Option Writers

Sellers of options are known as Option Writers. For every option sold, there is a buyer of that sold option.

Option Writers are big players and more informed. This is believed because you need way more money to sell one option contract comparatively to buying that option. So, we will be studying Option OI from the perspective of sellers and not buyers.

Open Interest in Options as Support Resistance

Open interest in Options represents the total number of outstanding options contracts that are currently held by market participants. We will be analyzing OI of Call and Put options at different strikes.

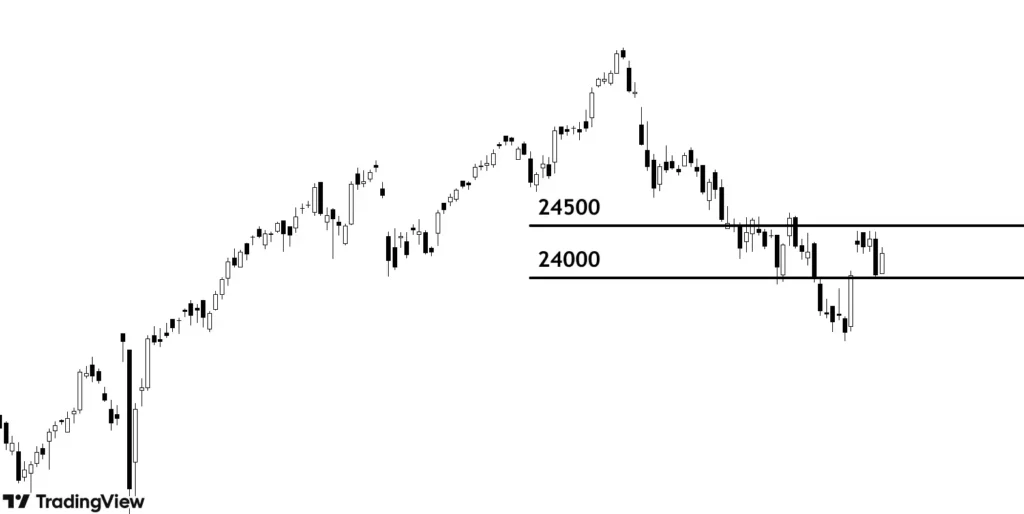

Maximum OI (73.5 lakh) on Call side is at 24500 represented by the biggest red bar at the bottom of left side and maximum OI (69.3 lakh) on Put side is at 24000 represented by big green bar at top of right side.

73.5 lakh Call contracts of 24500 strike have been bought and sold. Option writers (big players) have sold these Call options who will be in loss if price goes beyond 24500 so these Call writers will try to defend this level and hence act as a resistance for price.

69.3 lakh Put contracts of 24000 strike have been bought and sold. Again, Option writers have sold these Put options who would stand to lose if price falls below 24000, hence, these writers will defend 24000 on down side making it a good support.

Lets see the chart of the same instrument and see these levels on it.

We can see, 24500 on upside and 24000 on down side are good Resistance and Support respectively as per price action also.

Inference of Open Interest in Options

Strikes with high OI on Call side will act as resistance and high OI on Put side will act as support.

Change in Open Interest in Options on such strikes (strikes with high OI) can indicate strengthening and weakening of S/R. If OI is increasing, there are good chances such levels will act as tough S/R and if OI is decreasing on such strikes, that could indicate weakening of S/R.

Reliability of option OI increases as we approach expiry.

