What is a Cup and Handle Pattern?

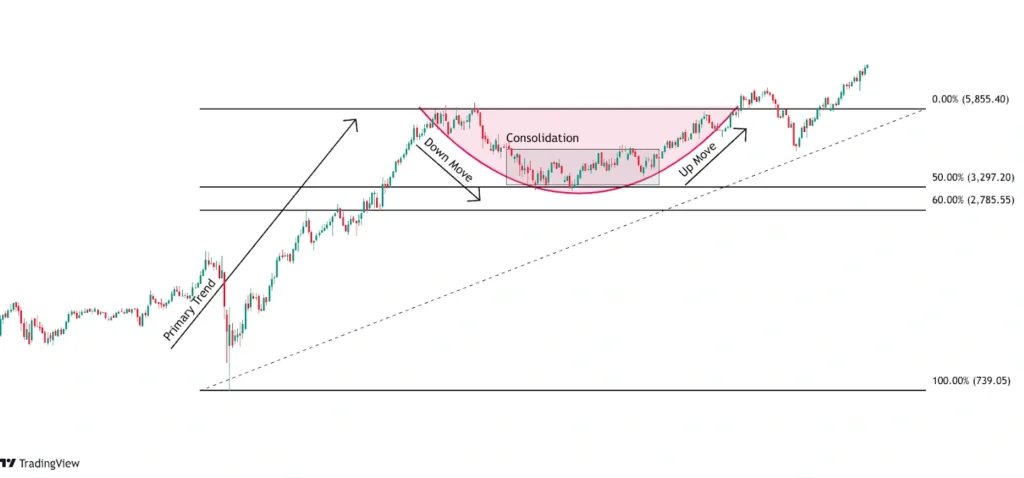

A cup and handle pattern is identified as a bullish continuation pattern which has two parts, a cup and a handle. A cup is a round shaped bottom that looks like a “U” shape on the chart and the handle is a pullback in the form of a channel, wedge, or flag.

A cup and handle pattern is predominantly seen as a continuation pattern with cups and handles as consolidations and pullbacks before resuming the trend. Reversal cup and candles are rare but can be seen at times.

Characteristics of a Cup

The following are some characteristics observed in the Cup:

- Usually have a rounded base forming the letter U. Rounded base shows prolonged consolidation after a down move on the left side of the cup.

- Cup is seen as consolidation to the primary trend (larger uptrend).

- Depth of cup should ideally be not more than 60% of primary trend.

- Shallow cups with prolonged consolidation are more bullish.

- Left side of cup is traders booking profits which brings price down and subsequently going into consolidation (accumulation) where buyers are accumulating forming a base before resuming uptrend.

Characteristics of a Handle

The following are some characteristics observed in the Handle:

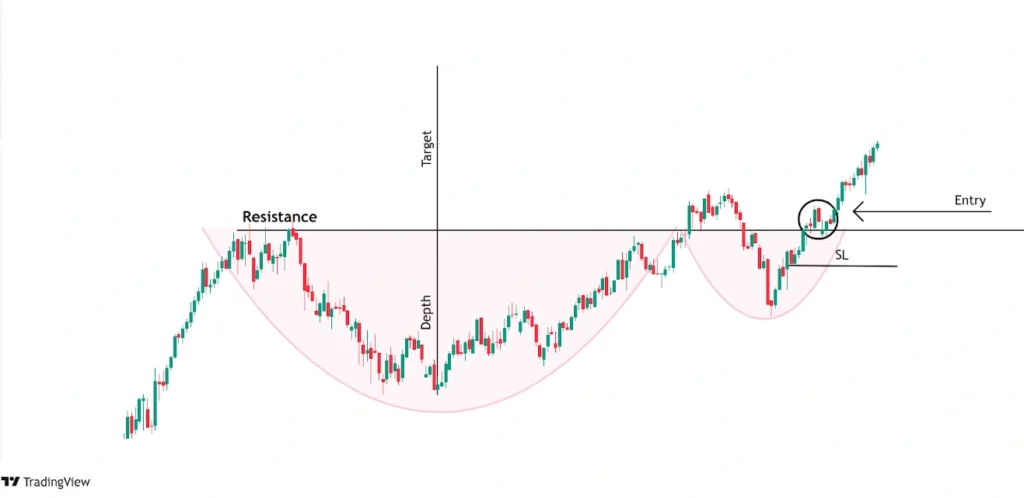

- As the price reaches the resistance (top of cup), some traders lock in profits which causes temporary pullback or retracement.

- This pullback is in the form of channel, wedge, flag etc.

- The pullback is brief and in V shape which shows the strength of buyers.

- Shallow the depth, stronger the buying pressure.

- The handle finally leads to breakout of the structure and price continues to move up with existing primary trend.

Trading the Cup and Handle pattern

The following points outline how to trade this pattern effectively with entry, exit, and stop-loss levels.

Entry:

Entry can be made either on breakout candle or during retest of resistance line is which rim of the cup. The volume candle corresponding to the price breakout candle should be higher than the average volume in recent times.

Target:

What conventional traders do is they measure the depth of the cup and project roughly the same upwards for the target. This should be used for reference and other techniques we have discussed should also be used for profit booking. You can read more about profit booking here.

Stoploss:

The reference for Stoploss should be the resistance zone which can be the SL with application of Average True Range (ATR). If the low of the handle is not too deep, that can be the 2nd point of exit depending on the risk tolerance and position sizing. Traders can use different combinations of stoploss already discussed but one should place SL around these two points.

Inverted Cup and Handle Pattern

It is a bearish pattern which breaks downwards with same characteristics as discussed above.

After a long downtrend, profit booking comes which takes prices slightly up (left side of cup). Distribution starts where big players are selling with low volume and finally the primary trend continues.

Near support, weak hands book profits forming a handle before finally breaking the support zone. Inverted cup and handle is traded with similar ideas as discussed above.

Key Takeaways

- Cup and Handles are generally continuation patterns but can be seen in reversals also.

- Ideally, Cups form U shape bottom while handles form V shape quick recovery.

- Depth of cup should ideally be not more than 60% of primary trend.

- Potential targets from the brim of the cup can be equal to the depth of the cup.

- Inverted Cup and Handle is a bearish pattern which breaks dow