What is Technical Analysis?

Technical Analysis is the study of past price of an instrument (stock, index, crypto etc). By doing this, a technical analyst makes an educated guess/prediction of future price.

It works on the assumption that history repeats itself and price does not move randomly. Human behavior does not change, they tend to act in similar fashion in similar situations.

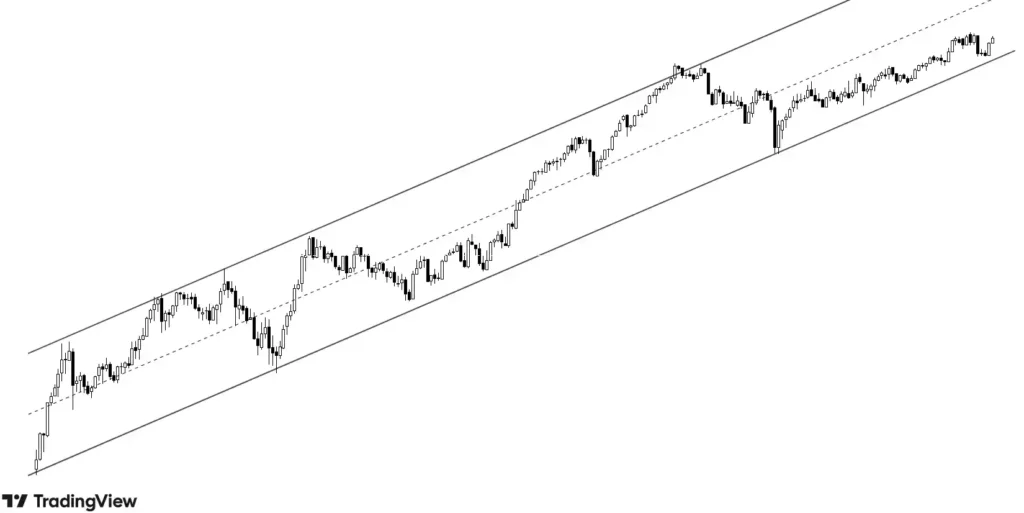

The image below illustrates the power of technical analysis.

Since the price has been respecting and trading between the channel in the past, there is high probability it will repeat the same in future.The middle line is the average increase of price. Whenever it comes below it, market participants jump to buy it which pushes the price up.

Just to clarify, when demand of an asset increases i.e, buyers are willing to buy at any available price, buyers will bid higher and higher to attract sellers and as sellers agree to sell at higher prices, price goes up. Opposite happens when the price falls.

The below image depicts another example why human behavior is reflected in price.

Imagine you bought a stock in 2018 at point A and since then, the price has not come back to its original value until 2023.

What happens when it comes? Your first instinct would be to sell it as you have just recovered your loss after 5 long years. People who entered at A would sell at Point B and price comes down as a result as it experiences selling pressure(as seen in the image, price comes down at point B).

So, traders and investors act/think in a particular way in similar situations thus creating identifiable patterns, which will be covered in future lectures.

Technical vs Fundamental Analysis?

Fundamental analysis is based on study of financial statements of companies, intrinsic value of assets, sectors and health of an economy.

It is more often used by investors who invest for a long time. Needless to say, it is not for trading for the short term.

We will be learning both methods for making better decisions to increase winning probability.

Advantages of Technical Analysis

- It helps in risk management. I cannot stress enough how important this part is.

- It is comparatively easy as it focuses on ‘What is happening’ vs ‘Why’.

- It yields immediate results.

- It can be applied on any instrument, any markets – US, India, Crypto, Forex.

An important thing to note about it is its subjectivity. People view same situations differently

Topics to be covered in Technical Analysis

- Different Charts, Timeframes and their importance

- Support Resistance

- Trends in market

- Indicators

- Risk Management, Risk Reward, Stoploss

- Patterns and Psychology behind

The list is not exhaustive and is only a building block for mastering Trading and Investing.

Bonus

How do people generally use technical analysis? – They focus on predicting the movement of price.

How should you use it? – While it is important to have a view, one should prioritize managing risk, that is knowing your losses if you are wrong and how to minimize it.

Key Takeaways

- With technical analysis, we try to predict the future based on past data points.

- History repeats and market participants behave in a predictable manner.

- Best part of Technical Analysis is Risk Management.