What is Volume Weighted Average Price (VWAP)?

Volume weighted average price (VWAP), is an indicator which calculates average price of a security, for a trading session (1 day), weighted by volume. VWAP is calculated for a single day, resets daily, hence suited for intraday only.

It is different from moving averages as moving averages do not include volume. Also, moving averages are continuous and can be used in multi timeframe analysis.So, introduction of volume into price is what makes VWAP one of favorite indicators of traders.

Below example shows single lined VWAP applied to an instrument on a 5 min time frame:

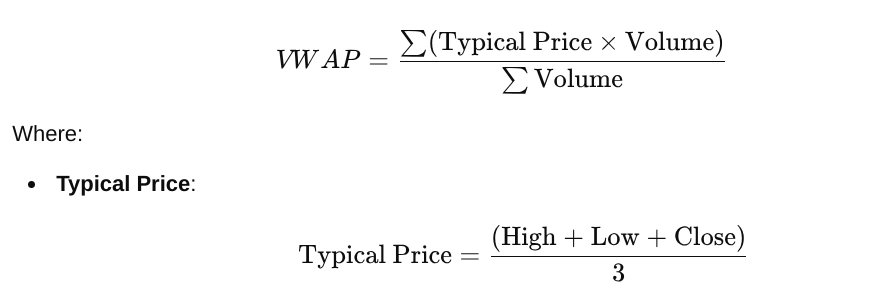

Volume Weighted Average Price – Calculation

Formula of Typical Price can vary and can sometimes include ‘Open Price’ also.

Volume Weighted Average Price – Applications

Application of VWAP can be studied under following heads:

- Bullish/Bearish sentiment

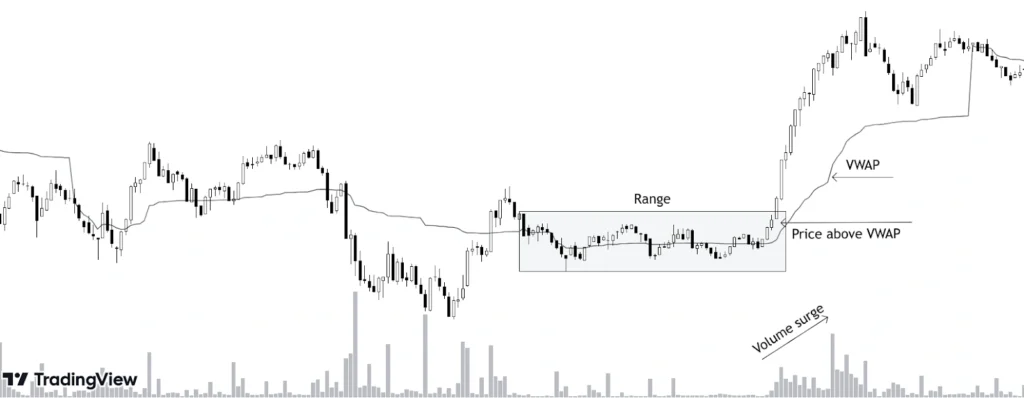

Price above VWAP is generally considered bullish and below it, as bearish. Using merely VWAP doesn’t signal much but when we club VWAP with other studies, we can make a high probability bet.

The above example shows how price moves up and below the VWAP line in a range bound market marked by low volume activity and once the range is broken, price being above VWAP and rising volume, one can take a bet on the long side.

- Entry and Exit Points

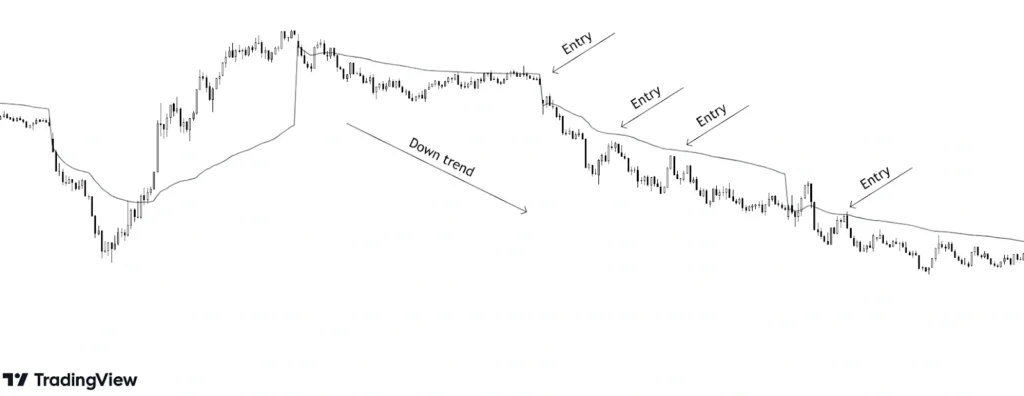

In an established trend, entry can be made during pullback near the VWAP line. The same is depicted in the below example where in downtrend, multiple entries can be spotted during pullbacks at VWAP line.

