What are charts?

A chart represents the movement of price of an asset with respect to time. In technical analysis, we study and analyze prices which are recorded on a chart. The only chart we will be using is called Candlestick which is made up of individual candles.

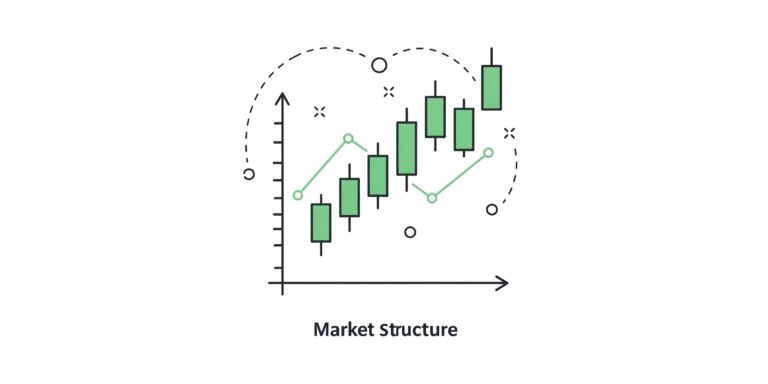

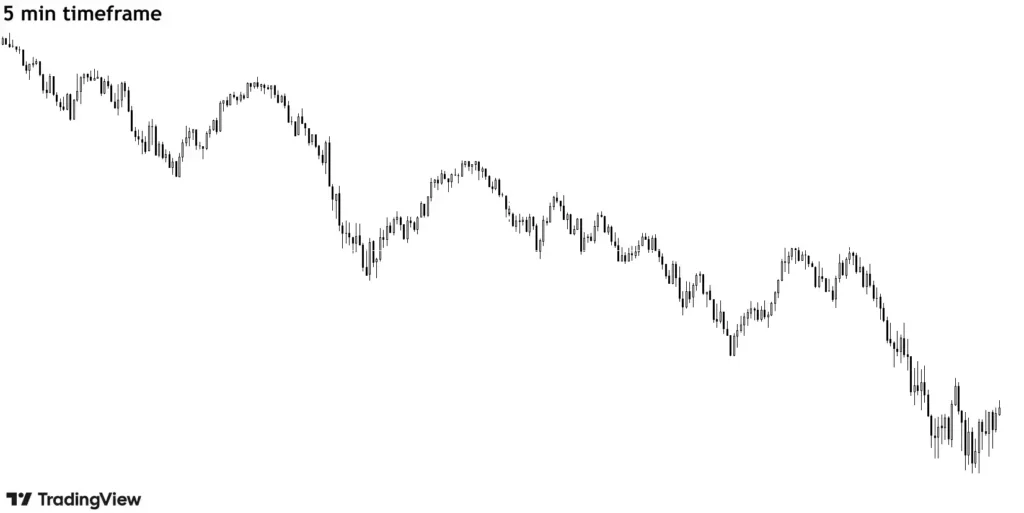

This is how a typical candlestick chart looks like.

