Candlestick patterns are visual formations on a candlestick chart that represent the price action of a financial instrument over a specific time period.

Before even starting the topic of candlestick patterns, it is of utmost important to keep following points in mind as to when and how to use study of candlesticks:

- Study of candlestick patterns works better on higher timeframes. Do not study candle types in TF lower than Daily.

- Never rely solely on candlestick patterns. Use them in confluence with other tools like Support Resistance, trend, volumes and other tools you’ll be studying in future.

- There can be a number of candlestick patterns, this posts only covers prominent ones and more importantly the psychology behind formation of candles.

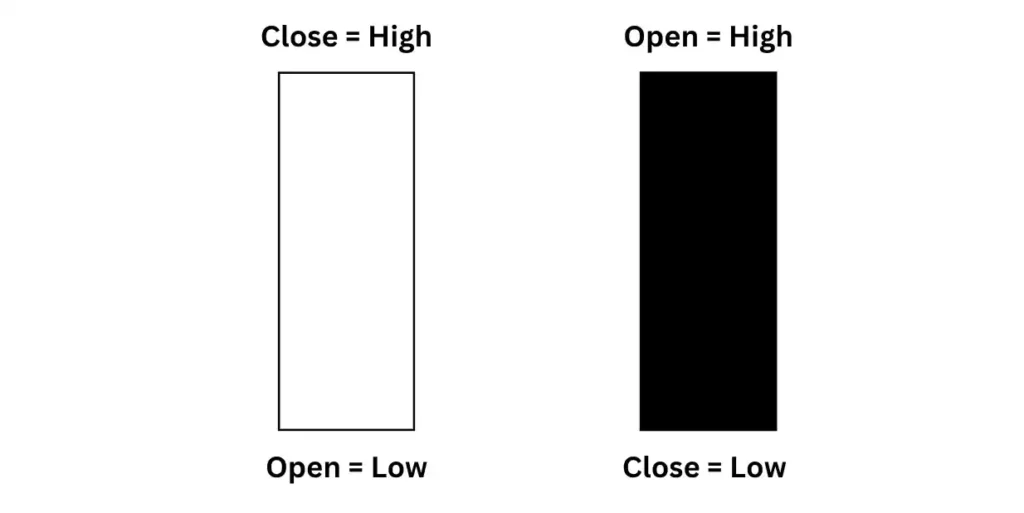

Basics

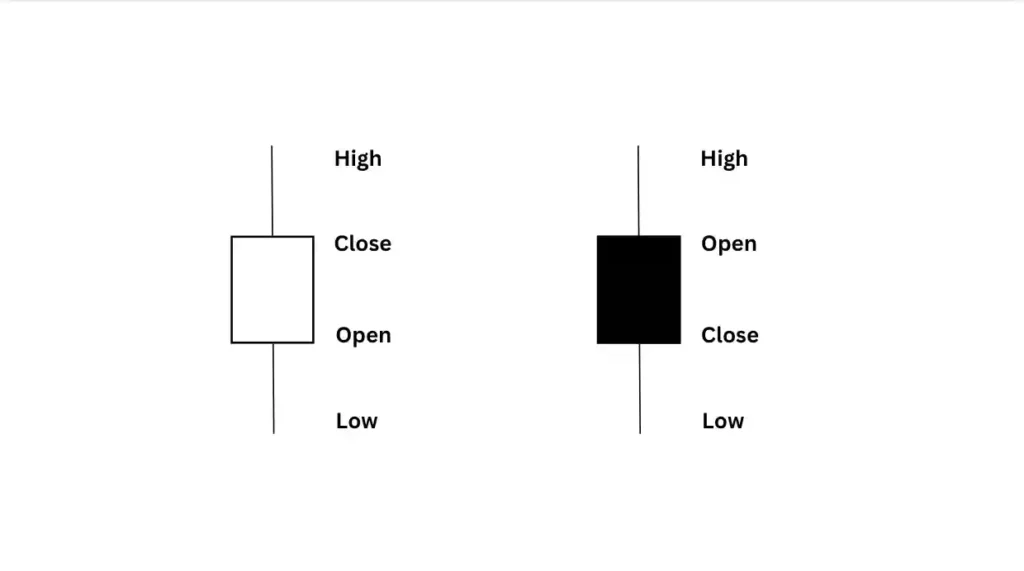

individual candles look like this

Open – it is the price at which candle starts to form.

