Technical Indicators

Indicators are mathematical calculations of historical data of price and volume. They are used to compare past to present to make a fair idea of the current situation of the market.

They help traders to plan their trades by providing entry/exit points and help control risk. Moving Average is one of such indicators.

Indicators are broadly divided into 4 categories:

- Trend – help spot general direction of market eg Moving Average, MACD, SuperTrend

- Momentum – shows strength in market eg RSI, ADX, Stochastic

- Volatility – help determine fluctuation in price eg ATR, Bollinger Bands

- Volume – On balance Volume, Volume profile, Money flow index

Moving Average

Moving Average calculate average price of past n candles, so value of moving average is average of previous n candles. What it does is, it smooths out the price variation. Eg 100 MA is giving moving avg of last 100 candles.

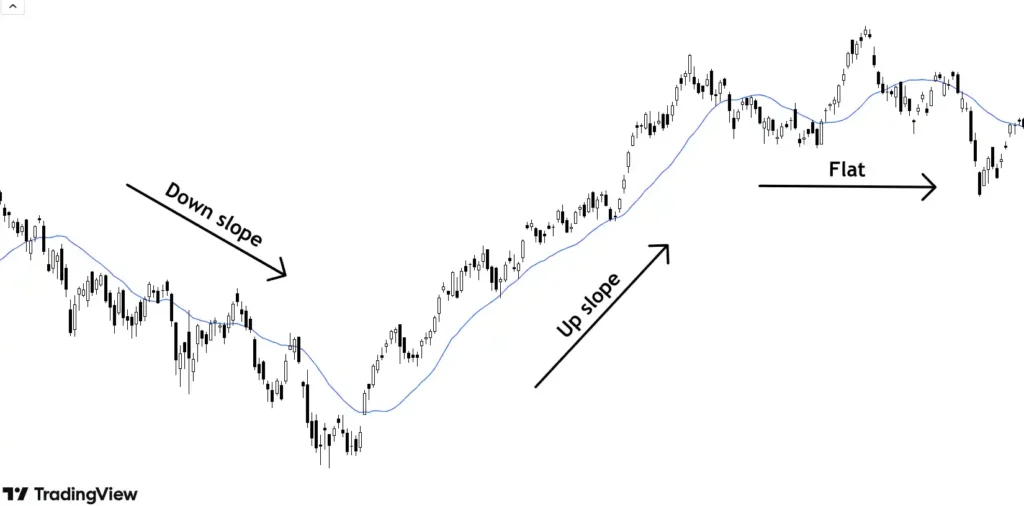

Blue line is 21 simple moving avg (21 SMA) which means at any point on the blue line, it represents the average closing price of the last 21 candles.

Application of Moving Average

- Trend identification

Slope of the moving avg depicts the trend. A downward sloping line is formed in downtrend and slope is up when the trend is up. The moving average becomes flattish in sideways movement.

