Why Risk Management in Trading?

Risk Management in trading is the most important aspect of trading. The only reason 90% are unsuccessful is they ignore Risk Management.Technical Analysis, charts, lines etc are only probability. These should be seen as tools to manage risk.

Risk management keeps you in control of your capital by fixing losses. What decides one being profitable in the long term is how much you lose when you are wrong.

Imagine you enter 100 trades randomly without analyzing. Considering 50% probability of winning/losing, it is logical to think you would end up at break even with no profit/loss. But this is not the case, 90% of people lose money in the long term.

This is due to emotional trading and not managing risk. Various aspects of Risk Management in trading include setting stop loss, correct position sizing and having a good risk reward ratio.

Stop-Loss

Stop Loss is the most important aspect in Risk Management in trading. It is the point where you exit your trade if it goes against you. It is important to have a stop loss to limit your loss.

The most important reason why we should have stop loss is we know how much we are willing to bet on a trade and know in advance how much we will lose if things go wrong.

This prevents emotional decision making and desists one from holding on to losses which can potentially turn into bigger losses in expectation of recovering.

Human emotions are the reason why scientists, doctors, engineers are not best traders. Trading has less to do with knowledge but more with discipline and emotional maturity.

How to set Stop loss

Stop loss can be set in various ways, from fixed SL (in terms of points) to percentage based. But it is best to have some logic behind placing an SL. While there can be multiple reasons, we are only covering the basics of it.

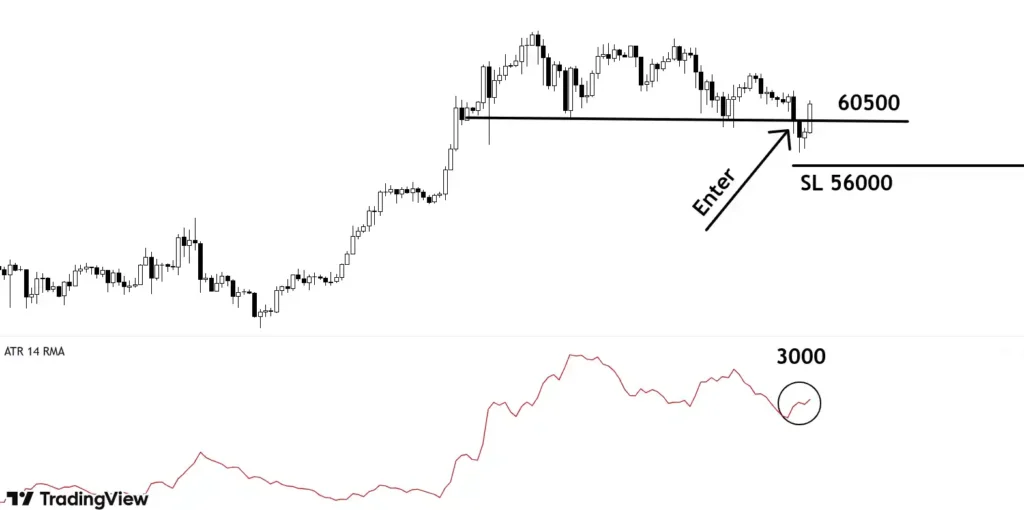

- Using Support Resistance and Average True Range (ATR)

ATR value is nothing but the average volatility which represents normal price fluctuations and this value varies asset to asset. We have already covered Average True Range (ATR) in detail.

For instance, you decide to enter the near support area at 60500 and want to keep SL beyond the support line. ATR at the entry candle is 3000 which is average volatility. You wish to take into account this volatility and give some room to your trade.

SL (taking ATR 1.5) = 1.5 x 3000 = 4500

Point of SL = 60500 – 4500= 56000

- Using Moving Averages

Moving averages act as dynamic support resistances and are easy to use. The above image shows 50 Simple Moving Average acting as support at multiple points.