High – it is the highest price a candle reaches

Low – it is the lowest price a candle reaches.

Close – it is the price at which a candle closes.

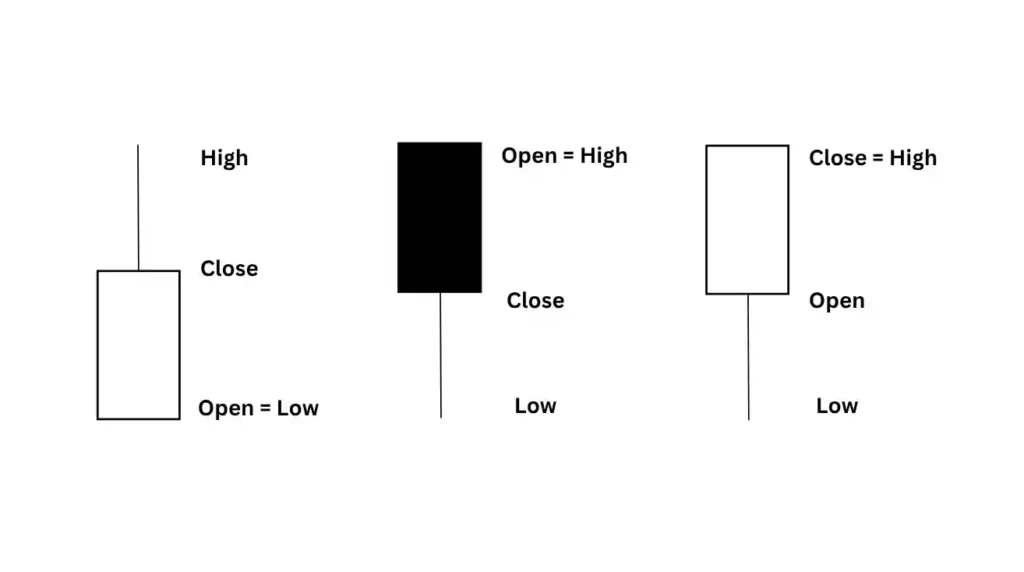

Based on the above information, a candle can have multiple combinations some of which are depicted below:

Candlestick Patterns

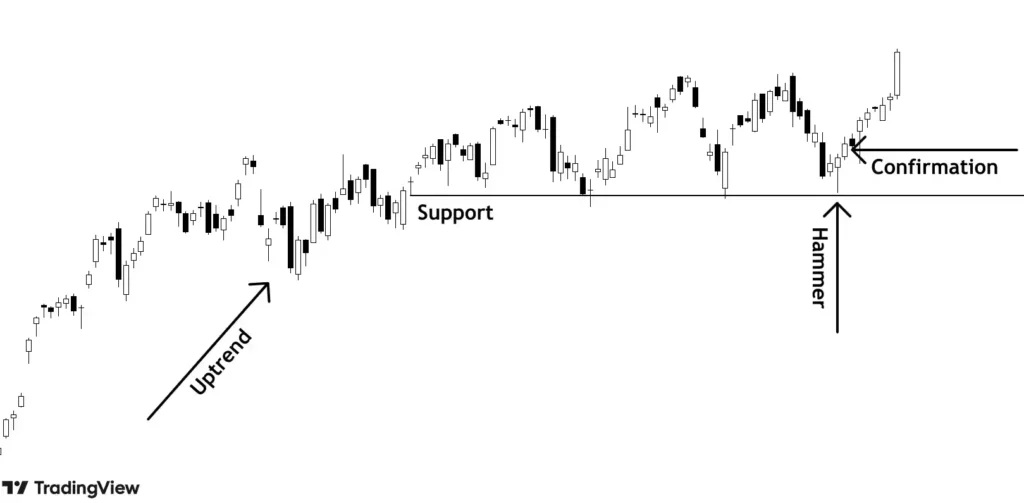

- Hammer

The candle looks exactly like a hammer and has a long lower wick and small body with small or no upper wick.

