Volume Study

Number of shares/contracts being traded over a period of time constitutes volume. For instance, for a time period of 1 hour, 1000 shares are bought by buyers; there must be an equivalent number of shares sold in that 1 hour by sellers. So, the total volume of shares traded/exchanged hands in that 1 hour candle is 1000 and not 2000.

Volume study involves analyzing the number of shares or contracts traded in a security over a specific period.

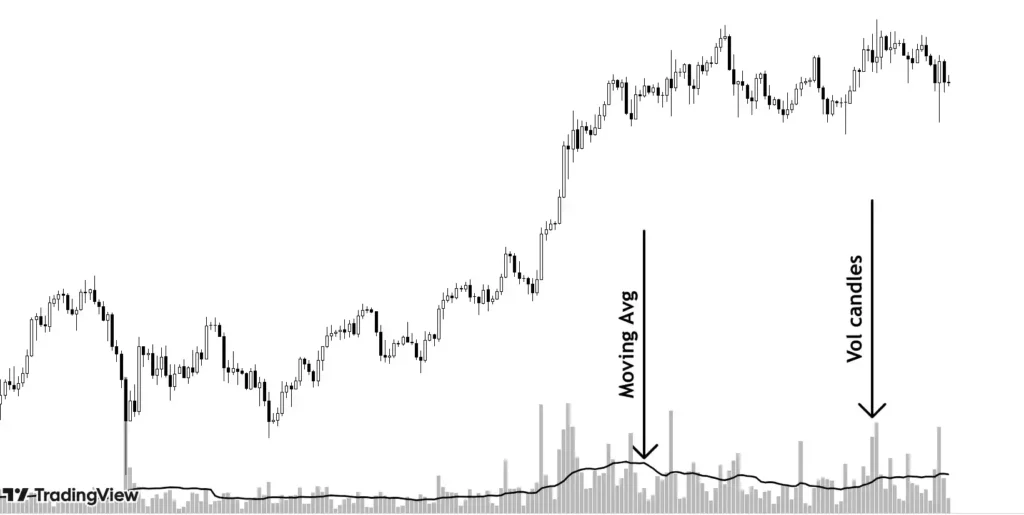

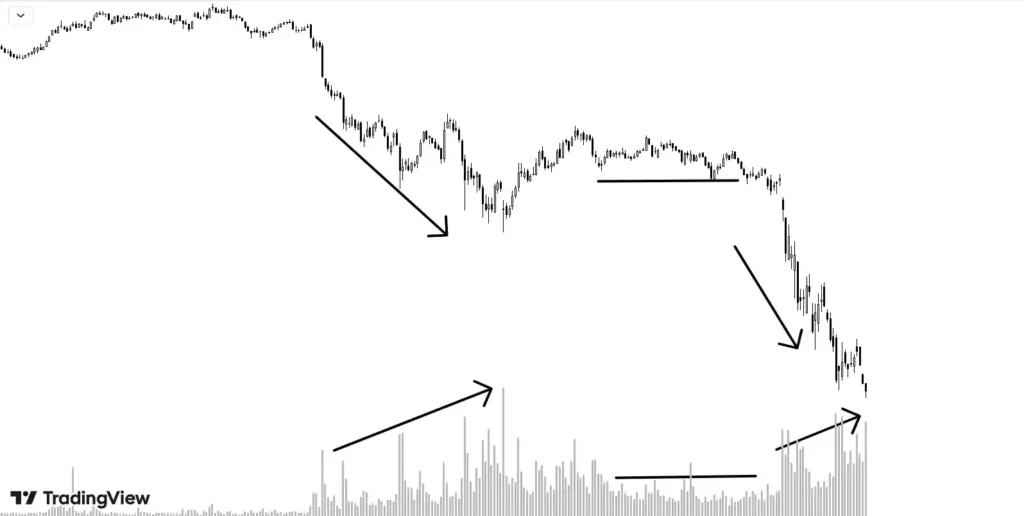

The above image depicts the volume candles corresponding to price candles. The black line is a moving average of the last 20 volume candles.

Moving average is simply the average of the last n number of candles eg 14 or 20. Volume activity more than the average is considered as high volume and signifies presence of big players in the market.

It is considered that high volume activity is smart money buying/selling who have more knowledge than the retailers and it is difficult to hide this activity.

Application of Volume:

- Breakout/ Breakdown with volume

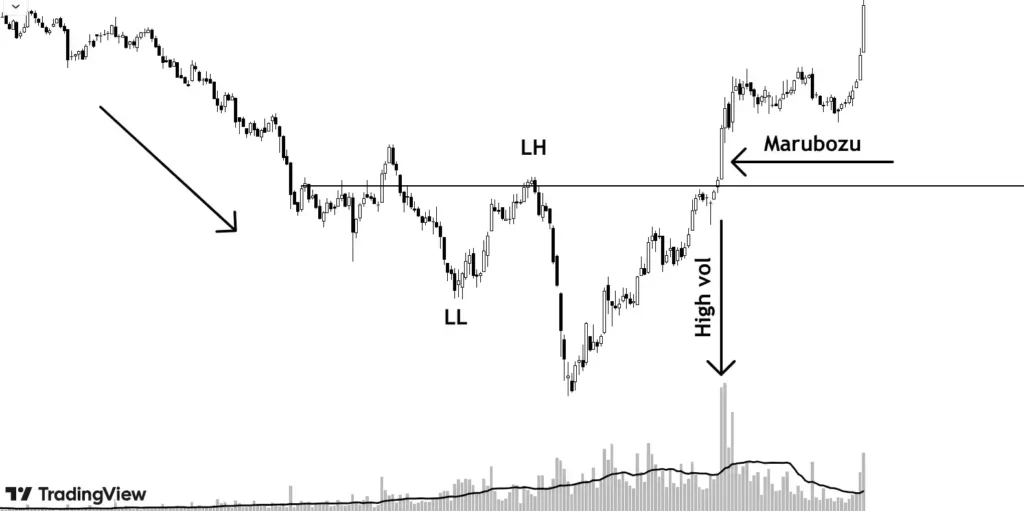

Breakouts/Breakdowns with high volume activity have more chances of sustaining.

