What are Chart Patterns?

Chart patterns are identifiable shapes and formations which are created on charts due to human nature and psychology. Psychology of market participants is believed to remain unchanged, for instance, after quick profits, they look to realize that profit.

Such similar actions tend to create certain price chart patterns which can be analyzed to understand current conditions in the market and possible future outcomes.

They are formed on all timeframes but bigger the TF, more the reliability. Chart Patterns can be divided into 3 categories – Continuation, Reversals and Neutral.

- Continuation: indicate trend may continue.

- Reversal: indicate trend may reverse.

- Neutral: indicate price can breakout in either direction.

Continuation Patterns

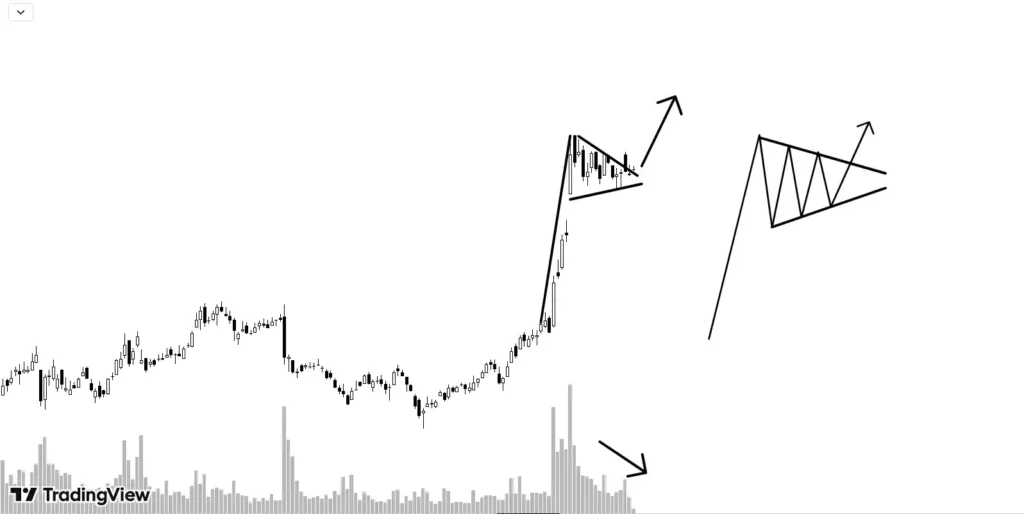

Pennants

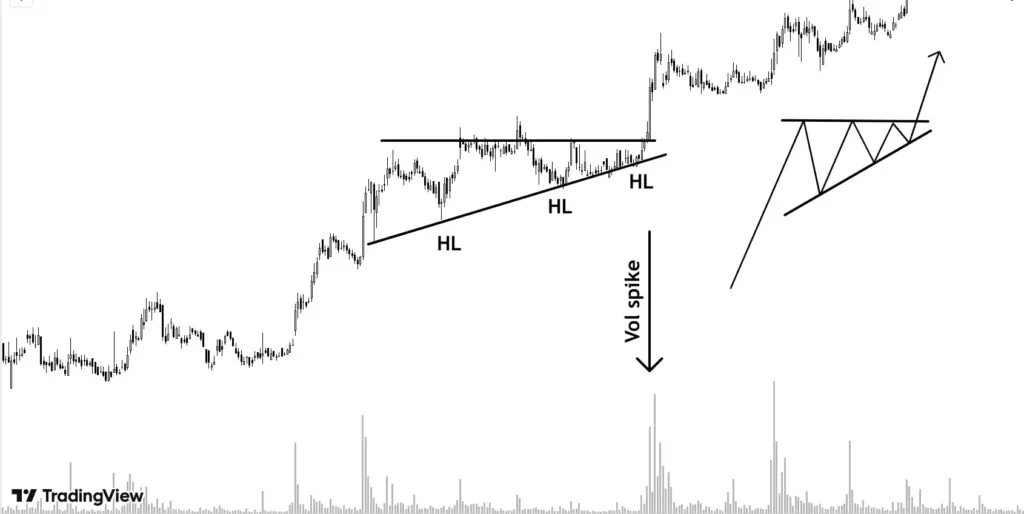

A bullish pennant is formed when price rises in a short time and takes a short pause within two converging lines before continuing the trend.

The above chart explains all the conditions leading to a pennant. A strong trend goes into consolidation after exhaustion volume . The price goes into consolidation between two converging lines. The volume reduces which is generally less than the average volume (blue line on volume).