Although one will find a chart full of such candles, we are interested in a hammer forming in a downtrend.

The above image depicts a number of concepts.

- A hammer is forming in a down move.

- Presence of Support zone during primary uptrend.

- Confirmation candle – a white/green candle after the hammer.

In trading, you have to find multiple reasons to enter. More the confluence, the better.

Psychology behind a Hammer:

During a downtrend, sellers are in complete control. During the formation of a hammer, sellers have managed to take the price to the lowest point but buyers emerged, reversed the selling pressure and managed to close the candle above opening.

So the hammer represents the emergence of buying pressure and bulls overcoming bears.

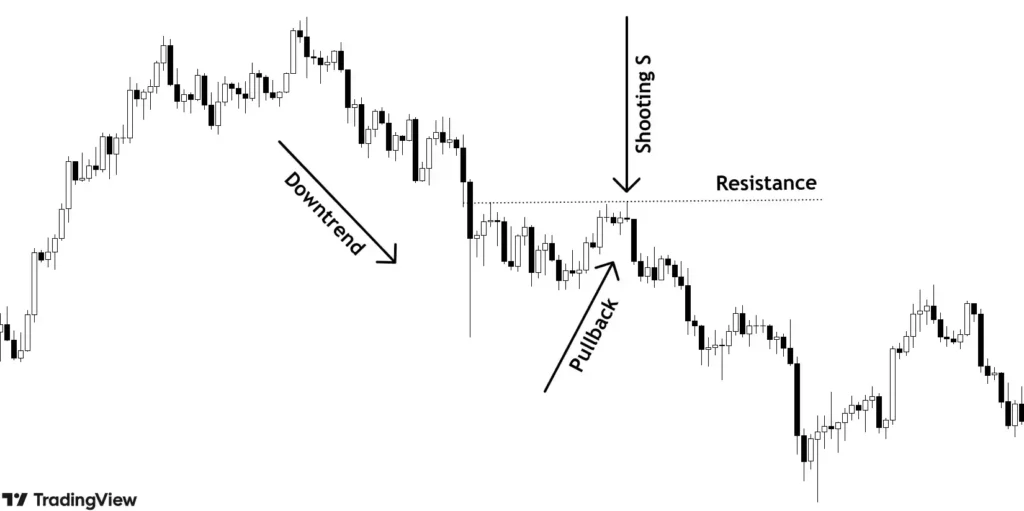

- Shooting star

A shooting star is the opposite of a hammer with long upper shadow and small body with no lower shadow.

We are interested in shooting star in an uptrend.

Following logics gives one confidence on the shooting star in the above image:

- The price is in downtrend, making lower lows.

- Resistance zone.

- Formation of shooting star at shooting star during upmove (secondary trend while primary being downtrend) and confirmation candle after that.

