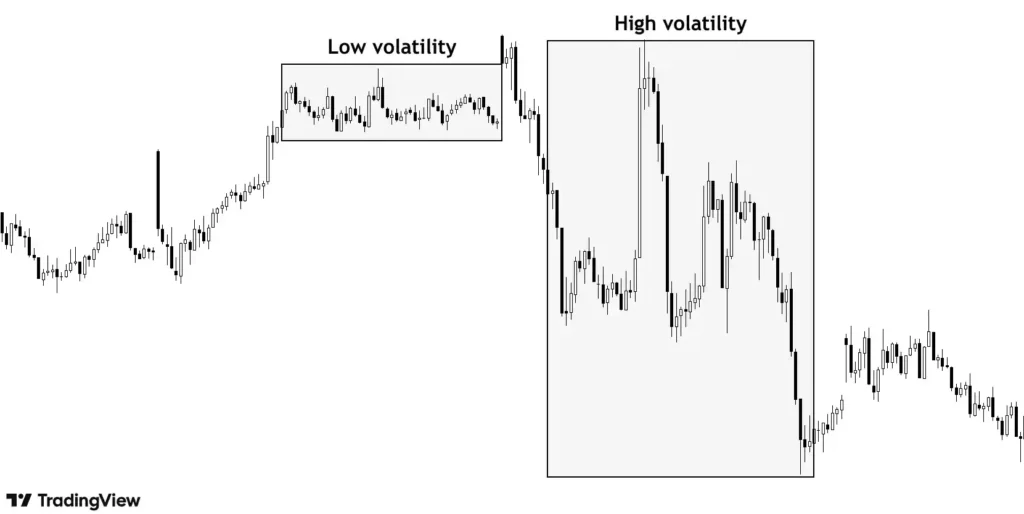

What is Volatility?

Volatility is the degree of variation in prices of an asset over a period of time. High volatility means prices are experiencing large variations (up and down) over a short period of time.

In less volatile periods, movement of prices is gentle.

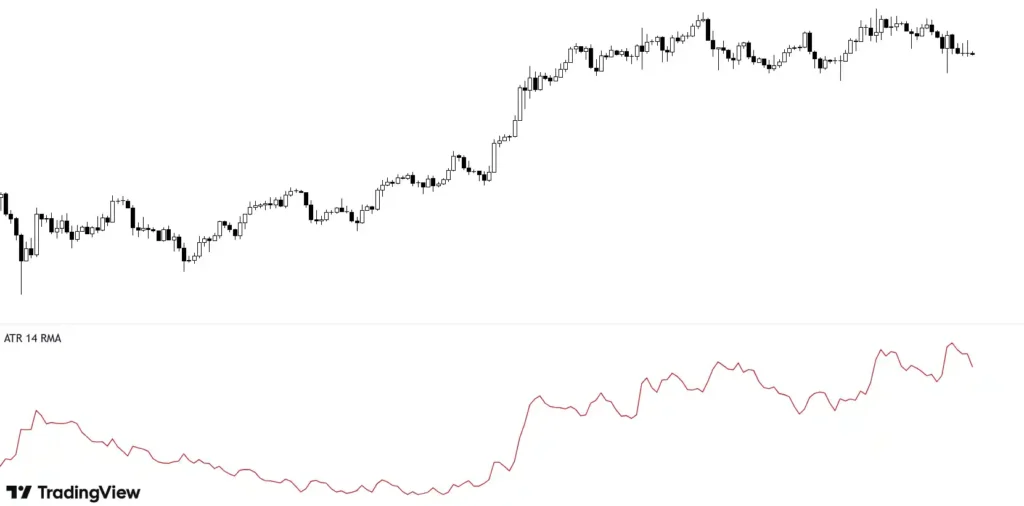

What is the Average True Range (ATR)?

Average True Range (ATR) is an indicator which measures the volatility in the prices. It shows how much a price is moving on an average per candle in either direction over a period of time (generally average of last 14 candles).

If ATR is 10, this means the asset has moved, on an average, 10 points per candle over the chosen time period.