- Dynamic Support Resistance

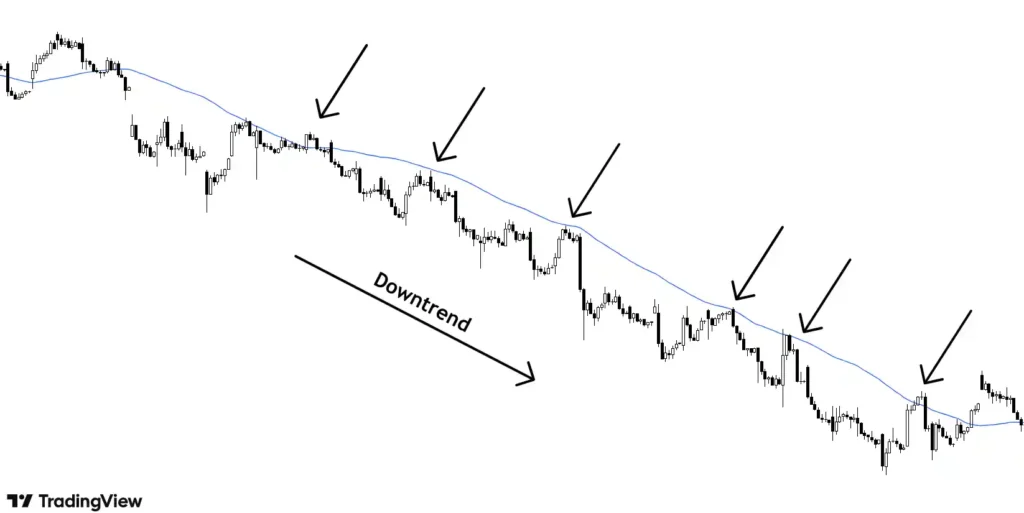

Example below shows how a 21 SMA is acting as support at various points. This can also be used as trailing stop loss.

It is important to mention that different moving avg work on different asset classes and on different timeframes. One must try different moving average and use the one which has been working well in the past.

Commonly used SMA are 9, 21, 50, 100 and 200.

Below example shows 100 SMA acting as dynamic resistance

- Crossover signals

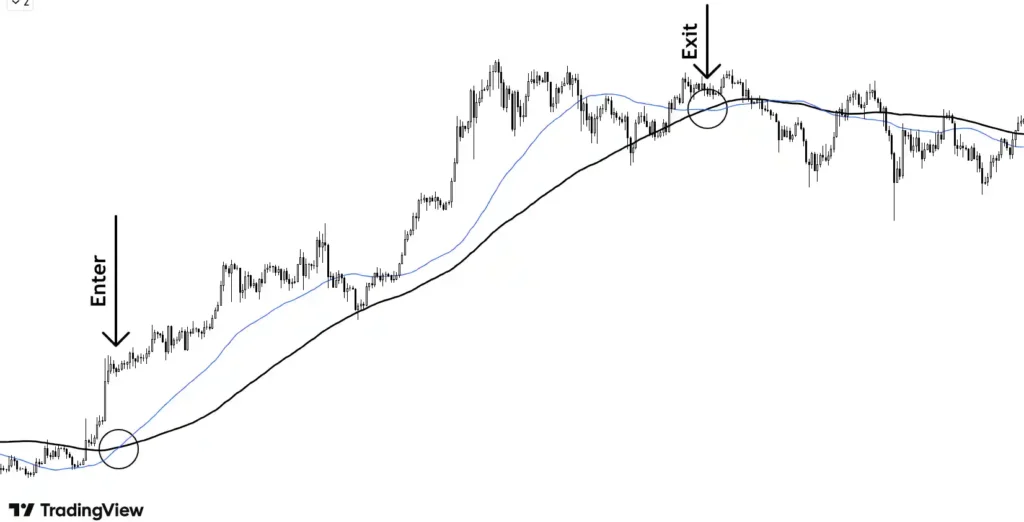

Simple rule used is buy (go long) when shorter SMA (50 SMA, blue) crosses and turn greater than the longer SMA (100 SMA, black) and exit when shorter SMA turns lesser.

This is best used in trending markets and fails in the sideways market.

(there can be many such combinations 9-21, 21-50, 50-100, 100-200 depending on the timeframe to be used)

When the price is above the moving average, it means participants are willing to buy at a price higher than the average price and the same is seen as bullish sentiment.

Crossing of shorter SMA above longer SMA means that the short term trend is strong enough to overcome the long term trend.

Now, there are many ifs and buts with this. This is a simple technique and should never be used in its basic form but as additional confirmation with other tools which will be covered in detail in upcoming lessons.

Exponential Moving Average (EMA)

This is a modified method of SMA wherein more weight is given to recent prices which makes it more sensitive to new price information. This is more useful in a volatile market when prices are moving up and down frequently in a short period of time.

Again, it is important to use and try different moving average on different securities and on different time frames to find the perfect MA which is being respected by the prices.

Key Takeaways:

- Technical Indicators are mathematical calculations of historical data of price and volume.

- Indicators are broadly classified as Trend, Momentum, Volume and Volatility.

- Moving average calculate the average closing price of the last n number of candles.

- Moving average can be used to find trends and as dynamic support resistance. It can be used to trail Stop loss.

- Exponential Moving Average allot more weight to the recent candles.