What are Futures?

Futures contracts are legally binding agreements to buy or sell a specific asset (stocks, cryptos) at a predetermined price (eg current price) on a specified future date.

Suppose you buy a future contract of bitcoin at 100, you are agreeing to buy bitcoin at a future date say after 30 days, at 100. By that time, if bitcoin has gone up, say 110, you will gain 10 and if bitcoin has gone down to 90, you will lose 10.

Futures have multiple applications like hedging, arbitrage etc which will not be covered here. It is enough to know, as of now, that futures allow us to sell or go short on an asset without owning them in the first place.

If you are of view that bitcoin may go down and you would like to capitalize on this opportunity by selling at current price and buying back at lower levels. This can only be done if you own bitcoin in the first place but what if you would want to do it without owning it?

Futures allow us to sell without owning an asset. Additionally, futures are leveraged instruments which allow us to carry big positions without having enough capital for it.

What is Open Interest (OI)?

Open interest is a number that tells how many contracts are currently active or open. These contracts are futures (or Options, which will be dealt separately).

If A is bullish, he will be looking to buy and say B is bearish, he will be looking to sell. They both come in agreement and initiate a future contract and create Open interest 1 meaning there is one active/open contract.

In the future course of time, if A is looking to close this active contract, he would need to sell it to B who would be looking to close his existing sold position. If it happens, the existing open contracts are now closed and OI becomes 0.

So, if new contracts are being opened, Open interest increases and if existing contracts are being closed, Open interest reduces.

While Open interest reflects the total number of outstanding active contracts, volume tells the number of contracts/units traded in a specific time period. OI is a continuous affair and volume is specific to the time frame selected.

Lets try to understand it with a detailed example:

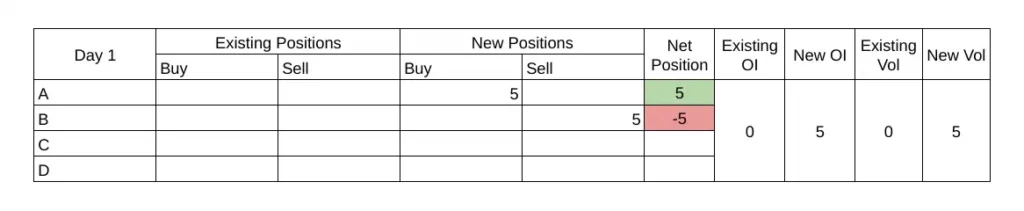

On day 1, trader A buys 5 contracts against which B sells 5 contracts.

No of contracts outstanding/open are 5, hence OI = 5

No of contracts traded today are 5, hence Volume = 5

On day 2, trader A buys 5 more and C buys 10 contracts against which D sells 15 contracts.

No of contracts outstanding from previous day were 5 and new contracts opened today are 15, hence OI increases to 20

No of contracts traded today are 15, hence Volume = 15

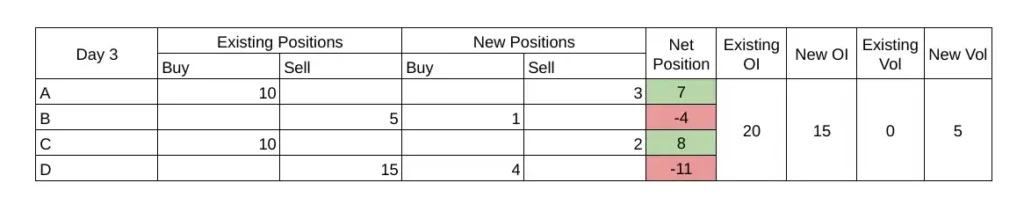

On day 3, trader A sells his existing 3, B buys back his already sold 1, C sells his existing 2 and D buys back 4 contracts.

No of contracts outstanding from previous day were 20 and no new contracts are opened today rather 5 of existing contracts were closed, hence becomes OI = 20-5 = 15

But number of contracts traded today are 5, hence Volume = 5

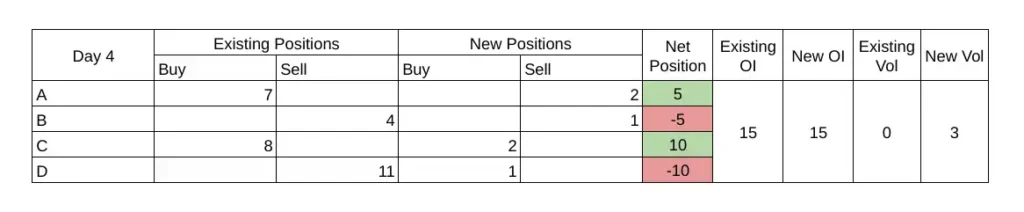

On day 4, A sells 2 of his contracts, B adds 1 to his sold positions, C adds 2 to his bought positions and D closes his sold position by buying back 1 contract.

