candles, a red candle appears, signaling a correction.

However, a key difference is that while Bitcoin has already broken its all-time high, Ethereum’s current rally has been relatively weak.

The current yearly candle is the third one in the sequence, yet Ethereum has not reached a new ATH.

Historically, Ethereum’s rallies (right chart) have far outpaced Bitcoin’s (left chart). Since Ethereum’s listing around 2015, the crypto market has experienced three major bull runs – starting in 2016, 2020 (post-COVID), and the ongoing one that began in 2023.

- In 2016, Bitcoin delivered returns of 9,042%, while Ethereum skyrocketed by 333,298% from its lows.

- In 2020, Bitcoin gained 1,700%, whereas Ethereum surged 5,567%.

- In 2023, Bitcoin is currently outperforming, having already reclaimed its previous all-time high, while Ethereum remains in consolidation, yet to break out.

This pattern points to Ethereum’s “high-risk, high-reward” nature.

However, just like its explosive bull runs, Ethereum’s declines from all-time highs have also been steep – often ranging between 70% and 90%, making its corrections even more severe than Bitcoin’s.

Recent Price Action: Bitcoin vs Ethereum

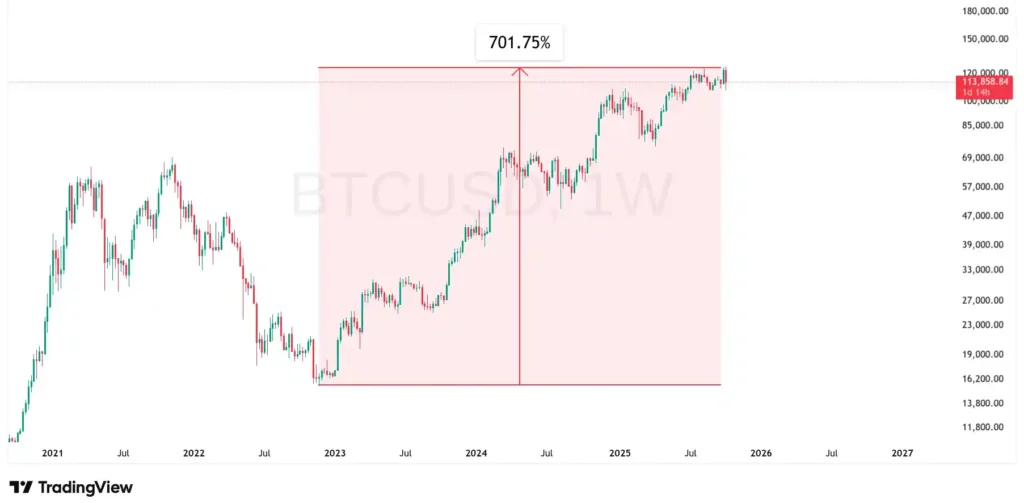

In this section, we analyze Bitcoin vs Ethereum weekly charts from a long-term investment perspective, focusing on key support and resistance levels, trendlines, and market structure, starting from the post-2022 low that marked the beginning of a new bull run.

Bitcoin

Since the 2022 lows, Bitcoin has delivered around 700% returns, highlighting strong underlying demand despite its already high market capitalization.

Bitcoin has been following the channel for the past three years, maintaining a strong uptrend with higher highs and higher lows on the larger timeframe.

This has provided dynamic support and resistance levels while identifying future targets.

This channel also highlights key levels to consider for exiting positions if the price breaks below the rising trend.

Since 2022, there have been two major corrections of around 30% each, yet the trendline has held firm.

Currently, the price is once again testing this key trendline, which will be an important level to watch for potential support.

Further, $110,000 level is likely to act as strong immediate support, with $100,000 serving as the next key support.

These round-number levels tend to hold significance in Bitcoin’s price action, as seen historically, where they have repeatedly acted as reliable support zones.

The weekly chart shows the 50 EMA in action, which has repeatedly acted as decisive support over time.