Change in ITM options

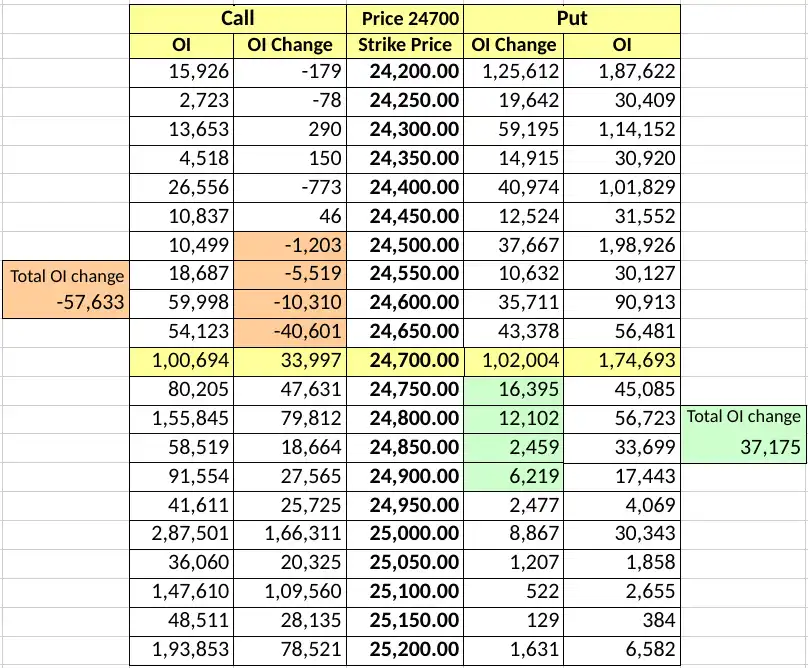

In this section, we will be analyzing overnight change in near ITM options on both call and put side.

Option writers predominantly sell OTMs as they have only carry time value and with time, they decay to 0. Also, time decay is faster in OTMs as compared to ITMs and the probability of winning with OTM is more than writing ITM options.

The above option chain shows decrease in ITM Call options and increase in ITM Put options. Option writers closing their ITM Call positions tells us that probability of ITM Call options turning OTMs (for option writers to profit) is less, meaning less chance of market falling.

On the contrary, we see new positions being created on the ITM Put side which shows confidence of Put writers that these ITM Put options will be turning OTMs, so there are good chances the market would go up.

Studying such overnight changes in Open Interest in Options can give us a fair idea of market sentiment.

Studying ATMs for intraday move

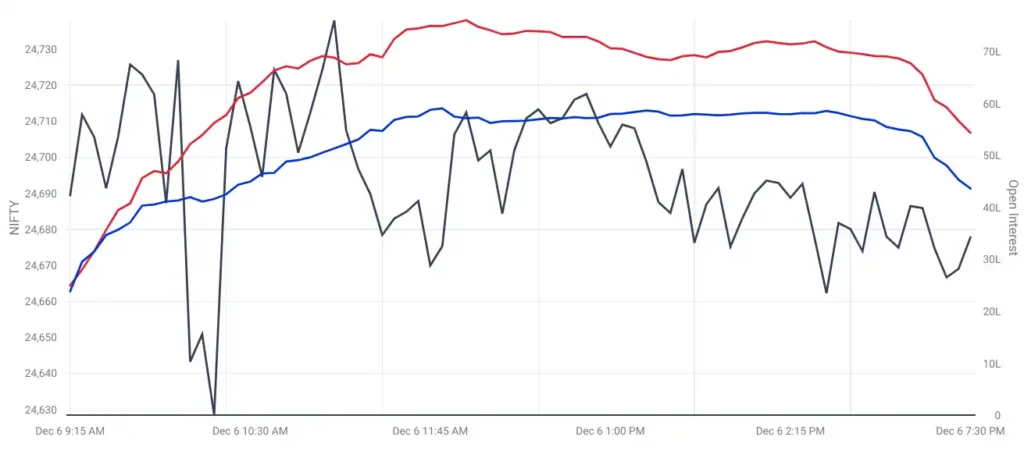

This is a chart which shows real time OI change in ATM strike price (24700) on both Call and Put side. Red line shows change in OI in 24700 CE, Blue line depicts change in OI 24700 PE and black line represents movement of price in the underlying asset.

On an intraday basis, ATM OI change is important and can give a clear picture where options are being written.

We can observe, right from the beginning, that the red line is increasing more than the blue line and stays well above. This shows that Call writers are dominant and it will be hard for price to go up which is clear by the black line.

Also, the blue line is not showing downtrend, which is pointing towards a sideways price action. If one is rising and other is not or decreasing, this shows aggressive writing on one side and educated guesses can be made as to which side option writers will take the price.

Key Takeaways

- Option writers are usually the big and intelligent players.

- Strikes with high Open Interest in Options act as support and resistance zones.

- Overnight change in Open Interest of near ITM options can indicate which side may turn OTM in coming days and hence the direction of price.

- Real time change in OI of ATM strike can indicate move on intraday basis for short term trading specially on expiry days.