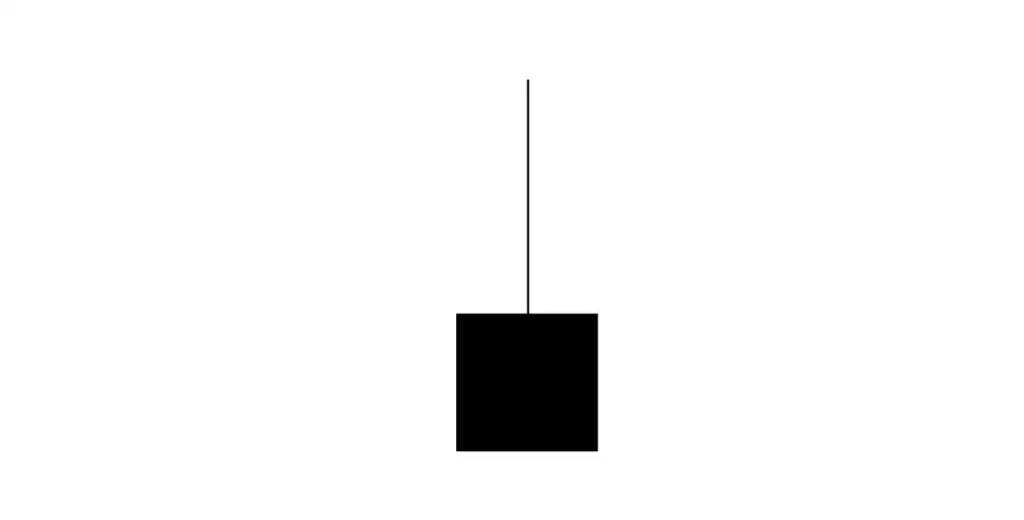

- Marubozu

A Marubozu candle has negligible/no wicks. A bullish Marubozu opens and bulls take the price up and close the candle at the highest point. The candle depicts bears being too weak to break the low of candle.

Bullish Marubozu, in uptrend, signifies buying pressure is still present and price may even higher and in downtrend, the candle may signal potential reversal of downtrend. Opposite is true for a bearish Marubozu.

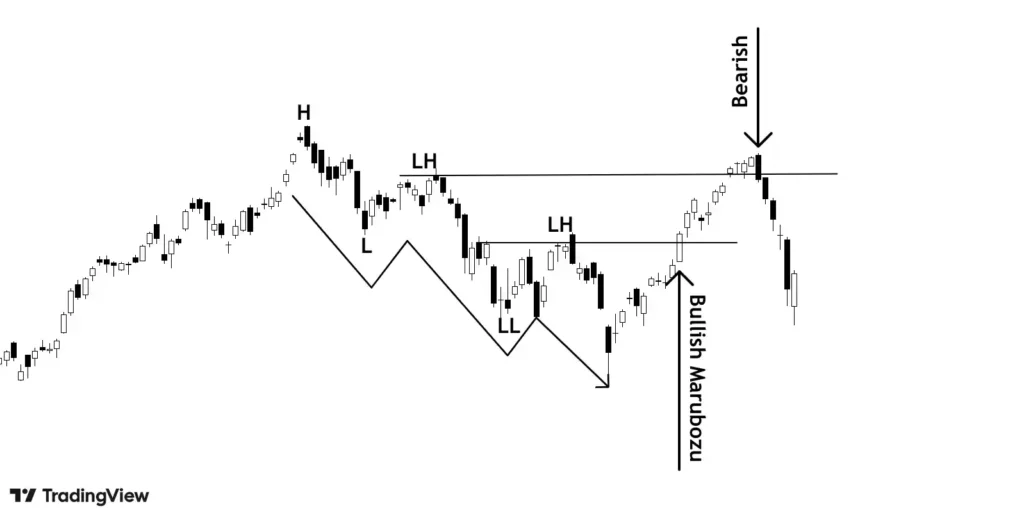

The above image shows the price in downtrend, making lower lows and lower highs. A bullish Marubozu candle forms which breaks previous lower high. Bulls being in control, price goes up.

A bearish Marubozu forms at top, breaking support zone which represents buying pressure reducing and emergence of sellers. At this point, one should look for booking profits or can take short trades after a confirmation candle.

