Math and Technical Analysis

“Go down deep enough into anything and you will find mathematics.” – Dean Schlicter

This is also true for markets and prices. Traders try to make sense of infinite random data points using math and technical analysis. There is a 50% probability of a trade going in our favor. We are always trying to increase this probability by making different studies.

Mathematics is central to technical analysis and must be used every chance we get. Some widely used applications of mathematics and its branches have been covered in this post.

Option Writing

For me, option writing is the best and easiest way to stay profitable in the market in the long term. It is equivalent to selling insurance and insurance companies seldom make losses.

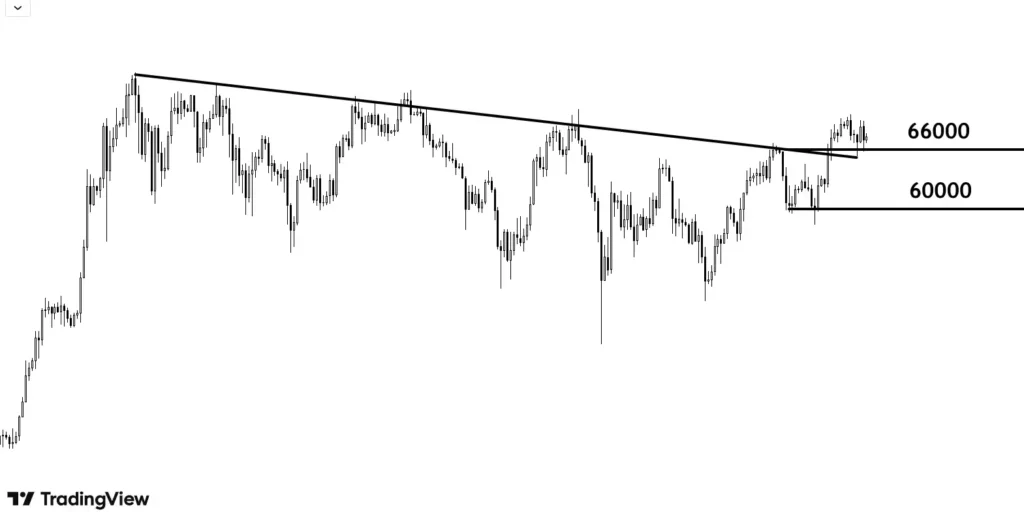

If you enter at 66000 with SL at 60000, you will lose if SL gets hit. In option writing, if you are selling Put option at 60000 with 1 month expiry, you will win if price does not go below 60000 for the next 1 month.

This is the basic idea of how option selling increases the probability of winning. At any point, there are 3 possibilities, price moving in your direction, opposite direction or staying within a range. You stand to win only in 1 out of these 3 outcomes, i.e, 33% of probability.

With option selling, you win in 2 out of these 3 outcomes, that is price moving in your direction or staying within a range i.e, 67% probability. This means if you sell an option with your eyes closed, you have a winning probability of 67%, which is all you need in the long term.

This 67% probability of winning is further increased by incorporating math and technical analysis and different strategies Options offer us.

Regression Analysis

It is a statistical concept wherein a relationship is established between a dependent variable (Price) and an independent variable (time, indices, events, indicators etc) with past data to predict future.

This analysis is important as it will teach you how studies are done and will help you become independent.

Some examples of Regression Analysis:

- For instance a stock falls 10% on a single day, you go back in history to check the number of times it has happened in history and how stock behaved after that. In this, we are keeping price as a dependent variable and historical time as an independent variable.

- How price reacts whenever RSI has reached a level of 90 historically.

- Study of how price reacts just before results of companies.

- Study of how different investment assets react to change interest rates.

Risk Management

It refers to how much you will lose if you are wrong and make, when correct. Ideally, it should be more than 1:2. So, either you lose 1 or win 2.

The above image is enough to show the importance of Risk Reward. Total trades taken are 10 and 50% worked in favor. With Risk Reward via Math and Technical Analysis, you will still end up making money.

- Position Sizing

Position sizing is deciding the quantity of shares/units to be purchased considering total capital and risk per trade to manage risk.

Now, risk per trade should be capped at 1-2% of total capital. Considering you have a total capital of $1000 and 1% risk on capital, the amount you bet in a single trade should be $10.