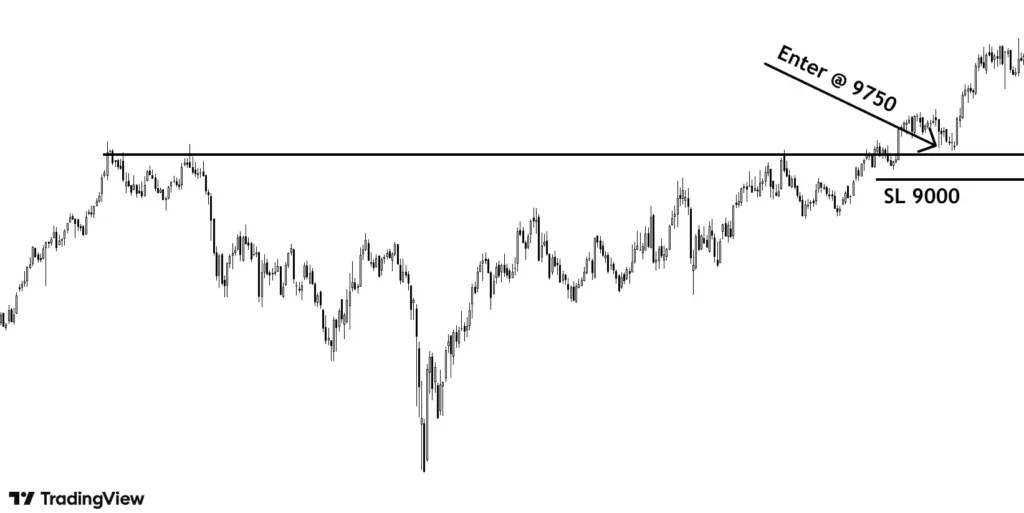

Position Sizing

Position sizing is deciding the quantity of shares/units to be purchased considering total capital and risk per trade to manage risk.

Now, risk per trade should be capped at 1-2% of total capital. Considering you have a total capital of $1000 and 1% risk on capital, the amount you bet in a single trade should be $10. How many units to be bought so that loss in a trade is exactly 1% is what position sizing is.

Position size (No of shares/units to be bought/sold) = Risk on capital (1-2%)/ Risk per share

Say your capital is $150000

Taking Risk per trade 1% that is $1500.

SL you have decided after proper due diligence is at $9000 and $9750 being the entry point around support level.

Risk per share is 9750 – 9000 = $750.

Position size = 1500/750 = 2 units

So, if your SL is 750 points away from the entry point, buy 2 units and your SL gets hit, you will lose exactly $1500.

It is pertinent to mention again, technical analysis will not make you successful, it’s the math behind risk management that will. If losses are controlled, you will be a profitable trader in the longer term.

Risk Reward

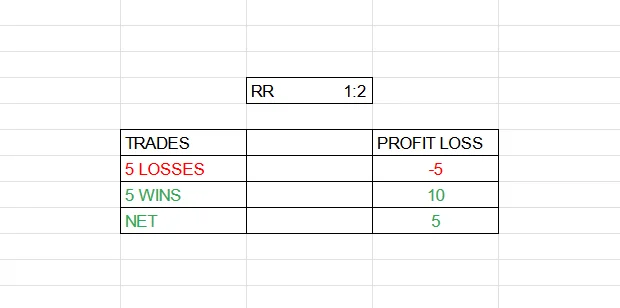

It refers to how much you will lose if you are wrong and make, when correct. Ideally, it should be more than 1:2. So, either you lose 1 or win 2.

In the above example of position sizing, risk per share was $750, so with RR 1:2, the point of profit should be atleast $1500 from the entry that is $11250.

The above image is enough to show the importance of Risk Reward. Total trades taken are 10 and 50% worked in favor. With Risk Reward, you will still end up making money.

Key Takeaways

- Ignoring Risk Management in trading is the biggest reason why maximum people lose money.

- Risk Management in trading keeps your emotions in control.

- Before you enter a trade, always mark your stop loss as to at which point you will exit if a trade is not working in favor.

- Position Size tells you the right quantity of shares to buy/sell.

- Never risk 1-2% of total capital in a single trade.

- Risk Reward should be atleast 1:2.