- Engulfing patterns

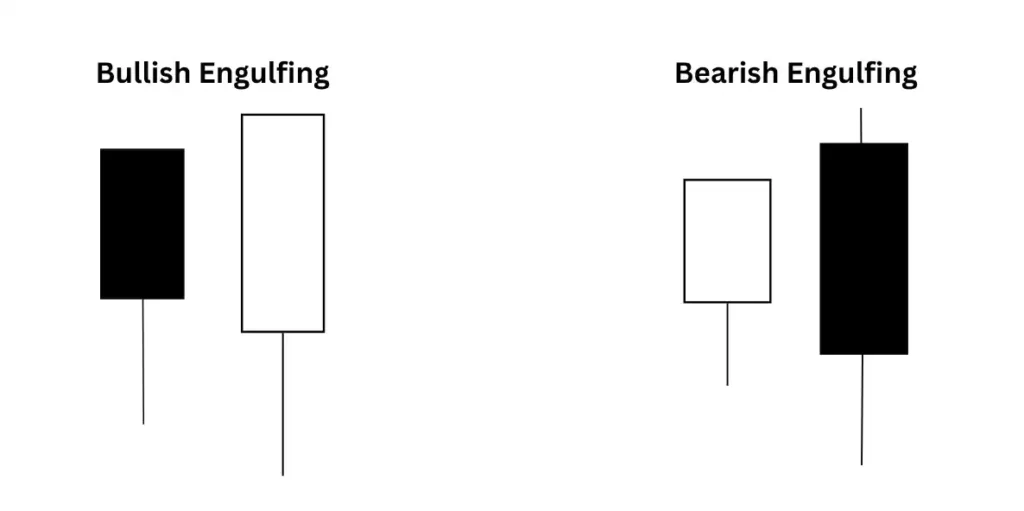

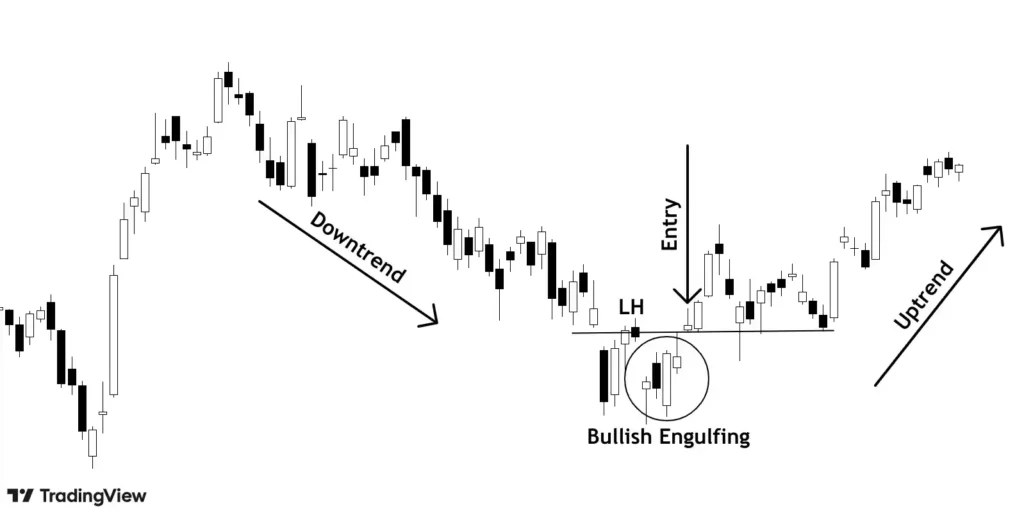

In the bullish engulfing pattern, the bullish candle (white/green) completely engulfs the bearish candle. An Important character of this pattern is that the white/green candle opens lower than the close of the black/red candle. The pattern appears in downtrend and is a reversal pattern.

An entry can be made after confirmation of a trend reversal, when the price closes above the previous lower high in a downtrend, following the formation of a bullish engulfing candle.

Bullish engulfing candle opens lower than the close of the previous candle. More sellers enter thinking price would fall further in downtrend but buyers step in trapping sellers and close the candle higher than the opening of the last candle.

Buyers entering even after lower open adds more conviction that the downtrend could be over. Further, this can lead to a short squeeze, meaning bearish traders rush to close their positions by buying, adding further upward pressure on the price.

Opposite holds true for bearish engulfing pattern.