After the consolidation, the price breaks out with a large volume (more than the average volume in recent times).

A pennant reflects a temporary halt between buyer and sellers as volume drops. Entry should be made after the breakout with stoploss at the low of the breakout candle. Consolidation between two converging lines should be much smaller than the pole of pennant (i.e, the rise/fall of price).

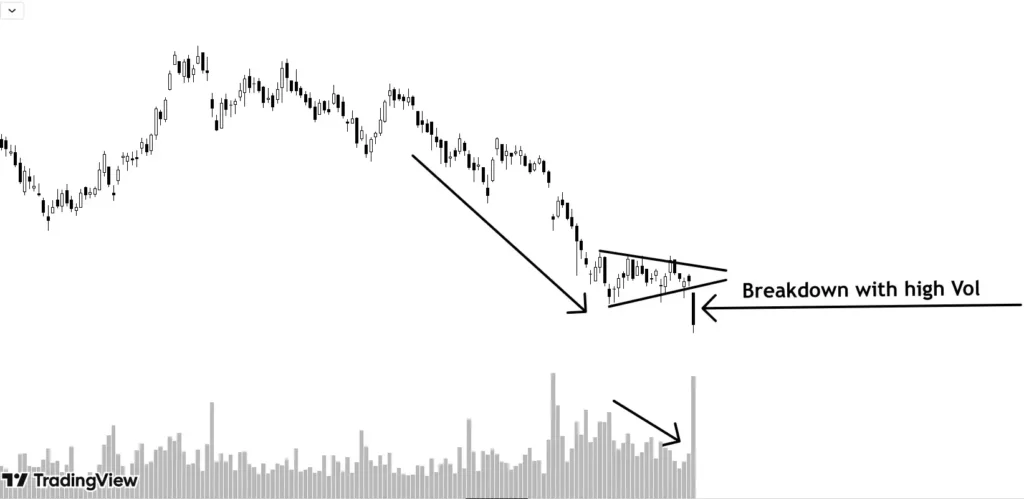

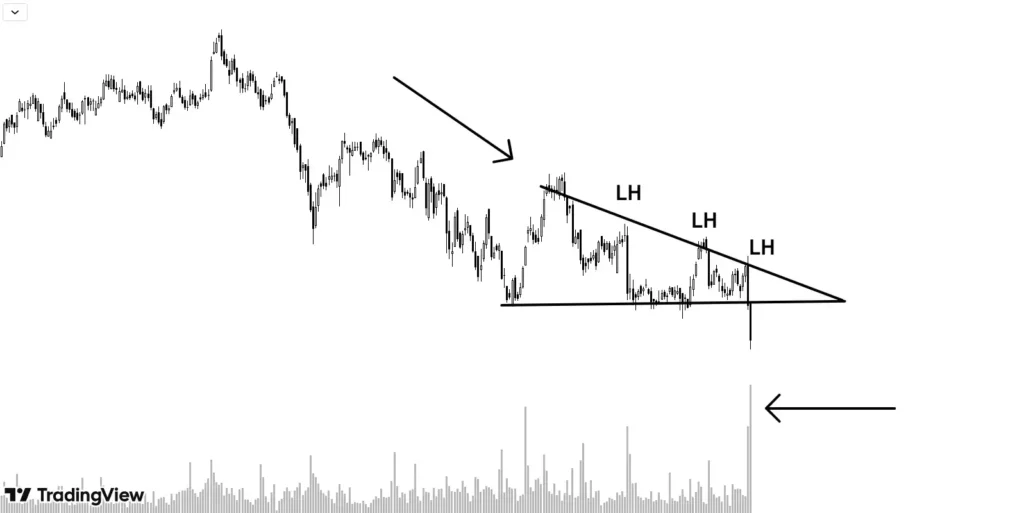

A bearish pennant looks completely opposite to a bullish pennant with similar conditions as shown below. Bearish entry can be made after the breakout with stoploss above high of the breakout candle.