Here what is happening is one buyer transferred his contracts to another buyer and so did the seller. No new contracts are created or closed hence OI remains the same but 3 contracts are traded, hence volume is 3.

Important observations

- OI is a continuous affair whereas volume is calculated on a day to day basis or any selected timeframe.

- OI increases when new contracts are opened in the market and decreases when existing contracts are closed.

- OI does not change when existing contracts change hands from one trader to another.

- Volume represents how many contracts are changing hands but doesn’t tell whether the contracts are being opened or closed whereas OI doesnt tell about how many traders are participating in trading but only tells about contracts being opened or closed.

How to use Open Interest?

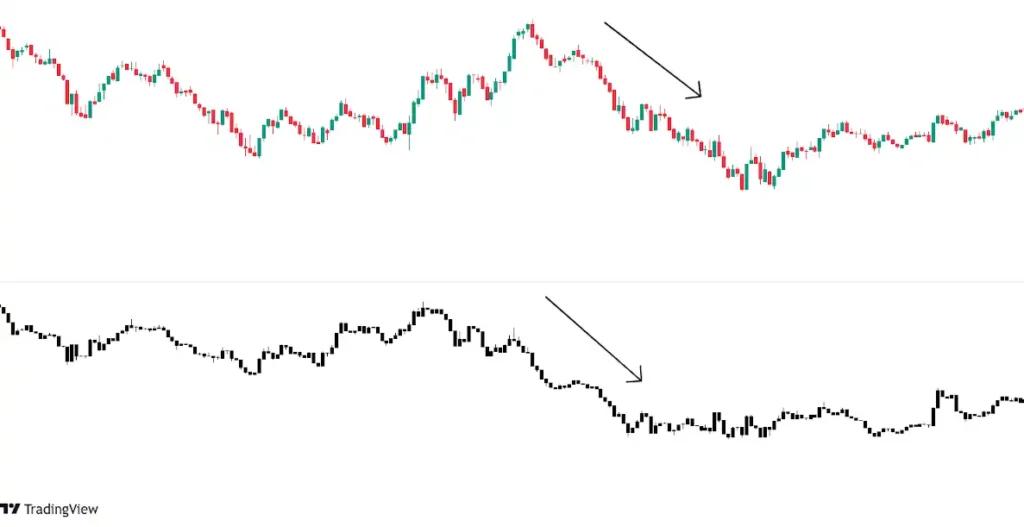

Note: Price is represented by green red candles while OI by black and white.

- Long Build-up

When price increases with increase in OI, it means buyers are more aggressive and are willing to buy at higher prices. This is generally known as long build-up where new money is flowing in and new contracts are being opened even at higher prices.

In such situations, one should be looking for opportunities to go long.

- Short Covering

When existing contracts are being closed, that is OI decreasing with prices increasing, this indicates short covering that is sellers closing their existing positions by buying back sold contracts.

This leads to temporary bullish movement. One should avoid going long during such conditions.

Understanding the concept behind opening/closing of contracts with price movement can tell a trader a lot of things.

The above chart shows how the price is moving up with an increase of OI. At some point, OI starts to decrease with price still moving up. Without OI, one sees this as price making HHs and HLs getting a bullish signal but increase in prices is not being supported by new contracts which should be an early warning for a trader.

- Short Build-up

When OI increases with falling prices, this is a short build-up where new sellers are entering, opening new contracts and selling at lower prices which shows selling pressure. One should be looking for shorting opportunities.

- Long unwinding

Long unwinding is buyers closing their existing positions by selling which leads to temporary downtrend. It is better to avoid going short in such situations.

Key Takeaways

- Open Interest tells how many contracts are open currently.

- Change in OI is related to opening/closing of contracts whereas change in volume is related to exchange of such contracts when we are dealing with futures and options.

- OI increases when new contracts are opened in the market and decreases when existing contracts are closed.

- When price increases with OI increase, look for long positions and when price decreases with OI increase, look for short positions.

- When price increases or decreases with decreasing OI, it’s time to be cautious.