What are Option Contracts?

Option contracts are financial agreements that give the buyer, right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a pre-specified price (strike price) to the seller of call/put option.

Buyer of a call option will have the right, but not the obligation, to buy an underlying asset at a pre-specified price to the seller of that call option. Buyer of a put option will have the right, but not the obligation, to sell an underlying asset at a pre-specified price to the seller of that put option. Buyer of the option pays a premium to have that obligation.

Underlying assets can be cryptocurrency, stocks, indices etc. Imagine you pay a small fee, 10 (premium) to buy bitcoin (call option) at 1000 in future and if the same increases to 1100, you exercise your right to buy bitcoin at 1000. You will gain 100 as the current price has increased to 1100 and the seller will lose the same amount.

If the price of bitcoin comes down to 900, you do not have the obligation to buy at 1000 and you will only lose premium paid i.e, 10.

Now let’s imagine you pay a small fee, 10 (premium buying put option) to sell bitcoin at 1000 in future and if the same goes to 900, you exercise your right to sell bitcoin at 9000. You will gain 100 and the seller will lose the same amount.

If the price of bitcoin goes up to 1100, you do not have the obligation to sell at 1000 and you will only lose premium paid i.e, 10.

So, if you buy a Call option, you will make profit when prices go up and if you sell, you will be in profit when prices go down whereas if you buy a Put option, you will make profit when prices go down and if you are a seller of a put option, you would make money if prices go up.

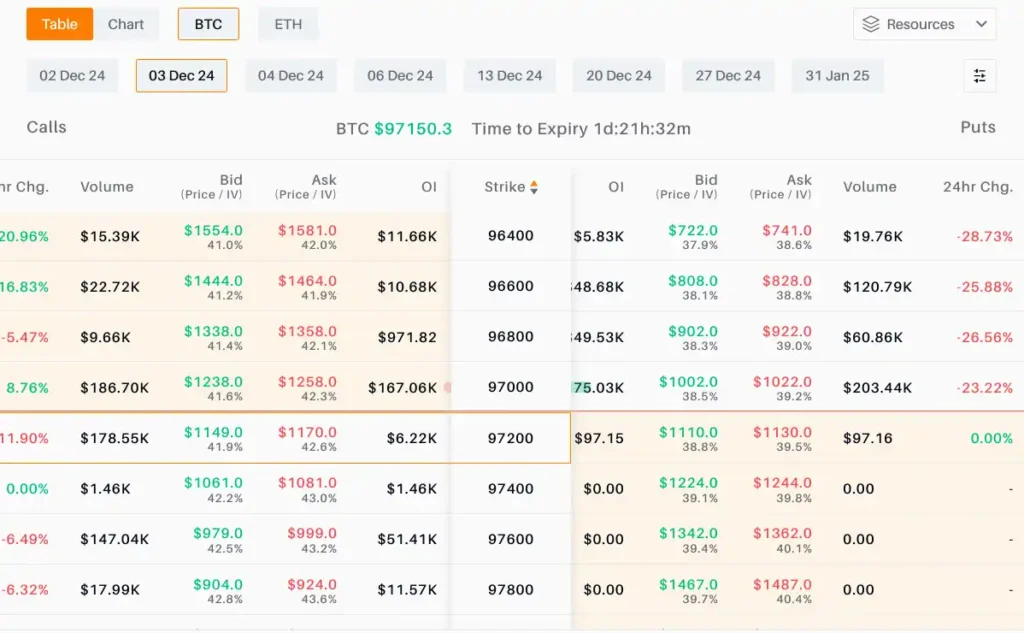

Option Chain

An option Chain is a display, in a tabular form, of all the available option contracts for the selected security e.g. Bitcoin along with important information eg OI, volume, last price etc corresponding to the contracts.

Bid and Ask are the prices buyer and sellers are willing to trade a particular option.

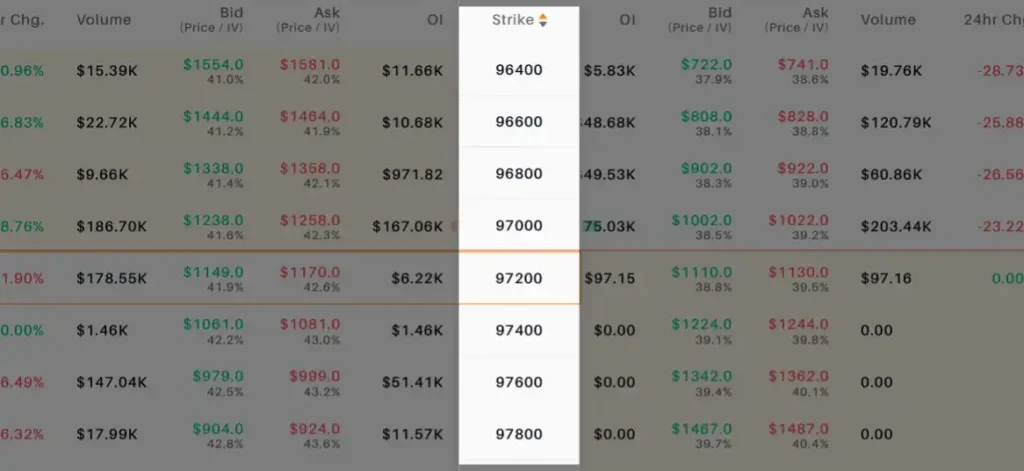

Strike Price

These are the prices at which various call and put option contracts are available to trade.