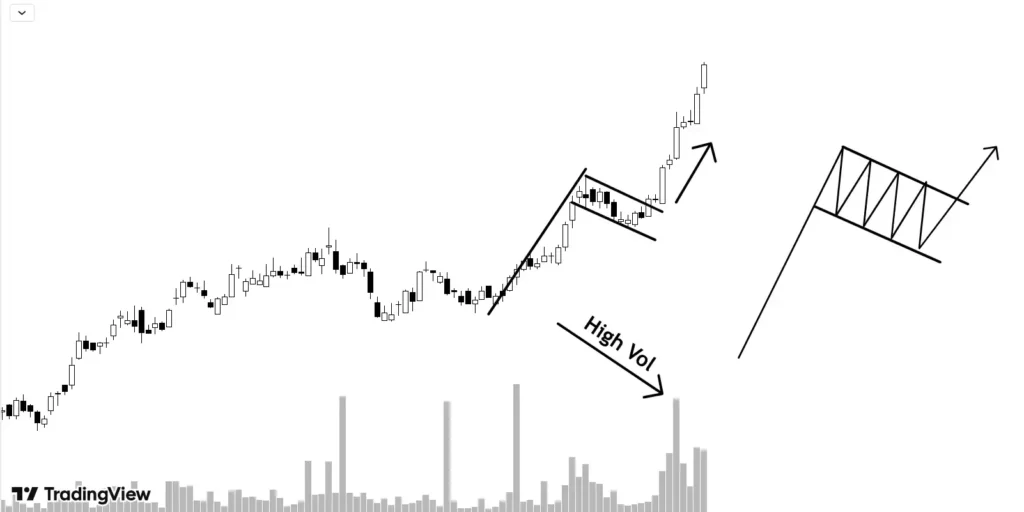

Flag Pattern

They differ from the pennant slightly and look like a rectangle sloping against the main trend which can be interpreted as a pullback.

In a bullish Flag Pattern, price after rising with high volume, starts to consolidate in down-sloping two parallel lines forming a rectangular shape. Volume is low during consolidation and breakout is done with a high volume candle.

The slight pullback in the form of a flag shows profit booking after a strong trend and a breakout candle signals continuation of existing trend. The pullback should be smaller than the actual trend.

A bearish Flag pattern is opposite to the above discussed:

Ascending/ Descending triangle

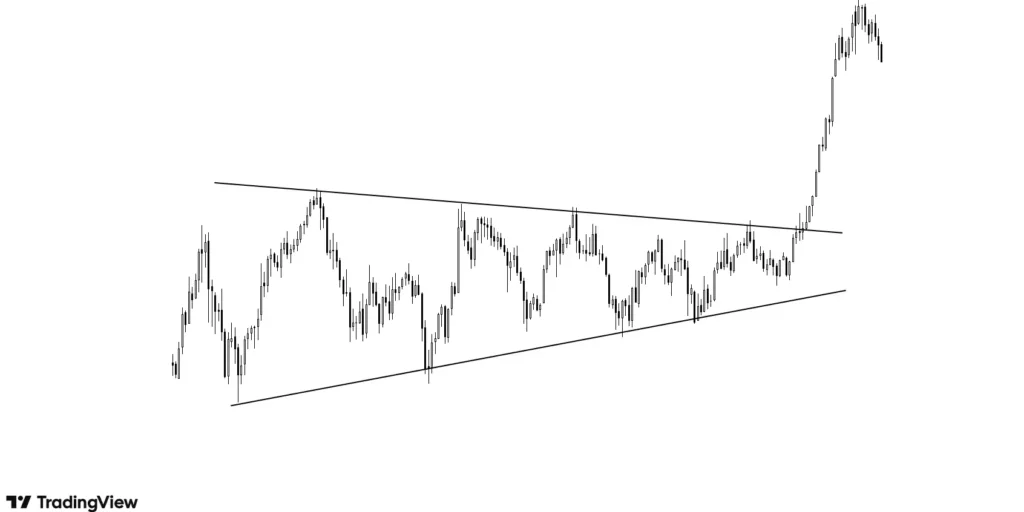

This is a very reliable pattern. An ascending triangle has a flat upper line (resistance zone) and rising lower trendline leading to a potential breakout on the upside.

The price is making higher lows as buyers are taking the price up. Everytime price is reaching near resistance, selling pressure emerges but buyers are coming back into control and price makes higher lows, meaning buying pressure is increasing slowly which ultimately results in price breaking out of the resistance.

The volumes are low during the formation of the pattern and increase significantly after the breakout.

In downtrend, descending triangle is formed with similar conditions and psychology breaking down side,

Symmetrical triangles

Sometimes such patterns can be spotted with two converging lines with similar slopes. The breakout can be either side. Entry should be taken after the breakout only.

Key Takeaways

- Chart patterns are a reflection of human psychology and nature which is why they are repeated over and over again.

- They are more reliable on larger TF.

- Continuation chart patterns are a temporary halt in an existing trend before continuing the trend.

- Pennant, flag and ascending/descending triangles are examples of continuation patterns.

- Traders should study different indicators during different phases of these chart indicators to improve the reliability of chart patterns.