What is On Balance Volume (OBV)?

On Balance Volume is a volume based indicator which measures the flow of volume.It reflects cumulative volume by adding/subtracting present volume to the value of OBV.

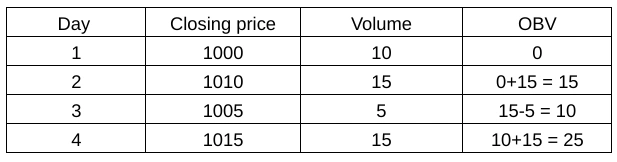

On Balance Volume – Calculation

OBV (current) = OBV (previous) + Volume (current) (if current close > previous close)

OBV (current) = OBV (previous) − Volume (current) (if current close < previous close)

OBV (current) = OBV (previous) − Volume (current) (if current close = previous close)

Below example explains the calculation of OBV.

So, when the closing is in green, OBV increases and when the closing is red, OBV decreases.

Rising OBV: Indicates that volume is increasing on up days, suggesting strong buying pressure.

Falling OBV: Indicates that volume is increasing on down days, suggesting strong selling pressure.

How to use On Balance Volume

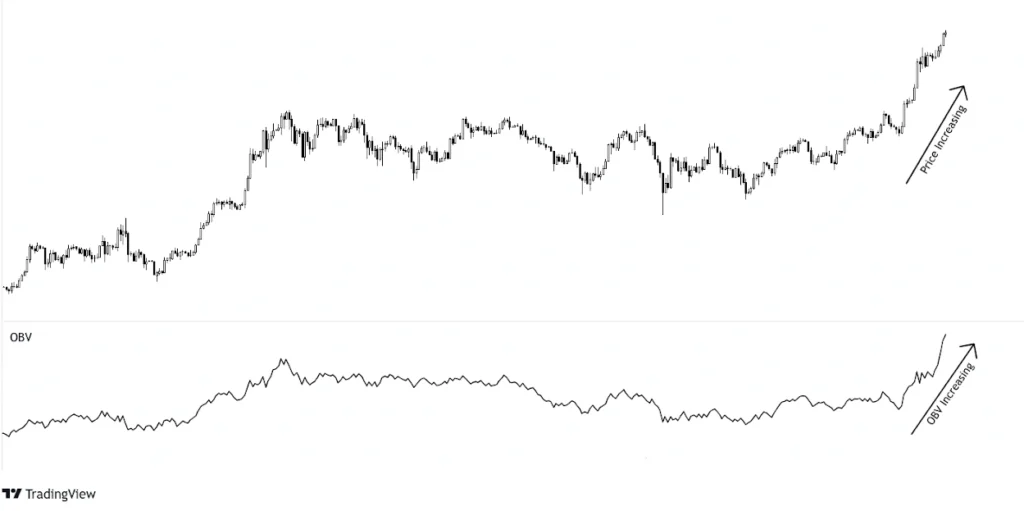

- Confirmations:

Up move should be supported by increasing OBV.

Similarly down move should be supported by decreasing OBV.

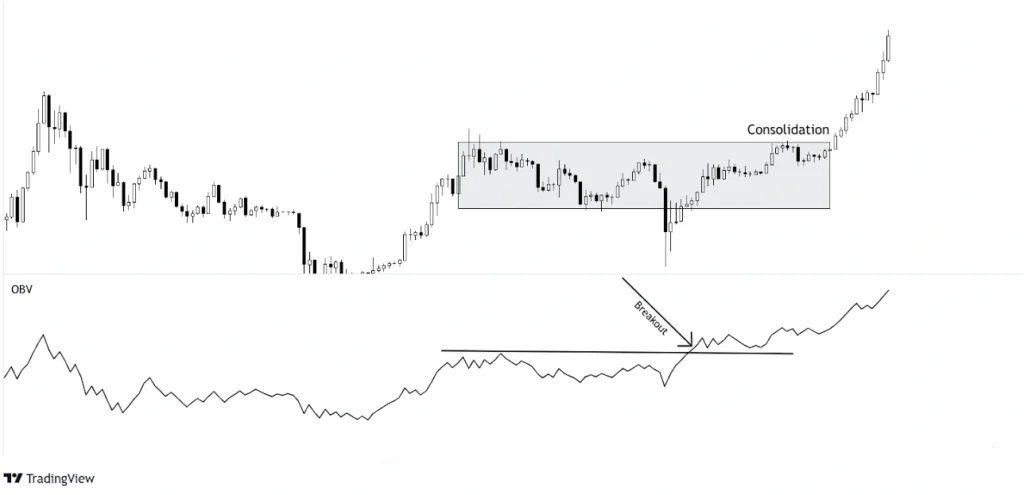

OBV can also be studied while consolidation of price for potential breakouts.

The above example shows how price is stuck in a range and OBV is rising which reflects volume is increasing on up days comparatively to down days, suggesting strong buying pressure.

- Divergences

The above chart shows the price is going down but OBV is actually rising. This means, volume is more on up days and low on down days that is net inflow of volume is less when going down. Such moves are not sustainable.

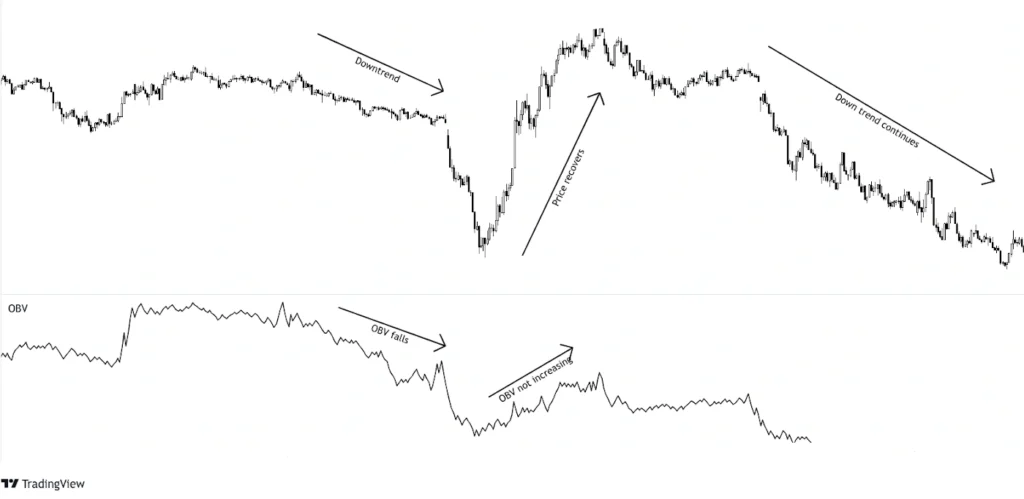

OBV can also be used to see if a trend has a strength of volume or a mere pullback.

The above example shows a downtrend and a pullback upside. The pullback crosses the previous high but OBV does not recover much which means the up move is not supported by buying pressure and we can finally see price going down continuing the original downtrend.

Traders should avoid taking long positions in such situations.

Key Takeaways

- On Balance Volume measures flow of volume, during upside or downside.

- Rising OBV means high buying pressure while falling OBV means high selling pressure.

- Uptrend should be supported by rising OBV and down move by falling OBV.

- If there is a divergence between price and OBV, traders should be cautious while trading such move.