As shown in the above image, from 96400 to 97800, these all prices are called strike prices which means these are the levels which are available to traders to take positions.

Left side shows the Call options and the right side shows the Put options. So, for every strike, say 97000, one can buy/sell Put/Call options of 97000 strike.

Expiry

Option contracts have an expiry on a specific day and on expiry, settlement of contracts take place.

Settlement can either be cash settled (that is profit/loss is settled in cash) or it can be a physical settlement wherein settlement is made in underlying assets (e.g. stock, that is, it is either received or delivered).

Moneyness of Options

Let’s assume the price of the underlying instrument (e.g. bitcoin) currently is 24300.

For Call options,

Option contracts with strike price < current price of bitcoin – In the Money (ITM) Options

Option contracts with strike price around current price (24300 in this case) – At the Money (ATM)

Option contracts with strike price > current price of bitcoin – Out of the Money (OTM)

And for Put Options, the opposite follows.

ITM option contracts carry intrinsic value whereas OTMs do not have intrinsic value and carry 100% time value.

Time value represents the potential for the option to gain value before it expires, due to factors like time remaining until expiry and market volatility. Time value decreases as we approach near the expiry and becomes 0 at the end of the expiry.

In simple terms, time value is the “extra cost” of an option contract for the possibility that the underlying asset will move in a favorable direction before the option expires.

Below chart explains the concept of Intrinsic Value and Time Value taking example of Call side.

(Note maximum time value is near ATM options)

Intrinsic Value for Call options, at expiry, is defined as the difference between Current Price of underlying asset (value of bitcoin on expiry day) and Strike price.

LTP = Intrinsic value + Time value

On expiry day, time value becomes 0 and LTP is equal to Intrinsic value. For OTMs, intrinsic value is 0, hence they become 0 on expiry day.

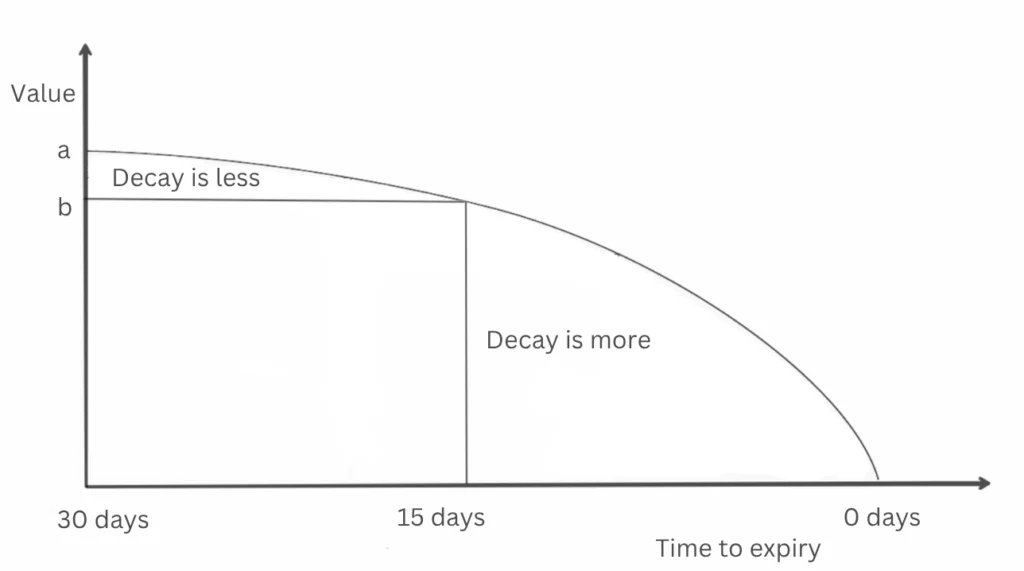

Time decay

Time decay (aka Theta) refers to the gradual erosion of an option contract’s value as it approaches its expiration date. This is due to the reason that chances of the underlying price moving favorably (to make the option profitable) diminish as expiration nears.

Rate of time decay is not linear, decay is more near expiry i.e, options will lose more time value near expiry. As depicted in the image above, for the first 15 days, value lost is from point a to b which is near to 20% only. For the next 15 days, the option value goes to 0.

Key Takeaways

- Option is a contract that gives the buyer the option to buy/sell the underlying asset but not obligation.

- Buyer of a Call option gains when prices go up and Buyer of a Put option gains when prices go down. Profit/Loss of a Seller will be opposite.

- Option contracts can be seen as an insurance instrument where the Buyer pays the premium.

- Option Chain is a display, in a tabular form, of all the available option contracts of an underlying instrument e.g. Bitcoin.

- Strike prices are the levels of prices at which options are available to trade.

- All options come with expiry – daily, weekly, monthly etc when settlement of underlying assets takes place.

- ITM options have an intrinsic value but OTMs have only time value.

- Time decay (aka Theta) refers to the gradual erosion of an option’s value as it approaches its expiration date.

![5-Minute Guide to Becoming 50% Pro Trader [Beginner]](https://thsinvestor.com/wp-content/uploads/2025/02/pro-trader-768x384.webp)