The above image shows the same wherein long term resistance and Lower high of downtrend has been broken with high volume. Also notice the breakout candle is a Marubozu.

- Volume during a trend

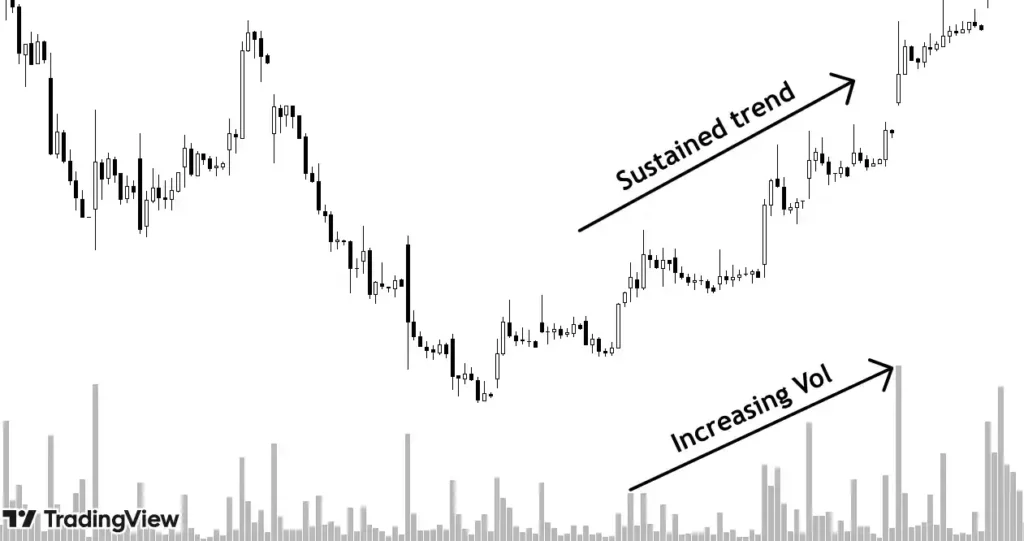

A trending market consists of moving and stopping phases. When price moves, it is supported by high volume and when it rests, volume activity drops.

A consolidation phase is where big players are building their positions by absorbing liquidity without moving the price much that is in small volume. During consolidation, they buy in large quantities, absorbing supplies and finally pushing prices up.

- Combination of price and volume

- Increasing price with high volume

Increase in price supported by high and increased volume activity is a healthy trend and sustainable.

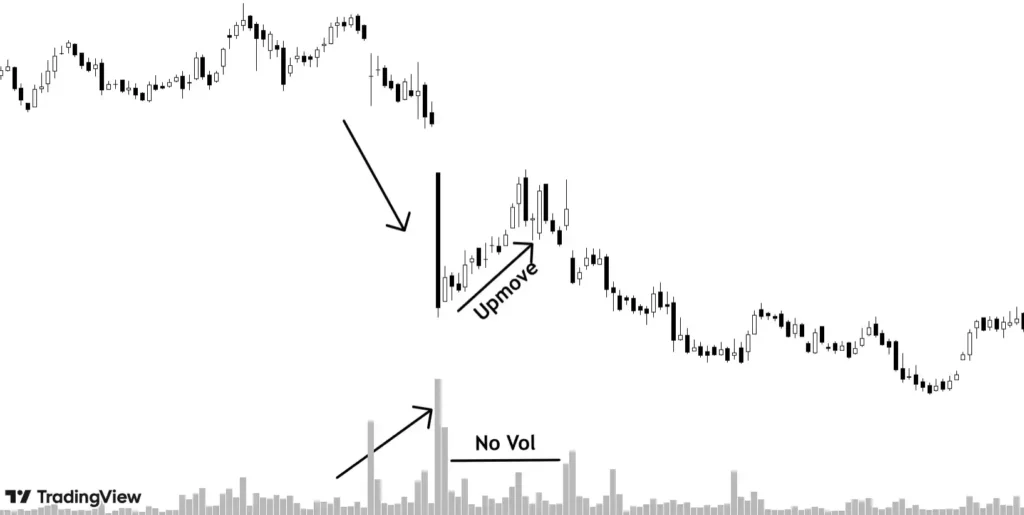

- Increasing price with low volume

Increase in price not supported by volume is not sustainable and generally part of the pullback of larger downtrend. It means the price is increasing because of retail participation and not due to big influential buying.

- Decrease in price with high volume

Decreasing prices supported by large volume confirms downtrend and one must avoid taking long entries.

- Decrease in price with low volume

Price and volume are increasing and as price decreases, volume also reduces which means reduction in price is just the secondary trend and uptrend is the primary one.

Key Takeaways

- Volume is the number of shares/contracts being traded over a period of time.

- High volume activity is smart money, they have more knowledge than retailers.

- Volume study helps traders assess the strength or weakness of price movements.

- Breakouts should be supported by volume.

- Volume activity is high in primary trends while it is subdued in secondary trends (pullbacks).