Option Writing

Option writing is selling an option contract to earn a premium. If you sell an Option randomly, your chances of winning are 66.67% against 33.33% in other cases. Sellers of options are also known as Option Writers.

An option is a contract of underlying assets (e.g. stocks, crypto etc) which are traded (bought and sold) in the market. These options are traded either as Call or Put.

If you buy a call option, you profit when prices rise, and if you sell a call, you profit when prices fall. Similarly, buying a put option results in profit when prices fall, while selling a put option generates profit when prices rise.

Why Option Writing?

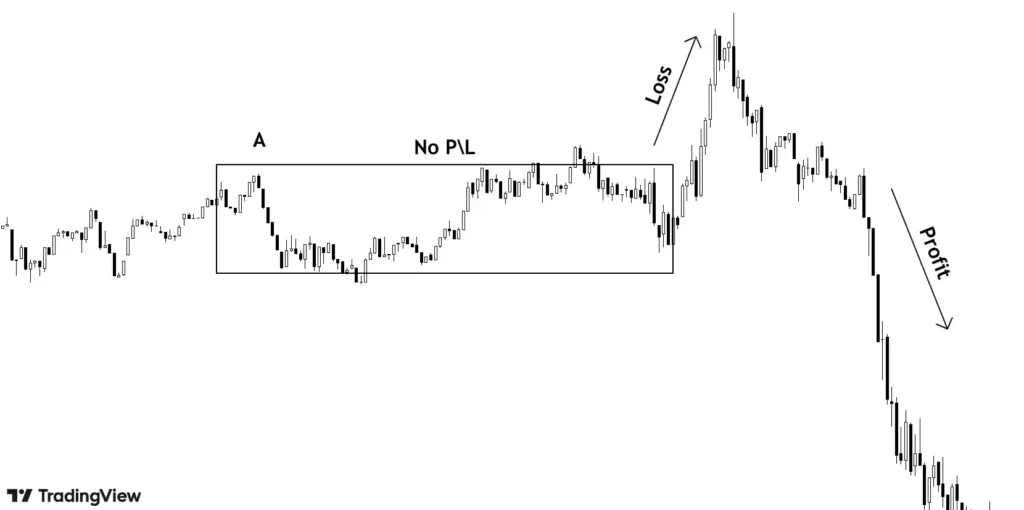

Suppose you sell a stock at A, there are 3 possibilities in market at any time:

- No Profit/Loss: when price stays in a range.

- Loss: when price goes above the entry point.

- Profit: when price goes below the entry point.

In such a case, you only win 1 out of 3 possibilities, mathematically the win % is 33.33%. Do note, when price stays in a range, you are losing your valuable time stuck in a non rewarding trade.

Let’s see what happens when you sell an option.

You decide to sell a Put option with a strike price at 50,000, following things can happen:

- Price goes up, you make a profit.

- Price stays at the same level (consolidation) till expiry of option contract you make a profit.

- Price goes down slowly but does not go below 50,000 till expiry of option contract, you still win.

All option contracts have a specific expiry date, such as 7 days from today. As the expiry date gets closer, the time value of the option decreases, a process known as time decay. This reduction in time value works in favor of the seller, as it causes the option’s overall value to decline, even if the price of the underlying asset remains unchanged.

So when does a person lose in option selling?

When the price makes a sharp move against your position within a short period.

Mathematically, if you sell an option, at least you win 2 out of 3 possibilities, that is 66.67%. This mathematical support with technical analysis is the only way to stay profitable in the long term.

Advantages

- Time decay (aka theta decay): price of option contract keeps on reducing as we approach expiry, this is known as time decay. This is why option sellers manage to be in profit even if prices go against them till expiry.

- Option selling gives a wide margin of error and gives an opportunity to earn without being correct all the time.

- It is a proven fact that 70-80% of the time, options expire worthless as the market stays in a range most of the time hence benefiting the sellers.

- There are 10s and 100s of different combinations possible with option selling, termed as Option strategies which can further increase our probability of winning.

- Comparatively, it is peaceful as odds of winning are in favor of sellers.

Challenges and Mitigation

- Option writing needs big capital. You need to have a big account to be able to sell options and capitalize on the full potential of option strategies. This can be mitigated using hedging benefits and leverage.

- Unlimited risk for naked selling. This means an option seller can potentially incur unlimited loss if the market goes against the trade. This can be tackled using different option strategies which fix sellers maximum loss even if there is a black swan event in the market.

- Rare big moves can potentially destroy months of profits if option selling is not done correctly.

Key Takeaways

- If you sell an Option randomly, your chances of winning are 66.67% against 33.33% in other cases.

- Time decay helps option writers to gain as we approach expiry day while option buyers lose the same.

- With various option strategies, one can increase the probability of winning in different market scenarios.

- Option writing requires large capital upfront.