You would need approximately 34 consecutive losses with a 2% risk per trade to reduce your capital by 50%.

Indicators

Mostly all indicators are math based as they are derived from historical price data points. Some of the most used are covered here with the idea behind them:

Moving Averages calculate average price of past n candles, so value of moving avg is average of previous n candles. What it does is, it smooths out the price variation. Eg 100 MA is giving moving avg of last 100 candles.

Blue line is 21 simple moving avg (21 SMA) which means at any point on the blue line, it represents the average closing price of the last 21 candles

At any time, price drifts away from the moving average, it is pushed back near the moving average. There are many other applications of moving averages which have already been covered in detail.

- Standard Deviation

Standard Deviation is a statistical concept which measures how deviated individual values are from its mean value.

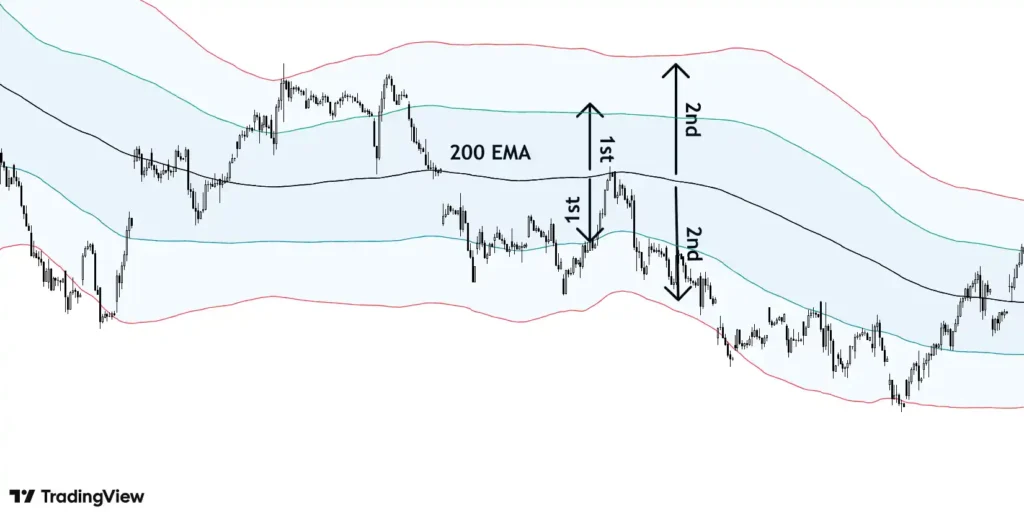

Deviations can be studied as a range of 1st, 2nd and 3rd deviations from the mean value. These deviations form ranges viz 1st, 2nd and 3rd deviation range

In ideal form (aka normal distribution of data), 68% of data is present within (+-)1st deviation from mean value and 95% within 2nd deviation. Rest 5% is beyond 2nd deviation.

In trading terms, 200 EMA is the average of the last 200 candles, in ideal form, price should stay in between 1st deviation 68% and 2nd deviation 95% of the time. As markets do not form exact normal distribution, we can still use the concept to increase probability of winning.

- Relative Strength Indicator (RSI)?

Relative Strength Indicator (RSI) is a momentum indicator which measures the strength or rate of increase/decrease in prices. Value of RSI increases/decreases when there is a large increase/decrease in prices in relatively less time. RSI has a value between 0 to 100.

These are all classic examples of Math and Technical Analysis at work.

Notable examples

- When the probability of winning a trade is more, you increase the risk and vice-versa.

- Correlation coefficient between two instruments. If the correlation is +ve, they move in the same direction and vice-versa.

- Calculator of Beta, if greater than 1 means stock is more volatile than market. This helps traders to hedge their portfolios.

- Logarithmic scale is used to analyze prices of a stock over a longer period ranging from years to decades which adjusts the prices as per % change rather than absolute values.

- Fundamental analysis includes analyzing profit loss and balance sheets of companies wherein trend of important ratios is studied.

Key Takeaways

- In option writing, the winning probability is at least 67% against 33% in other instruments.

- Regression Analysis is the study of the relationship between price and other variables like time, indicators, events. Studying how price behaved in price and what could happen in future.

- Most of the technical indicators like RSI, Bollinger Bands are based on different concepts of mathematics.

- Math and Technical Analysis help quantify uncertainties, limit losses, and enhance profitability.