The above image shows the ATR value of Bitcoin on Daily timeframe. ATR value corresponding to a candle represents the average volatility of the last 14 days (candles).

Average True Range is the moving average of the True Range over a period (last 14 candles) where True Range is the greatest value among the difference of current candle’s high, low and previous candle’s close.

Stop Loss using Average True Range (ATR)

Primary application of ATR is setting Stop loss (SL) for a trade that is deciding the point where you exit a trade.

ATR value is nothing but the average volatility which represents normal price fluctuations and this value varies asset to asset.

The basic idea is to keep SL bigger than average volatility to give some room to trade to work by taking in account current natural volatility of assets.

In highly volatile markets, we need to keep our SLs bigger while the same can be reduced in less volatile markets. This further changes our position sizing, which we will be covering in our upcoming lessons.

How to avoid average volatility?

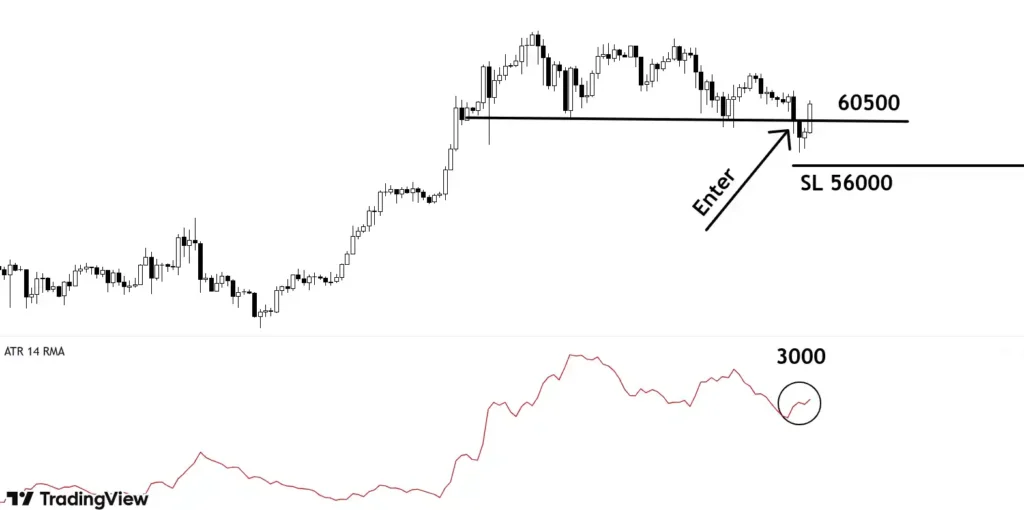

Stop loss should ideally be placed beyond 1.5 x ATR to 3 x ATR value from entry point. If you are entering at 100 and ATR is 1, SL should be placed at/beyond 2 points (2×1) that is around 98.

For instance, you decide to enter the near support area at 60500 and want to keep SL beyond the support line. ATR at the entry candle is 3000 which is average volatility. You wish to take into account this volatility and give some room to your trade.

SL (taking ATR 1.5) = 1.5 x 3000 = 4500

Point of SL = 60500 – 4500= 56000

Notice how ATR prevents your SL from being taken out and price reverses and starts moving up.

Trailing Stoploss using Average True Range (ATR)

For Long (buy) Positions: TrailingSL = Current Price−(ATR×Multiplier)

For Short (sell) Positions: TrailingSL = Current Price + (ATR×Multiplier)

Let’s consider you are going long (buy side trade):

Buying entry at 100 with ATR = 1, SL =100 – (2 x ATR) = 98 (keeping multiplier = 2)

If the price moves in your favor, adjust the SL based on the new ATR value.

If the price moves against you, the SL remains unchanged (trailing stop only moves in one direction).

Eg When the price moves 102, the new SL should be 100 (considering ATR remains 1)

This helps protect and maximize profit.

Key Takeaways

- Volatility is the degree of variation in prices of an asset.

- Average True Range (ATR) measures average volatility over a period of time.

- ATR doesn’t suggest any direction.

- ATR helps decide logical dynamic stop loss which prevent our trades from random fluctuation in price.

- ATR can also be used to trail stop loss.