The same VWAP line can also be used to trail profit by exiting when price closes above the VWAP line. Remember, to use this technique in trending marketing only. In a sideways market or when price is in a range, price frequently crosses the VWAP line.

- Reversals

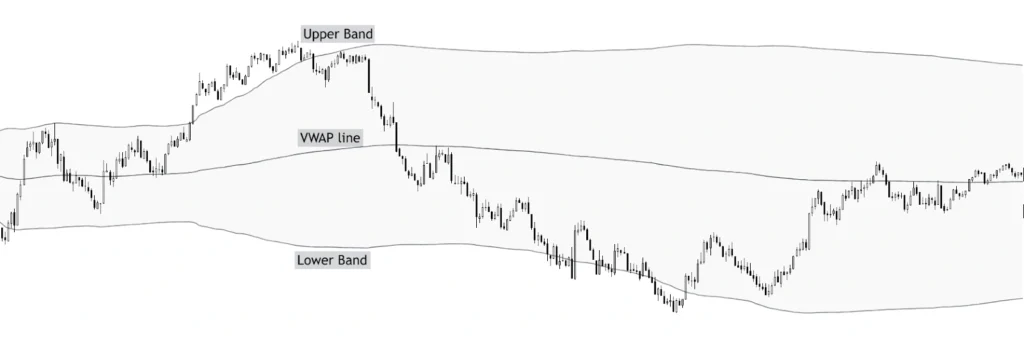

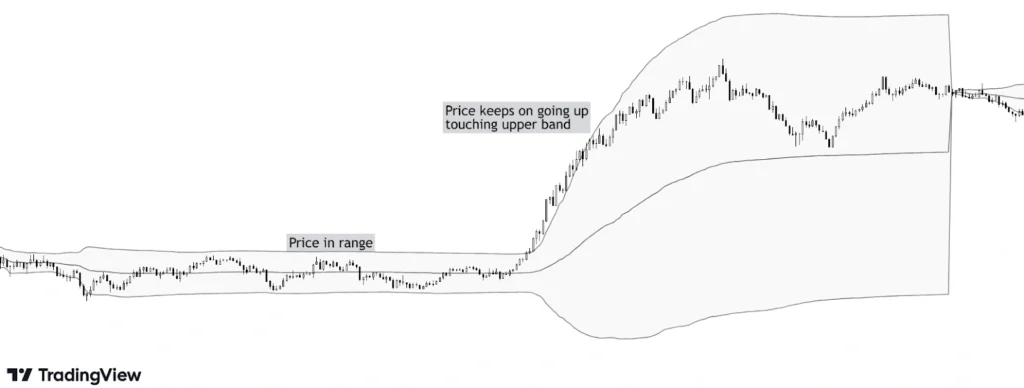

Upper and lower band in VWAP represents overbought and oversold zones. So, one should avoid going long near the Upper Band or look for booking profits and should avoid going short near Lower Band.

But one can find an exception to this – if price has been trading in a small range for quite some time subsequently breaking the range, price can keep going in one direction along with the upper/lower band.

So, it is important to know the immediate history of price whether it is in a range or trending. The same is depicted below:

So, it is imperative to combine multiple studies together to come to a conclusion before taking a decision and not relying completely on a single indicator.

What is Anchored Volume Weighted Average Price?

Anchored VWAP is a modified version of VWAP wherein we can set the starting point on any timeframe against VWAP which was confined to day trading only resetting every single day.

These starting points can be important turning points in the existing trend – Top/bottom of previous trend, breakout of price, key economic or company-related events etc

So, Anchored VWAP tries to understand the average position of market participants since a specific event.

The above image shows how price has been taking resistance from AVWAP drawn from top of previous trend.

Key Takeaways

- VWAP Overview: VWAP calculates the average price of a security weighted by volume for a single trading day, resetting daily, making it suitable for intraday trading.

- Usage: VWAP reflects bullish sentiment when price is above it and bearish sentiment when below, especially when combined with other indicators.

- Applications: Used for entries during pullbacks, profit trailing, and identifying overbought/oversold zones via VWAP bands in trending or range-bound markets.

- Anchored VWAP: AVWAP allows traders to anchor the starting point to significant events, tracking the average price since that point for broader analysis.

- Key Insight: VWAP’s integration of volume into price makes it a favorite for traders, but its effectiveness increases when paired with other studies.