What is Money Flow Index (MFI)?

Money Flow Index (MFI) is an indicator that measures flow of money into and out of security over a specified period. It is a modified version of Relative Strength Index (RSI) which adds volume to the calculation of RSI.

Money Flow is a volume-weighted measure that combines price movement and trading volume to determine whether money is flowing into or out of an asset.

When the average price is higher than the previous average price, buyers are dominant and money is said to be flowing into the asset and the opposite is true when the average price is lower than the previous average price.

How much money is flowing is determined by the volume. This combination of average price and corresponding price gives us the Money Flow Index.

While RSI only takes price into account, MFI takes a combination of price and volume making it more comprehensive than RSI.

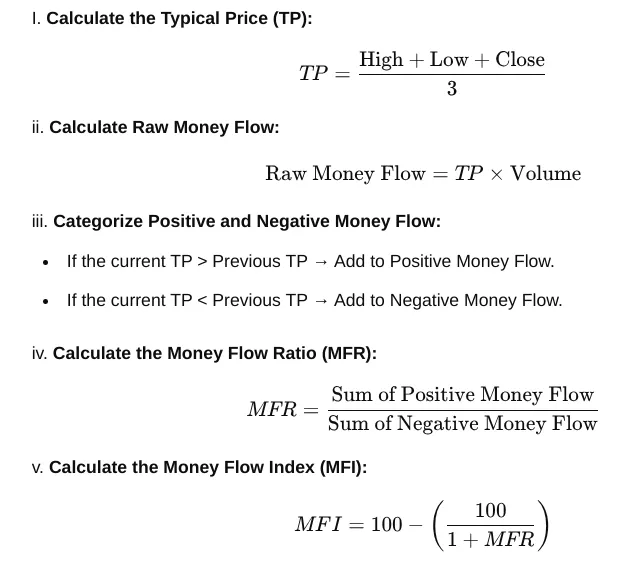

Money Flow Index (MFI) – Calculation

If the sum of positive average price and volume is more than negative average price and volume over a specified period of time (eg 14 days), MFR increases which in turn increases MFI.

So, if MFI is increasing, it means positive money flow (+ combination of price and volume) is higher indicating buying pressure and opposite is true for selling pressure.

Combination of Price and MFI

Increasing MFI means money inflow (combination of + avg price and volume) is more than money outflow (combination of -ve avg price and volume) and the opposite is true for decreasing MFI.

- Both Price and MFI increasing

This means that Positive Money Flow > Negative Money Flow, uptrend is supported by high volume and Buyers are in control with rate of money inflow is increasing. This indicates a strong bullish trend.

- Price Down, MFI Down

Negative Money Flow > Positive Money Flow, Sellers are in control, and the downtrend is supported by high volume. The rate of money outflow is increasing. This indicates a strong bearish trend.

- Price Up, MFI Down

While the price is still rising with MFI going down, this is due to decline in positive money flow or an increase in negative money flow.This indicates that the rate of money in flow is slowing and buying pressure is weakening.

- Price Down, MFI Up

When the price is still going down but MFI starts to go up, this shows that the rate of money outflow is now reducing and selling pressure is weakening.

Money Flow Index vs Relative Strength Index

As MFI incorporates volume study, it gives a better picture of the prices than RSI.

We can see, as the price makes Lower low at A, MFI is making a strong divergence whereas RSI is only showing a weak divergence.

MFI shows although the price is reducing, the rate of fall of price combined with volume is reducing and sellers are weakening.

At B, price is making Higher high, MFI shows strong divergence while RSI only shows a weak divergence.

Divergence in MFI depicts the rate of increase of price and volume is now reducing and buyers are reaching an exhaustion level.

Key Takeaways

- The Money Flow Index (MFI) is a volume-weighted indicator that measures the flow of money into or out of a security by combining price and volume.

- Interpretation of Price and Money Flow Index (MFI):

- Price & MFI Up: Strong bullish trend with buyers in control.

- Price & MFI Down: Strong bearish trend with sellers dominating.

- Price Up, MFI Down: Weakening buying momentum; potential bearish divergence.

- Price Down, MFI Up: Selling pressure reducing; potential bullish divergence.

- MFI vs RSI: Unlike RSI, MFI integrates volume, offering deeper insights into price trends. MFI captures divergences more accurately, indicating shifts in buyer or seller strength.