Moving Average is an indicator which calculates average price of past n candles, so value of moving average is average of previous n candles. What it does is, it smooths out the price variation. Eg 50 MA is giving moving avg of last 50 candles.

Currently, the 50 EMA aligns with the $100,000 level, adding extra strength to this support zone.

Additionally, past 30% corrections coincided with RSI reaching around 80. With the current RSI near 50, there is still significant upside potential.

Risk management: Investors can consider placing stop-losses just below the 50 EMA or below the close of a weekly candle that breaks the long-term trendline.

Ethereum

Bitcoin has surged 7x from its 2022 lows, Ethereum has only risen about 3.5x. While Bitcoin has been showing a clear uptrend, Ethereum has under-performed, still struggling to surpass its 2021 all-time high that Bitcoin long ago exceeded.

The chart above shows how Ethereum has been consolidating within a rectangular range over the past four years.

Once Ethereum breaks out of this consolidation, it has the potential to lead the crypto market in the next phase of growth.

A positive development for Ethereum is that it has decisively broken Resistance 1, which is now acting as support. Additionally, it is testing Resistance 2, near its all-time high.

Risk management: Long-term investors can place stop-losses just below the low of the latest candle (marked support) and consider re-entering once the price moves back above Resistance 1.

Conclusion: Bitcoin vs Ethereum

From a Fundamental Perspective

- Bitcoin’s strength lies in its fixed supply (21 million), decentralization, and institutional acceptance as a store of value.

- Ethereum’s strength lies in utility and innovation. Its supply can shrink through burns, and its Proof of Stake model is energy efficient.

From a Technical Perspective

- Bitcoin’s growth is maturing, smaller but steadier rallies compared to previous cycles.

- Strong support zones and RSI structure indicate lower immediate downside risk.

- Ethereum mirrors Bitcoin’s trends but with higher returns and deeper corrections.

- A breakout from Ethereum’s 4-year range could lead to stronger relative upside.

- Bitcoin represents market stability and leadership; Ethereum offers higher growth potential.

Who Should Buy Bitcoin?

- Long-term investors seeking a store of value similar to gold.

- Those who prefer lower relative risk and higher stability compared to altcoins.

- Investors looking for hedging against inflation and fiat currency.

- Bitcoin may have lower explosive upside than smaller coins, but it has given good returns in every market cycle.

Who Should Buy Ethereum?

- Investors who believe in the future of Web3, decentralized finance, and innovations.

- Investors seeking high risk high reward – higher growth potential (along with higher volatility) compared to Bitcoin.

Final Thoughts: Bitcoin vs Ethereum

- Bitcoin and Ethereum are not competitors, they’re complementary.

- Bitcoin offers stability, scarcity, and a hedge.

- Ethereum offers growth, innovation, and utility.

In short: “Bitcoin preserves wealth. Ethereum grows it.”

Frequently Asked Questions

Bitcoin is stable and scarce; Ethereum offers higher growth. “Better” depends on whether you value safety or upside potential.

Invest in Bitcoin for long-term wealth preservation; Ethereum for high-risk, high-reward growth in Web3.

Possible. Ethereum has greater growth potential due to its broad utility, but Bitcoin currently remains the market leader.

Bitcoin’s fixed supply makes it more stable, while Ethereum is more volatile but offers higher growth potential.

Bitcoin is digital gold and a store of value; Ethereum is a smart contract platform powering decentralized apps.

![Bitcoin Analysis [March 2025]: Charts, Trends & Predictions](https://thsinvestor.com/wp-content/uploads/2025/02/Bitcoin-march-768x403.webp)

![Best Cryptocurrencies to Invest [2026]: Top Small-Cap Altcoins](https://thsinvestor.com/wp-content/uploads/2025/11/Best-Cryptocurrencies-smallcap-768x384.webp)

![What is the Real Value of Bitcoin and Other Cryptocurrencies? A Fundamental Perspective [2025]](https://thsinvestor.com/wp-content/uploads/2025/04/cryptocurrency-utility-768x384.webp)