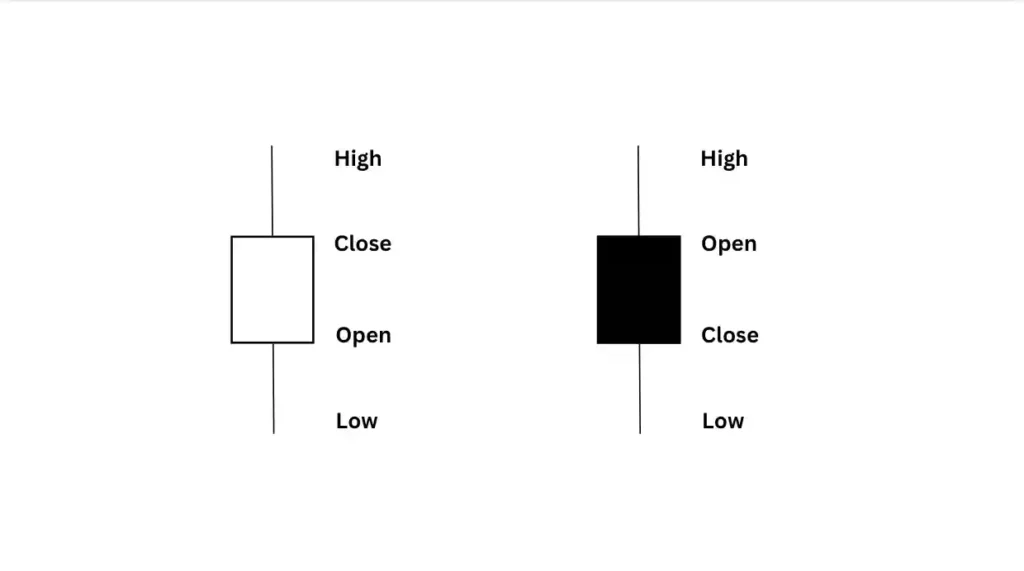

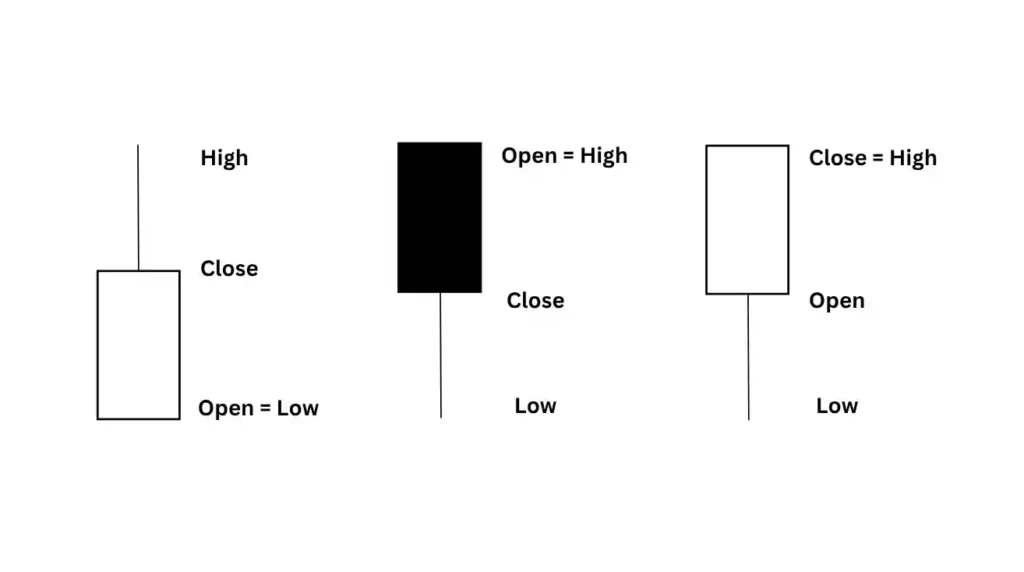

And individual candles look like this

A candle has 5 information points

- Time/ timeframe – duration of one candle (a candle takes some time to form completely) that is time between open and close of a candle.

- Open – it is the price at which candle starts to form.

- High – it is the highest price a candle reaches

- Low – it is the lowest price a candle reaches.

- Close – it is the price at which a candle closes.

Based on the above information, a candle can have multiple combinations some of which are depicted below:

- Candle 1: it opens and goes up, makes a high and closes below the highest point. In this case, OPEN = LOW.

- Candle 2: it opens, makes a low and closes above the low. In this case, open = high.

- Candle 3: it opens, forms a low and manages to close at the highest point which means CLOSE = HIGH.

Generally, if closing > opening, the color used is white/green (aka bullish candle) and if closing < opening (aka bearish candle), then black/red. It goes without saying that these color combinations are customisable.

Timeframe

This is an important part of trading journey as timeframe varies for trading and investing.

- For intraday trading(same opening and closing trade), popular timeframes used are 5 mins and 15 mins.

- For swing trade (closing trader after a few days), preferred timeframes are 1 hr and 4hr.

- For investing, 1 day, 1 week and 1 month.

What does 5 min, 1 hr, 1 day timeframe mean?

A 5 min candle completely forms in 5 mins, it opens and closes exactly after 5 min.

Below are the charts of the same underlying asset with a 5 min and 1 day timeframe. Look and observe how the chart completely changes.

One candle on a daily timeframe depicts the journey of price on that particular day representing open price at the start of day, high of candle as the highest price the asset traded, low of candle as the lowest price asset traded and close of candle as price at end of the day.

Pro tips

- Technical analysis works better with bigger timeframes, the bigger the better.

- Any timeframe you are working on, analyze the chart in one step bigger timeframe to get the bigger picture (more on this later).

- The Closing of a candle is generally given more importance (will be dealt in detail in upcoming lectures).

Key takeaways

- The Candlestick chart is the most widely used chart.

- A Candlestick provides information regarding timeframe, open, high, low and closing price.

- Timeframe is the duration in which one complete candlestick is formed.

- Different timeframes have different applications.