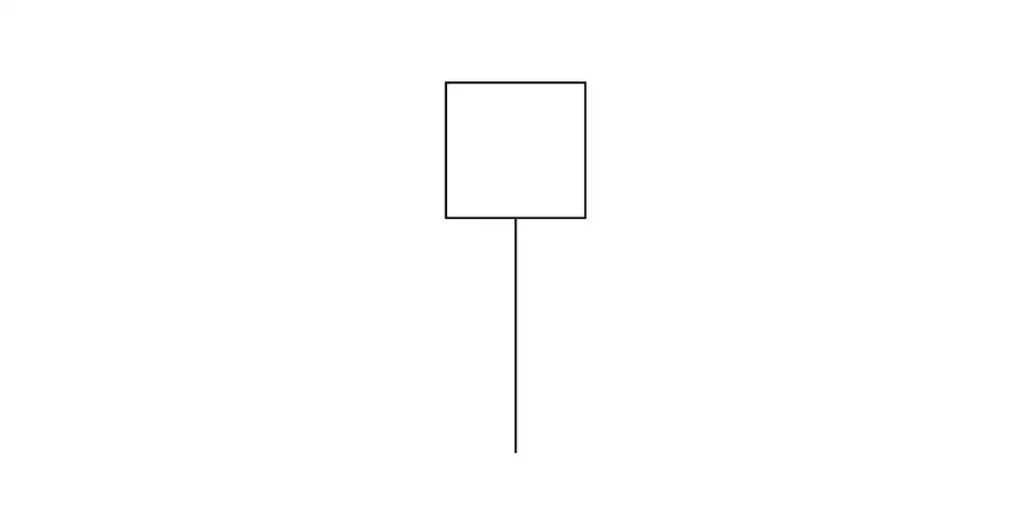

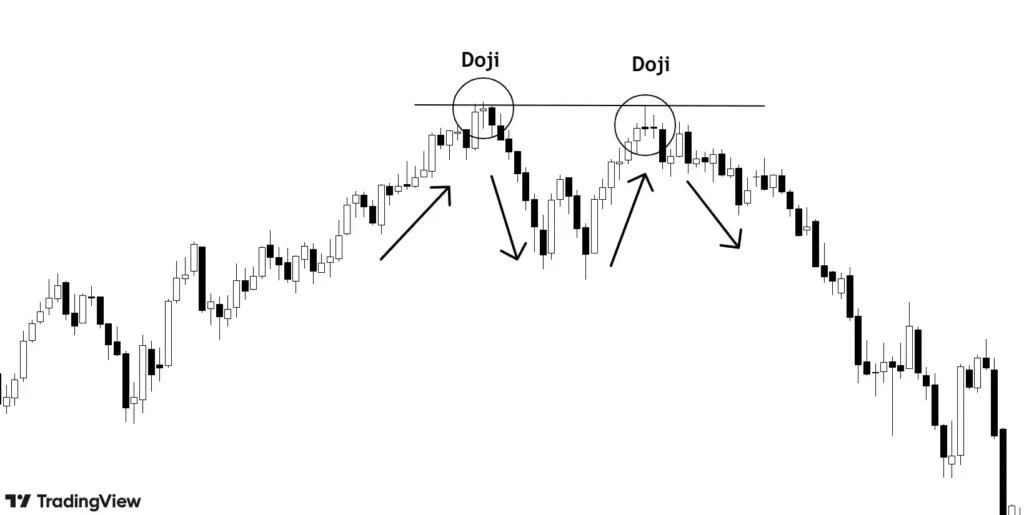

- Doji

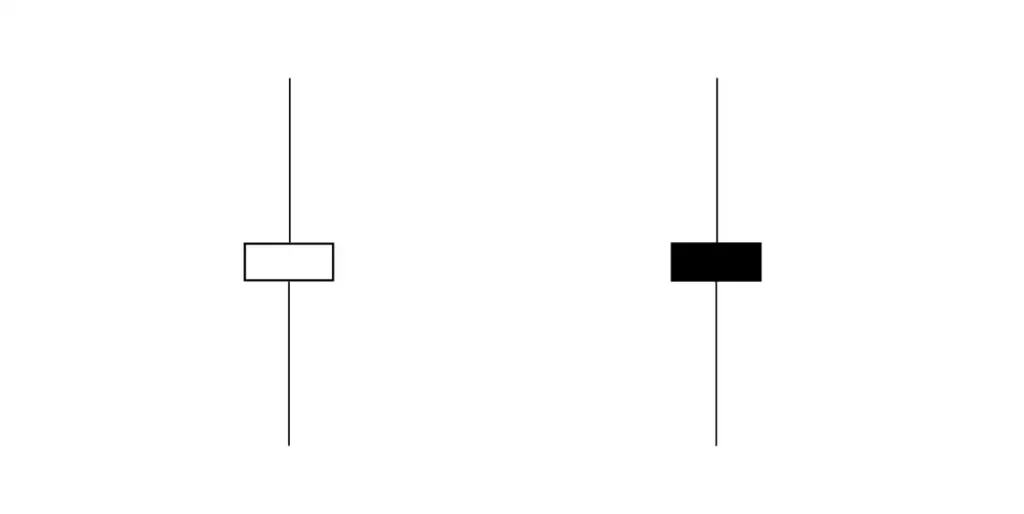

Doji has a small body with opening and closing price almost equal. This shows buyers and sellers are in equilibrium wherein none is dominating the other.

This can have a two meanings:

- Reversal of existing trend.

- Continuation of existing trend after phase of indecision.

For this reason, it is important to wait for a confirmation candle and evaluate other market conditions before coming to a conclusion.

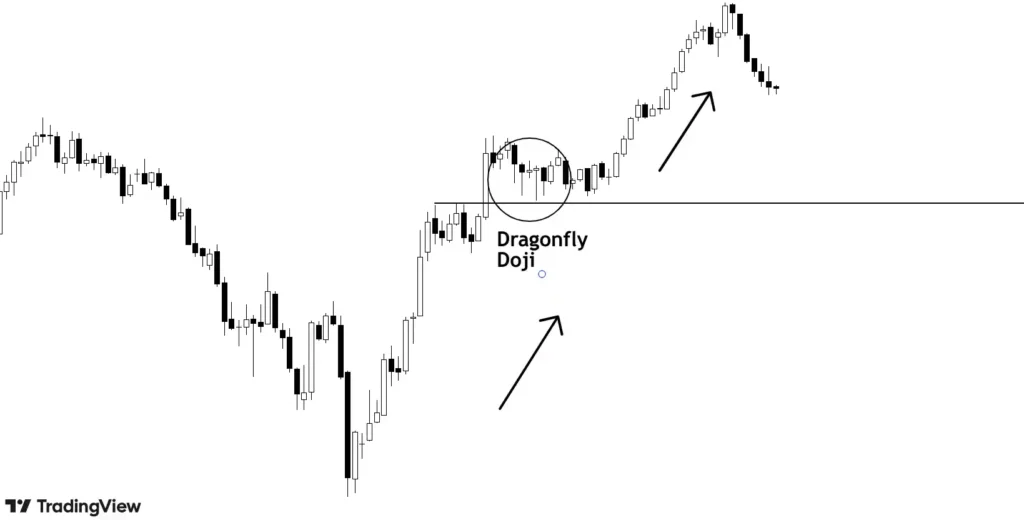

Dragonfly Doji: A Doji with a long lower wick with no upper wick. This shows buying pressure and potential end of downtrend/ temporary down move in ongoing primary upmove.

The above image shows a strong trend upwards making higher highs and higher lows. Formation of dragonfly dojis near support and potential another HL suggests continuation of uptrend and ending of smaller pullback.

Gravestone Doji: Opposite to Dragonfly Doji, this has a longer upper wick with no lower wick. This shows increasing selling pressure and ending of uptrend.

That’s it, wait for confirmation candles and have a confluence of multiple reasons before making a view.

Key Takeaways

- Hammer represents the emergence of buying pressure and bulls overcoming bears.

- A shooting star is the opposite of a hammer with long upper shadow and small body with no lower shadow.

- Hammer is stronger than Dragonfly Doji and Shooting Star is stronger than Gravestone Doji.

- Doji has a small body with opening and closing price almost equal.

- Marubozu has a long body with no wicks.